Exhibit 99.2 Investor Presentation Fall 2022

Disclaimer For the purposes of this notice, this “presentation” will mean and include the slides, any oral presentation of the slides by members of management of GSR II Meteora Acquisition Corp. (“GSRM”) or Lux Vending, LLC d/b/a Bitcoin Depot (the “Company” or “Bitcoin Depot”) or any person on their behalf, any question-and-answer session that follows that oral presentation, hard copies of this document and any materials distributed at, or in connection with, that presentation. By attending the meeting where the presentation is made, or by reading the presentation slides, you will be deemed to have (i) agreed to the following limitations and notifications and made the following undertakings and (ii) acknowledged that you understand the legal and regulatory sanctions attached to the misuse, disclosure or improper circulation of this presentation. Confidentiality: This presentation is preliminary in nature and provided solely for informational and discussion purposes only and must not be relied upon for any other purposes. This presentation is intended solely for investors that are qualified institutional buyers (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)), institutional accredited investors (as defined under Regulation D as promulgated under the Securities Act) and eligible institutional investors outside the U.S. and has been prepared for the purposes of familiarizing such investors with the potential business combination (the “Business Combination”) between GSRM and the Company and related transactions, including the proposed private offering of GSRM’s or the Company’s securities (the “PIPE” and together with the Business Combination, the “Proposed Transactions”) and for no other purpose. The release, reproduction, publication or distribution of this presentation, in whole or in part, or the disclosure of its contents, without the prior consent of the Company and GSRM is unlawful and prohibited. Persons who possess this document should inform themselves about and observe any such restrictions. Each recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non-public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b- 5 thereunder. By accepting this presentation, each recipient agrees: (i) that the information included in this presentation is confidential and may constitute material non-public information, (ii) to maintain the confidentiality of all information that is contained in this presentation and not already in the public domain and (iii) to use this presentation for the sole purpose of evaluating the Company and the Proposed Transactions. No Offer or Solicitation: This presentation and any oral statements made in connection with this presentation do not constitute an offer to sell, or the solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, consent or approval in any jurisdiction in connection with the Proposed Transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities pursuant to the PIPE will be made only pursuant to a definitive subscription or purchase agreement and will be made in reliance on an exemption from registration under the Securities Act for offers and sales of securities that do not involve a public offering. GSRM and the Company reserve the right to withdraw or amend for any reason any offering and to reject any subscription or purchase agreement for any reason. The communication of this presentation is restricted by law; in addition to any prohibitions on distribution otherwise provided for herein, this presentation is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. The contents of this presentation have not been reviewed by any regulatory authority in any jurisdiction. No Representations or Warranties: No representations or warranties, express or implied, are given in, or in respect of, this presentation or as to the accuracy, reasonableness or completeness of the information contained in or incorporated by reference herein. To the fullest extent permitted by law, in no circumstances will GSRM, the Company or any of their respective affiliates, directors, officers, employees, members, partners, shareholders, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents (including the internal economic models), its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, none of the Company, GSRM or any of their respective affiliates, directors, officers, employees, members, partners, shareholders, advisors or agents has independently verified the data obtained from these sources or makes any representation or warranty with respect to the accuracy of such information. Recipients of this presentation are not to construe its contents, or any prior or subsequent communications from or with GSRM, the Company or their respective representatives as investment, legal or tax advice. In addition, this presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of the Company, GSRM or the Proposed Transactions. Recipients of this presentation should each make their own evaluation of the Company, GSRM or the Proposed Transactions and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Recipients are not entitled to rely on the accuracy or completeness of this presentation and are entitled to rely solely on only those particular representations and warranties, if any, which may be made by GSRM or the Company to a recipient of this presentation or other third party in a definitive written agreement, when, and if executed, and subject to the limitations and restrictions as may be specified therein. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision. Any representations, warranties, agreements or covenants between the recipient and any parties involved in the Proposed Transactions will be set forth in definitive agreements by and among such persons. The Company and GSRM expressly disclaim any duty to update the information contained in this presentation, whether as a result of new information, future events or otherwise. 2

Disclaimer Forward-Looking Statements: This presentation includes “forward-looking statements” within the meaning of the federal securities laws, including, but not limited to, opinions and projections prepared by the Company’s and GSRM’s management. Forward-looking statements generally relate to future events or the Company’s or GSRM’s future financial or operating performance, including pro forma and estimated financial information, and other “forward-looking statements” (as such term is defined in the Private Securities Litigation Reform Act of 1995). For example, projections of future EBITDA, Adjusted EBITDA and other metrics are forward-looking statements. The recipient can identify forward-looking statements because they typically contain words such as “outlook,” “believes,” “expects,” “ will,” “projected,” “continue,” “increase,” “may,” “should,” “could,” “seeks,” “predicts,” “intends,” “trends,” “plans,” “estimates,” “anticipates” or the negatives or variations of these words or other comparable words and/or similar expressions (but the absence of these words and/or similar expressions does not mean that a statement is not forward-looking). These forward-looking statements specifically include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity and market share, potential benefits of the Proposed Transactions and the potential success of the Company’s strategy and expectations related to the terms and timing of the Proposed Transactions. Forward-looking statements, opinions and projections are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s and GSRM’s current beliefs, expectations and assumptions regarding the future of their respective businesses and of the combined company, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s or GSRM’s control. These uncertainties and risks may be known or unknown. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the shareholders of GSRM or Bitcoin Depot is not obtained; failure to realize the anticipated benefits of the proposed business combination; risks relating to the uncertainty of the projected financial information with respect to Bitcoin Depot; future global, regional or local economic and market conditions; the development, effects and enforcement of laws and regulations; Bitcoin Depot’s ability to manage future growth; Bitcoin Depot’s ability to develop new products and services, bring them to market in a timely manner, and make enhancements to its platform; the effects of competition on Bitcoin Depot’s future business; the amount of redemption requests made by GSRM’s public shareholders; the ability of GSRM or the combined company to issue equity or equity-linked securities in connection with the proposed business combination or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; and those factors described or referenced in GSRM’s final initial public offering prospectus dated February 24, 2022 and its most recent Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, in each case, under the heading “Risk Factors,” and other documents of GSRM filed, or to be filed, from time to time with the SEC. If any of these risks materialize or the Company’s or GSRM’s assumptions prove incorrect, actual results could differ materially from the results implied by the forward-looking statements contained herein. In addition, forward-looking statements reflect the Company’s and GSRM’s expectations and views as of the date of this presentation. The Company and GSRM anticipate that subsequent events and developments will cause their respective assessments to change. However, while the Company and GSRM may elect to update these forward-looking statements in the future, each of them specifically disclaims any obligation to do so. Accordingly, you should not place undue reliance on the forward-looking statements, which speak only as of the date they are made. Use of Projections: This presentation contains financial forecasts with respect to the Company’s projected financial results. Such projected financial information constitutes forward-looking information, is included for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Actual results may differ materially from the results contemplated by the projected financial information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved. The independent auditors of the Company and GSRM have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, they have expressed no opinion and have not provided any other form of assurance with respect thereto for the purpose of this presentation. Financial Information; Non-GAAP Measures: Certain of the financial information and data contained in this presentation have not been subject to a completed audit and do not conform to Regulation S-X promulgated under the Securities Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement, registration statement or prospectus that may be filed with the Securities and Exchange Commission (the “SEC”). This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) including, but not limited to, EBITDA, Adjusted EBITDA, Adjusted Gross Profit and certain ratios and other metrics derived therefrom. The Company defines (i) EBITDA as earnings before interest expense, taxes, depreciation and amortization and (ii) Adjusted EBITDA as EBITDA further adjusted by the removal of certain non-recurring costs and assumed public company costs. The Company defines Adjusted Gross Profit as revenue less cost of revenue (excluding depreciation and amortization). These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Such measures may not be indicative of the Company’s historical operating results nor are such measures meant to be predictive of future results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. As such, undue reliance should not be placed on these non-GAAP financial measures. 3

Disclaimer The Company believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. Please refer to footnotes where presented on each page of this presentation and/or to the appendix found at the end of this presentation for more details regarding the calculations of such measures and/or for a reconciliation of these measures to what the Company believes are the most directly comparable measures evaluated in accordance with GAAP. This presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included. Industry and Market Data: In this presentation, the Company relies on and refers to certain information and statistics obtained from third-party sources which it believes to be reliable. Neither the Company nor GSRM has independently verified the accuracy or completeness of any such third-party information. Trademarks and Trade Names: The Company and GSRM own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with the Company or GSRM, or an endorsement or sponsorship by or of the Company or GSRM. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®,™ or℠ symbols, but such references are not intended to indicate, in any way, that the Company or GSRM will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Additional Information About the Proposed Business Combination and Where to Find It: The proposed business combination will be submitted to shareholders of GSRM for their consideration. Copies of the proxy statement (a preliminary filing of which has been made with the SEC) will be mailed (if and when available) to all GSRM shareholders once definitive. GSRM also plans to file other documents with the SEC regarding the proposed business combination. GSRM will mail copies of the definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the proposed business combination. GSRM’s shareholders and other interested persons are advised to read the preliminary proxy statement and any amendments thereto and, once available, the definitive proxy statement, as well as all other relevant materials filed or that will be filed with the SEC, in connection with GSRM’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed business combination, because these documents will contain important information about GSRM, Bitcoin Depot and the proposed business combination. Shareholders may also obtain a copy of the preliminary proxy statement and, once available, the definitive proxy statement, as well as other documents filed with the SEC regarding the proposed business combination and other documents filed with the SEC by GSRM, without charge, at the SEC’s website located at www.sec.gov or by directing a request to Cody Slach or Alex Kovtun, (949) 574-3860, GSRM@gatewayir.com. Participants in the Solicitation: GSRM, Bitcoin Depot and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from GSRM’s shareholders in connection with the proposed business combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation GSRM’s shareholders in connection with the Proposed Transactions is set forth in the preliminary proxy statement that has been filed with the SEC. You can find more information about GSRM’s directors and executive officers in GSRM’s final initial public offering prospectus dated February 24, 2022 and filed with the SEC on February 28, 2022. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the definitive proxy statement and other relevant materials to be filed with the SEC when they become available. Shareholders, potential investors and other interested persons should read the proxy statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above. 4

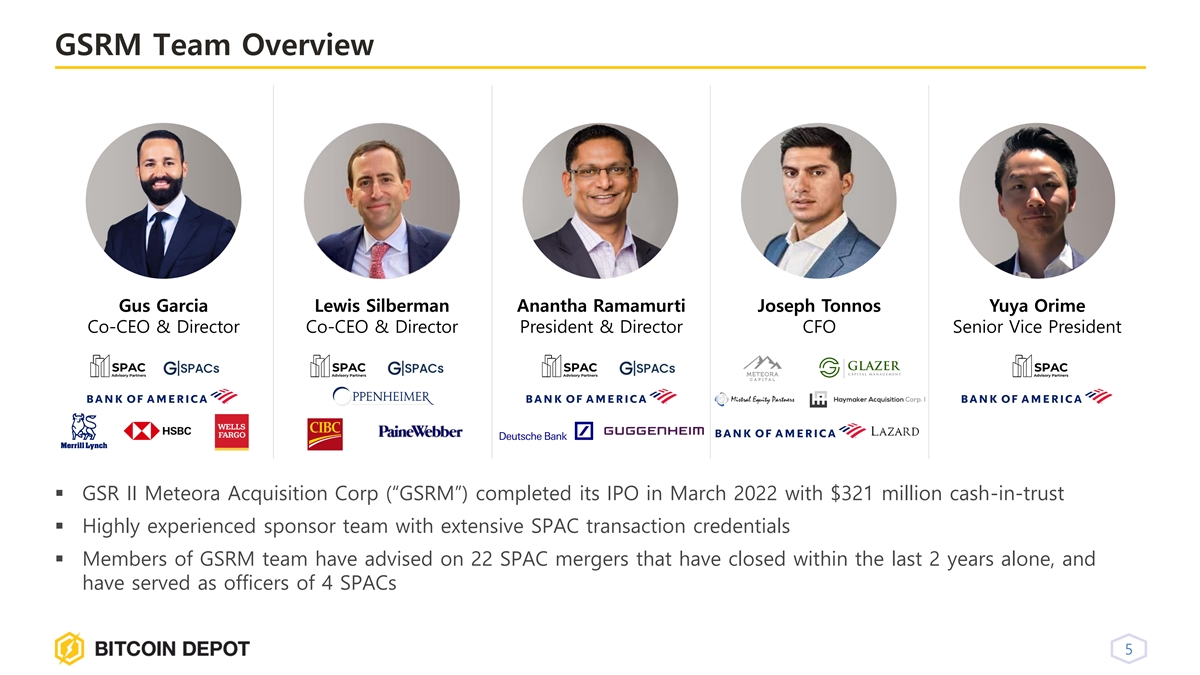

GSRM Team Overview Gus Garcia Lewis Silberman Anantha Ramamurti Joseph Tonnos Yuya Orime Co-CEO & Director Co-CEO & Director President & Director CFO Senior Vice President ▪ GSR II Meteora Acquisition Corp (“GSRM”) completed its IPO in March 2022 with $321 million cash-in-trust ▪ Highly experienced sponsor team with extensive SPAC transaction credentials ▪ Members of GSRM team have advised on 22 SPAC mergers that have closed within the last 2 years alone, and have served as officers of 4 SPACs 5

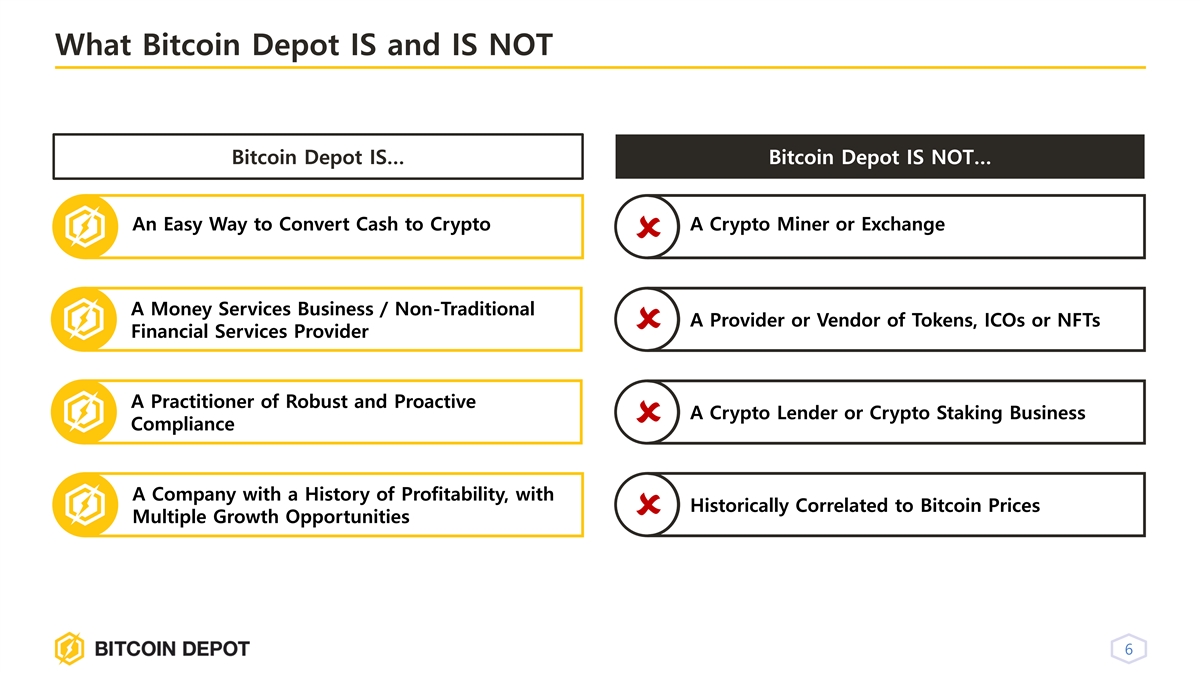

What Bitcoin Depot IS and IS NOT Bitcoin Depot IS… Bitcoin Depot IS NOT… An Easy Way to Convert Cash to Crypto A Crypto Miner or Exchange û A Money Services Business / Non-Traditional A Provider or Vendor of Tokens, ICOs or NFTs û Financial Services Provider A Practitioner of Robust and Proactive A Crypto Lender or Crypto Staking Business û Compliance A Company with a History of Profitability, with Historically Correlated to Bitcoin Prices û Multiple Growth Opportunities 6

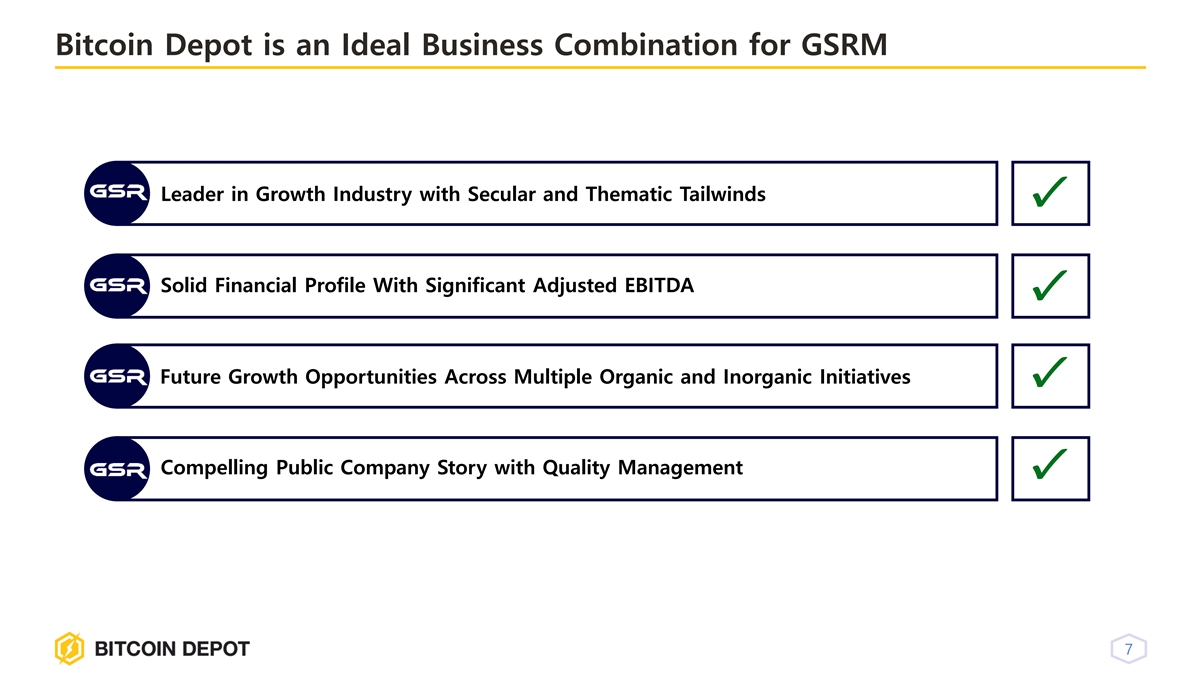

Bitcoin Depot is an Ideal Business Combination for GSRM Leader in Growth Industry with Secular and Thematic Tailwinds ✔ Solid Financial Profile With Significant Adjusted EBITDA ✔ Future Growth Opportunities Across Multiple Organic and Inorganic Initiatives ✔ Compelling Public Company Story with Quality Management ✔ 7

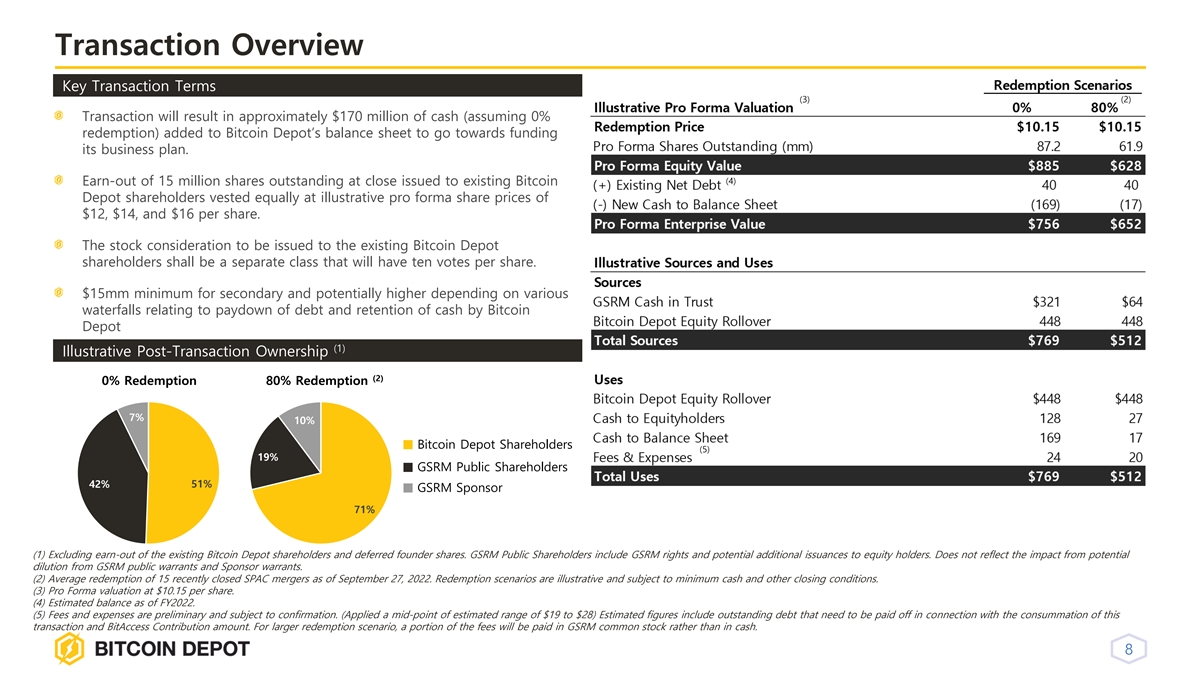

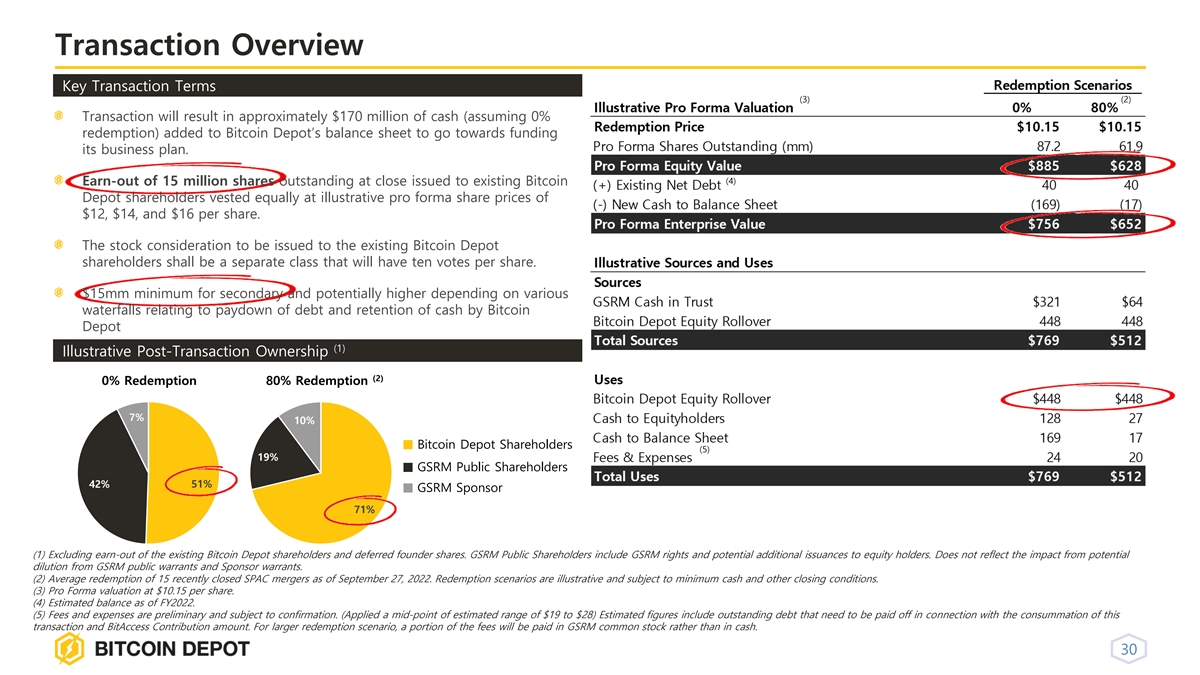

Transaction Overview Key Transaction Terms (3) (2) Transaction will result in approximately $170 million of cash (assuming 0% redemption) added to Bitcoin Depot’s balance sheet to go towards funding its business plan. (4) Earn-out of 15 million shares outstanding at close issued to existing Bitcoin Depot shareholders vested equally at illustrative pro forma share prices of $12, $14, and $16 per share. The stock consideration to be issued to the existing Bitcoin Depot shareholders shall be a separate class that will have ten votes per share. $15mm minimum for secondary and potentially higher depending on various waterfalls relating to paydown of debt and retention of cash by Bitcoin Depot (1) Illustrative Post-Transaction Ownership (2) 0% Redemption 80% Redemption 7% 10% Bitcoin Depot Shareholders (5) 19% GSRM Public Shareholders 42% 51% GSRM Sponsor 71% (1) Excluding earn-out of the existing Bitcoin Depot shareholders and deferred founder shares. GSRM Public Shareholders include GSRM rights and potential additional issuances to equity holders. Does not reflect the impact from potential dilution from GSRM public warrants and Sponsor warrants. (2) Average redemption of 15 recently closed SPAC mergers as of September 27, 2022. Redemption scenarios are illustrative and subject to minimum cash and other closing conditions. (3) Pro Forma valuation at $10.15 per share. (4) Estimated balance as of FY2022. (5) Fees and expenses are preliminary and subject to confirmation. (Applied a mid-point of estimated range of $19 to $28) Estimated figures include outstanding debt that need to be paid off in connection with the consummation of this transaction and BitAccess Contribution amount. For larger redemption scenario, a portion of the fees will be paid in GSRM common stock rather than in cash. 8

Company Overview 9

Mission BRINGING BITCOIN to the MASSES

Entrepreneurial and Visionary Management Team Brandon Mintz Scott Buchanan Founder & Chief Executive Officer Chief Operating Officer / Chief Financial Officer Cash to Crypto Sarah Wessel Jason Sacco Mark Smalley Bill Knoll VP of Sales VP of Operations Chief Compliance Officer Head of Product 11

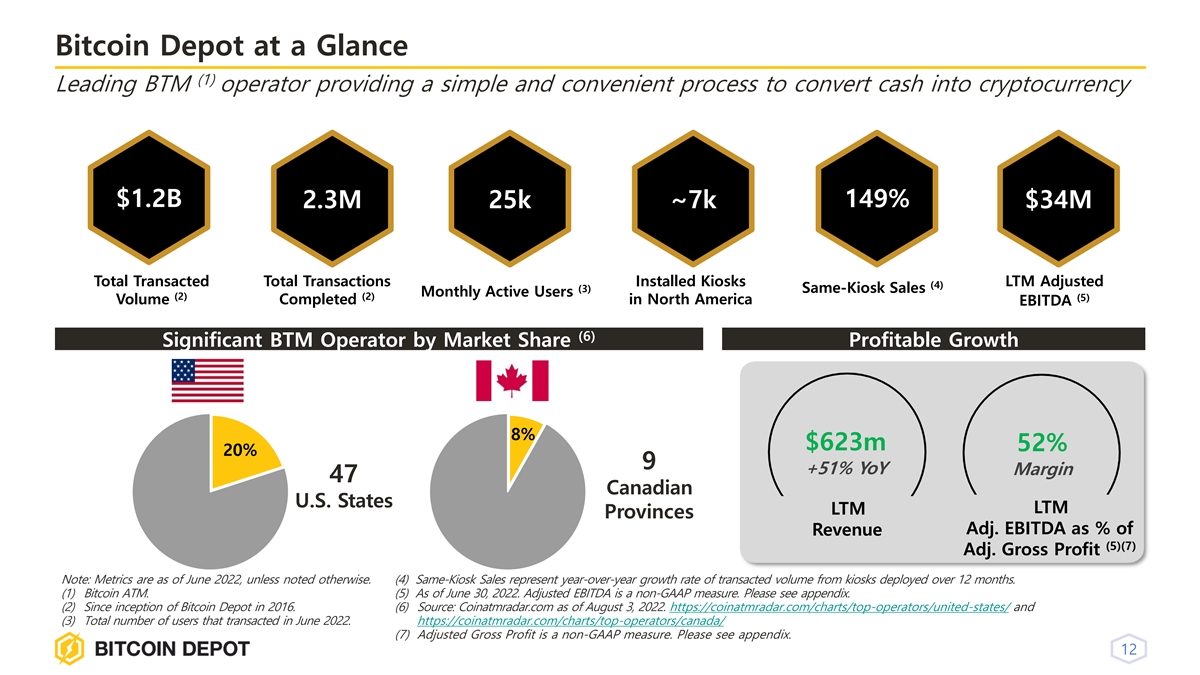

Bitcoin Depot at a Glance (1) Leading BTM operator providing a simple and convenient process to convert cash into cryptocurrency $1.2B 149% 2.3M 25k ~7k $34M Total Transacted Total Transactions Installed Kiosks LTM Adjusted (4) (3) Same-Kiosk Sales Monthly Active Users (2) (2) (5) Volume Completed in North America EBITDA (6) Significant BTM Operator by Market Share Profitable Growth 8% $623m 52% 20% 9 +51% YoY Margin 47 Canadian U.S. States LTM LTM Provinces Adj. EBITDA as % of Revenue (5)(7) Adj. Gross Profit Note: Metrics are as of June 2022, unless noted otherwise. (4) Same-Kiosk Sales represent year-over-year growth rate of transacted volume from kiosks deployed over 12 months. (1) Bitcoin ATM. (5) As of June 30, 2022. Adjusted EBITDA is a non-GAAP measure. Please see appendix. (2) Since inception of Bitcoin Depot in 2016. (6) Source: Coinatmradar.com as of August 3, 2022. https://coinatmradar.com/charts/top-operators/united-states/ and (3) Total number of users that transacted in June 2022. https://coinatmradar.com/charts/top-operators/canada/ (7) Adjusted Gross Profit is a non-GAAP measure. Please see appendix. 12

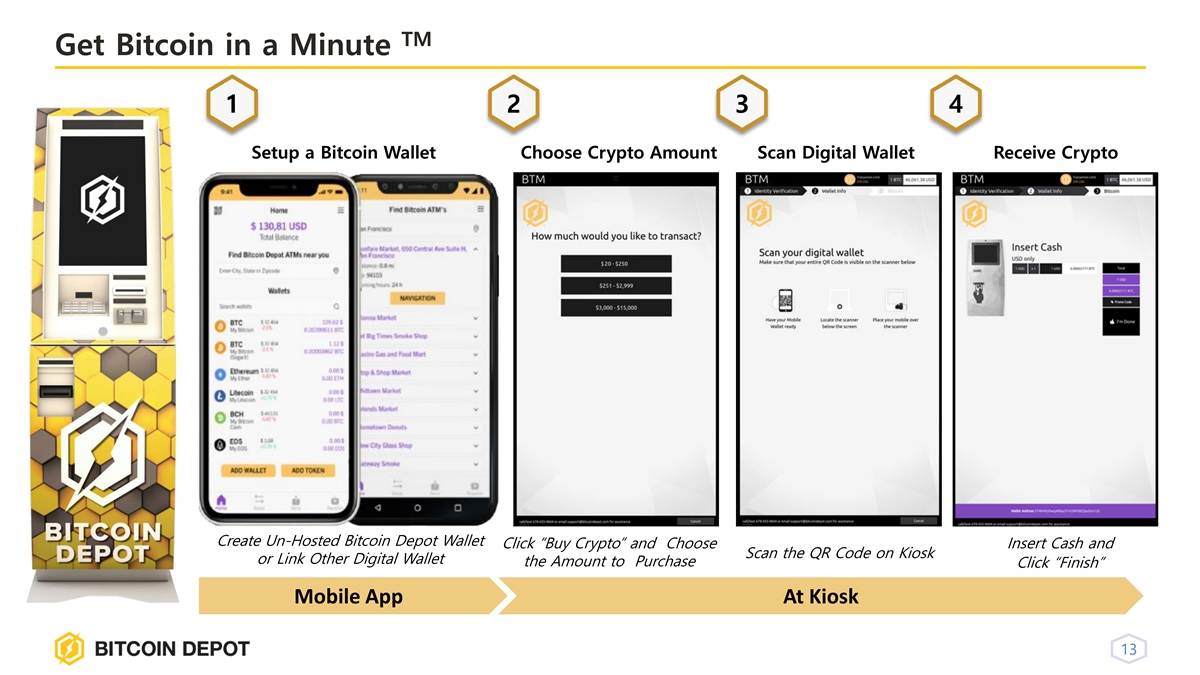

TM Get Bitcoin in a Minute 1 2 3 4 Setup a Bitcoin Wallet Choose Crypto Amount Scan Digital Wallet Receive Crypto Create Un-Hosted Bitcoin Depot Wallet Click “Buy Crypto” and Choose Insert Cash and Scan the QR Code on Kiosk or Link Other Digital Wallet the Amount to Purchase Click “Finish” Mobile App At Kiosk 13

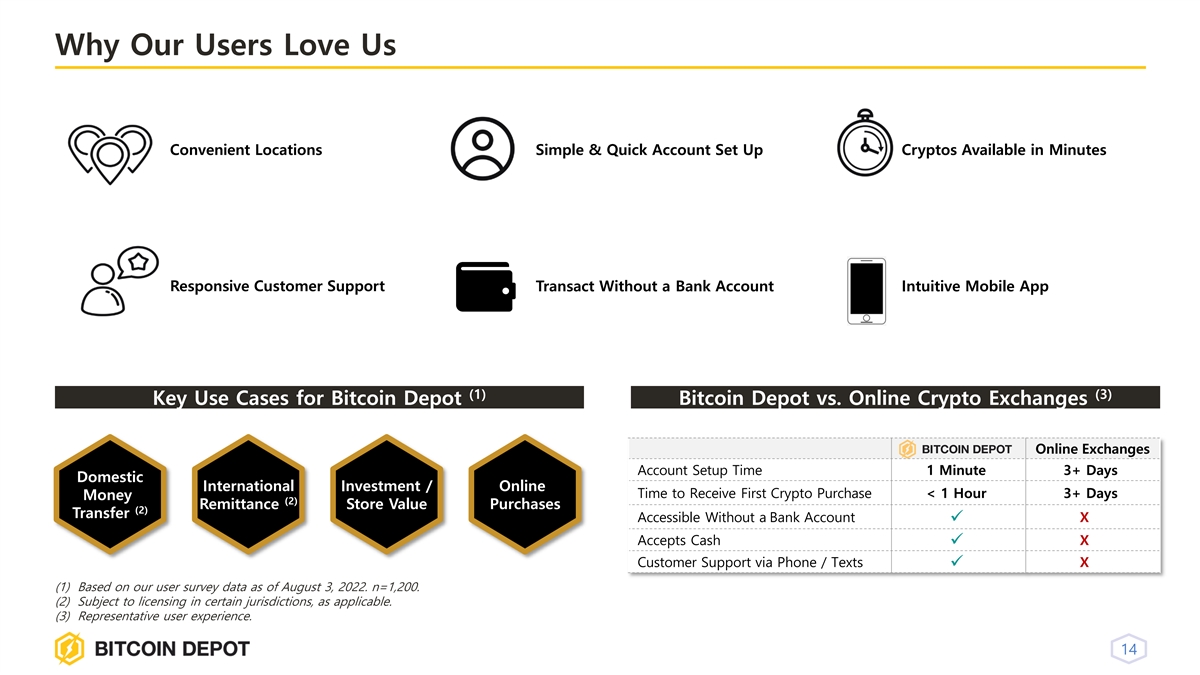

Why Our Users Love Us Customers use the Bitcoin Depot mobile app to access several dynamic tools that are key to the cryptocurrency user experience Convenient Locations Simple & Quick Account Set Up Cryptos Available in Minutes Responsive Customer Support Transact Without a Bank Account Intuitive Mobile App (1) (3) Key Use Cases for Bitcoin Depot Bitcoin Depot vs. Online Crypto Exchanges Online Exchanges Account Setup Time 1 Minute 3+ Days Domestic International Investment / Online Time to Receive First Crypto Purchase < 1 Hour 3+ Days Money (2) Remittance Store Value Purchases (2) Transfer Accessible Without a Bank Account X ✓ Accepts Cash X ✓ Customer Support via Phone / Texts X ✓ (1) Based on our user survey data as of August 3, 2022. n=1,200. (2) Subject to licensing in certain jurisdictions, as applicable. (3) Representative user experience. 14

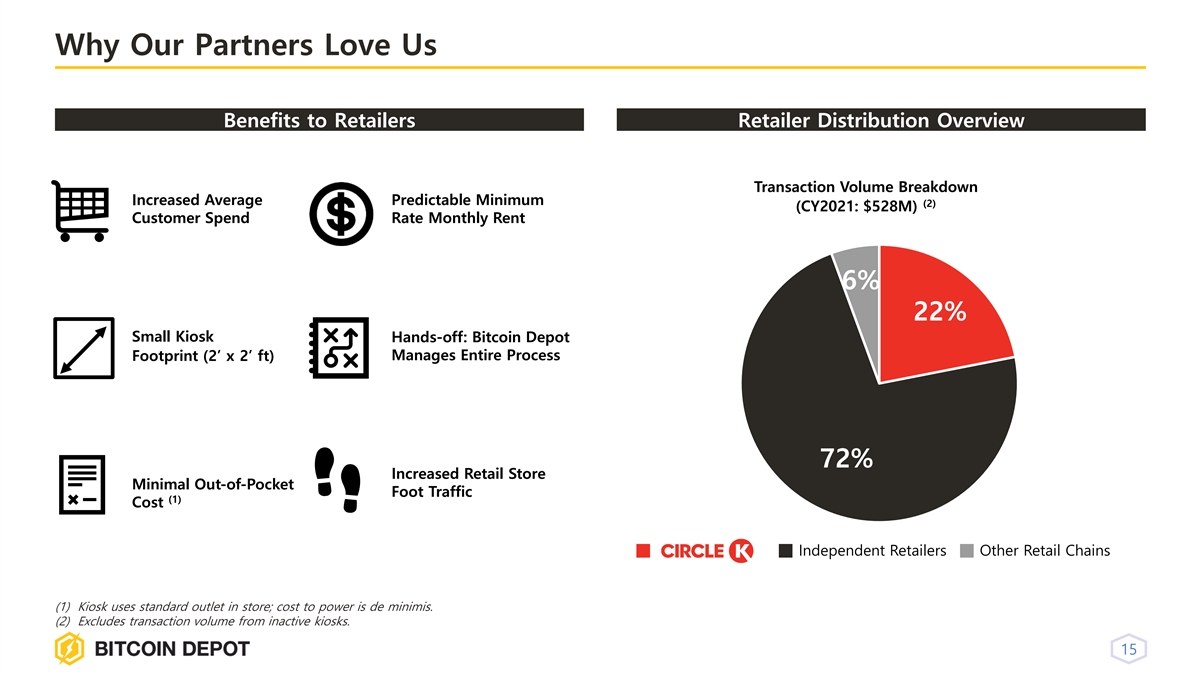

Why Our Partners Love Us Benefits to Retailers Retailer Distribution Overview Transaction Volume Breakdown Increased Average Predictable Minimum (2) (CY2021: $528M) Customer Spend Rate Monthly Rent 6% 22% Small Kiosk Hands-off: Bitcoin Depot Manages Entire Process Footprint (2’ x 2’ ft) 72% Increased Retail Store Minimal Out-of-Pocket Foot Traffic (1) Cost Independent Retailers Other Retail Chains (1) Kiosk uses standard outlet in store; cost to power is de minimis. (2) Excludes transaction volume from inactive kiosks. 15

Setting the Bar with our Compliance Practices and Standards Best-in-Class Compliance is a Core Value for Bitcoin Depot Bitcoin Depot's compliance team takes a proactive approach to industry requirements, monitoring and reporting suspicious activities and working closely with law enforcement as required Bitcoin Depot has established robust multi-layer compliance procedures, including KYC (Know-Your- Customer) and AML (Anti-Money Laundering) programs Bitcoin Depot has robust transaction monitoring systems to analyze transactions in real-time, taking advantage of the rich transaction data from its own network and on the blockchain 16

Bitcoin Depot Compliance Infrastructure Communication: Proactive Dialogue People: Experienced Technology: Multi-Layer with Regulatory Agencies Compliance Team Compliance Procedures Bitcoin Depot’s compliance team Accounts are verified at the time Bitcoin Depot coordinates closely has approximately 100 years of of creation with ongoing with financial regulators, combined experience in AML, transaction monitoring and screening for blacklisted KYC, BSA (Bank Secrecy Act), and screening against sanctions lists individuals and wallets OFAC (Office of Foreign Assets Control) compliance Transaction review includes ID, Bitcoin Depot regularly files wallet check, OFAC screening, Currency Transaction Reports and Bitcoin Depot utilizes Blockchain FinCEN reporting, and Suspicious Activity Reports analysis and works with various screening/reporting via third- third parties for transaction party compliance software monitoring and case management 17

Investment Highlights 18

1 2 3 4 5 Investment Highlights Beneficiary of Megatrend: Broadening Adoption of Cryptocurrencies 1 Network of Approx. 7,000 Kiosks for Converting Cash to Digital Currency, with Convenient, High-Performing Locations 2 Attractive Combination of Historical Growth and Current Profitability with Demonstrated Track Record of Success 3 Transaction Volumes Are Not Historically Correlated to the Price of Bitcoin; Resiliency Despite Cryptocurrency Volatility 4 Primed for Unique Growth Opportunities Through Strong Partnerships, Consolidation of Highly-Fragmented Market and 5 International Expansion 19

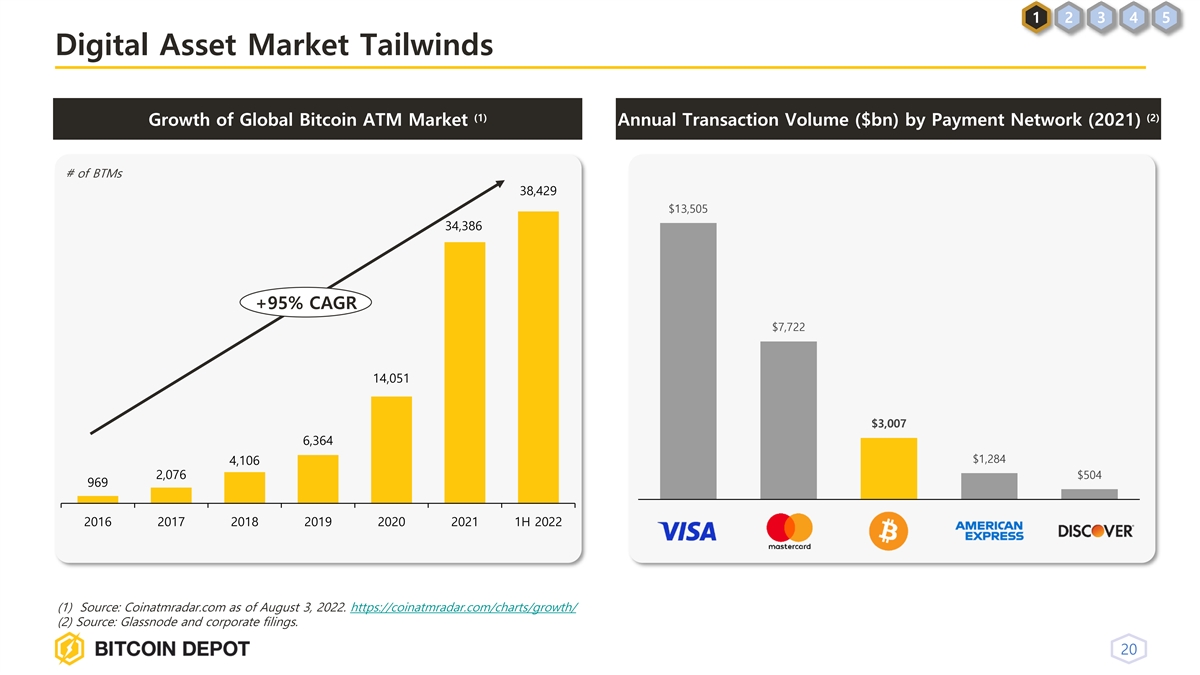

1 2 3 4 5 Digital Asset Market Tailwinds (1) (2) Growth of Global Bitcoin ATM Market Annual Transaction Volume ($bn) by Payment Network (2021) # of BTMs 38,429 $13,505 34,386 +95% CAGR $7,722 14,051 $3,007 6,364 $1,284 4,106 2,076 $504 969 2016 2017 2018 2019 2020 2021 1H 2022 (1) Source: Coinatmradar.com as of August 3, 2022. https://coinatmradar.com/charts/growth/ (2) Source: Glassnode and corporate filings. 20

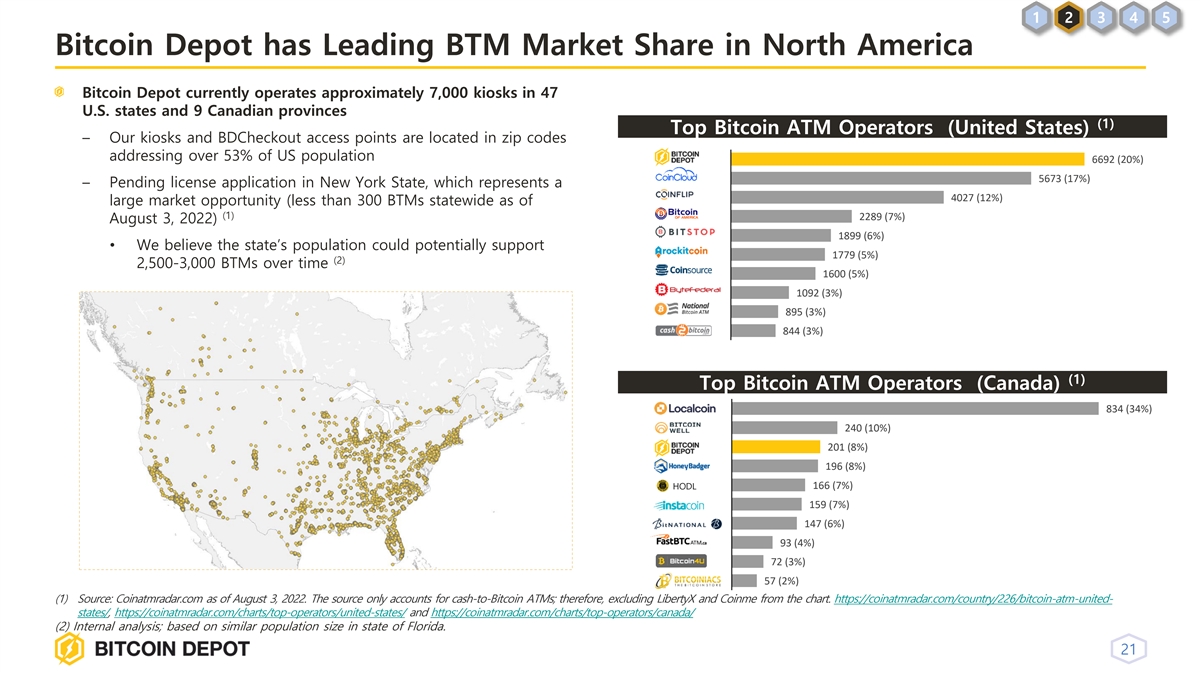

1 2 3 4 5 Bitcoin Depot has Leading BTM Market Share in North America Bitcoin Depot currently operates approximately 7,000 kiosks in 47 U.S. states and 9 Canadian provinces (1) Top Bitcoin ATM Operators (United States) – Our kiosks and BDCheckout access points are located in zip codes addressing over 53% of US population Bitcoin Depot 6692 (20%) CoinCloud 5673 (17%) – Pending license application in New York State, which represents a Coinflip 4027 (12%) large market opportunity (less than 300 BTMs statewide as of (1) Bitcoin of America 2289 (7%) August 3, 2022) BITSTOP 1899 (6%) • We believe the state’s population could potentially support ROCKITCOIN 1779 (5%) (2) 2,500-3,000 BTMs over time COINISURNACE 1600 (5%) Byte Federal 1092 (3%) National Bitcoin ATM 895 (3%) Cash Bitcoin 844 (3%) (1) Top Bitcoin ATM Operators (Canada) Localcoin 834 (34%) Bitcoin Well 240 (10%) Bitcoin Depot 201 (8%) HoneyBadger 196 (8%) HODL 166 (7%) HODL Instacoin 159 (7%) Bitnational 147 (6%) FastBTC 93 (4%) Bitcoin4U 72 (3%) Bitcoiniacs 57 (2%) (1) Source: Coinatmradar.com as of August 3, 2022. The source only accounts for cash-to-Bitcoin ATMs; therefore, excluding LibertyX and Coinme from the chart. https://coinatmradar.com/country/226/bitcoin-atm-united- states/, https://coinatmradar.com/charts/top-operators/united-states/ and https://coinatmradar.com/charts/top-operators/canada/ (2) Internal analysis; based on similar population size in state of Florida. 21

1 2 3 4 5 Robust Retail Partnerships Pave Our Path for Further Growth (1) Bitcoin Depot is Circle K’s Exclusive BTM Provider We Partner with Major Retailers Fortune 500 Largest Privately Owned Specialty Retailer American Gas Station Chain Over 1,900 kiosks deployed across U.S. and Canada as of July Fortune 500 Major Convenience 2022 American Gas Station Chain Store Chains Circle K has over 9,000 stores in North America, with over 4,800 stores in Europe and other International markets “Our partnership with Bitcoin Depot further builds on our commitment, giving our brand an important, early presence in the fast-growing cryptocurrency marketplace as a convenient destination where customers Leading Retail Outlets can buy Bitcoin.” Denny Tewell, Senior Vice President Global Merchandise and Procurement (1) Via a partnership with payment processing provider. Select partners represented. 22

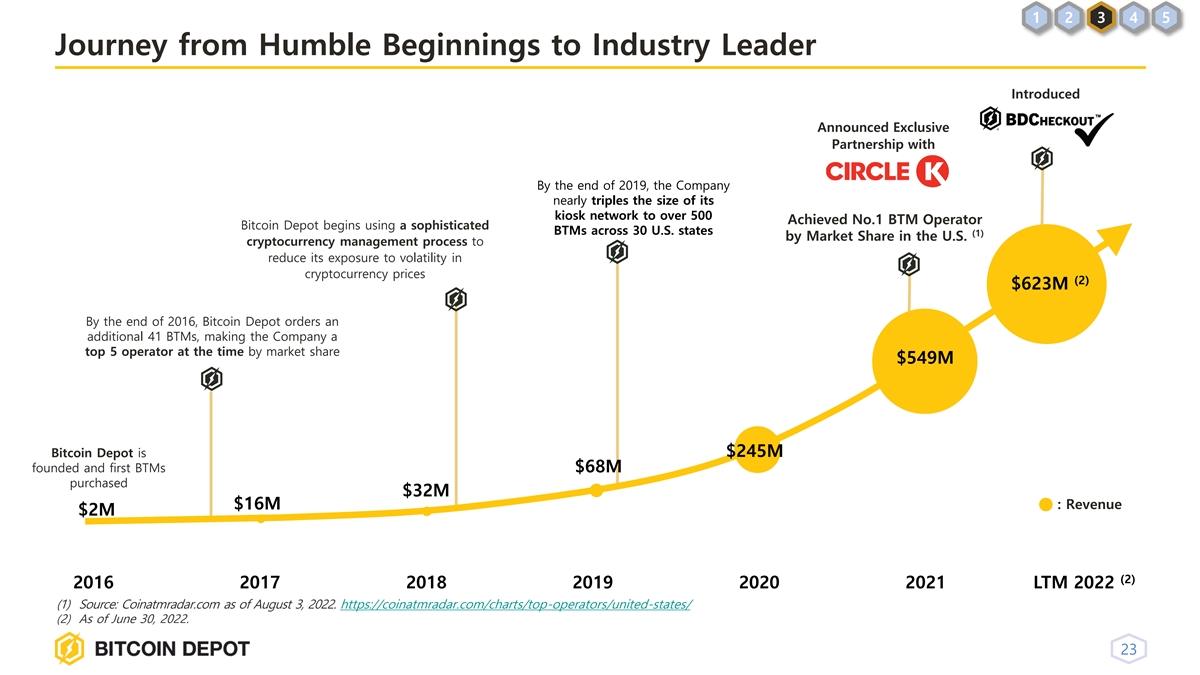

1 2 3 4 5 Journey from Humble Beginnings to Industry Leader Introduced Announced Exclusive Partnership with By the end of 2019, the Company nearly triples the size of its kiosk network to over 500 Achieved No.1 BTM Operator Bitcoin Depot begins using a sophisticated BTMs across 30 U.S. states (1) by Market Share in the U.S. cryptocurrency management process to reduce its exposure to volatility in cryptocurrency prices (2) $623M By the end of 2016, Bitcoin Depot orders an additional 41 BTMs, making the Company a top 5 operator at the time by market share $549M Bitcoin Depot is $245M founded and first BTMs $68M purchased $32M : Revenue $16M $2M (2) 2016 2017 2018 2019 2020 2021 LTM 2022 (1) Source: Coinatmradar.com as of August 3, 2022. https://coinatmradar.com/charts/top-operators/united-states/ (2) As of June 30, 2022. 23

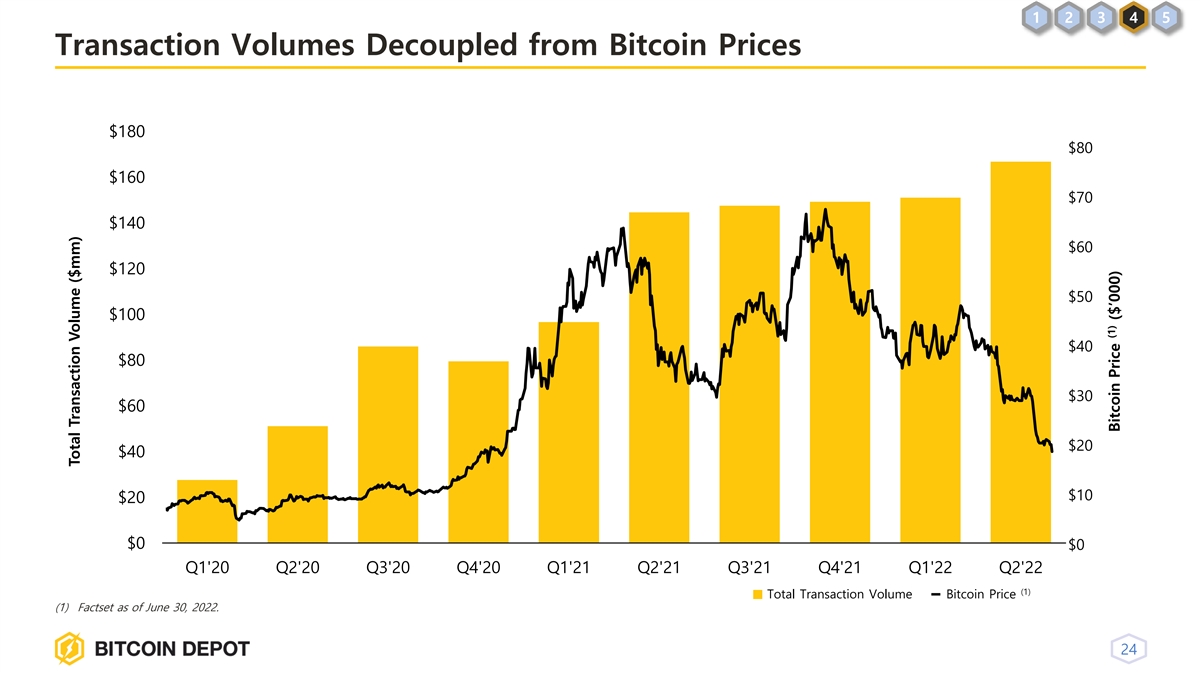

1 2 3 4 5 Transaction Volumes Decoupled from Bitcoin Prices $180 $80 $160 $70 $140 $60 $120 $50 $100 $40 $80 $30 $60 $20 $40 $10 $20 $0 $0 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 (1) Total Transaction Volume Bitcoin Price (1) Factset as of June 30, 2022. 24 Total Transaction Volume ($mm) (1) Bitcoin Price ($’000)

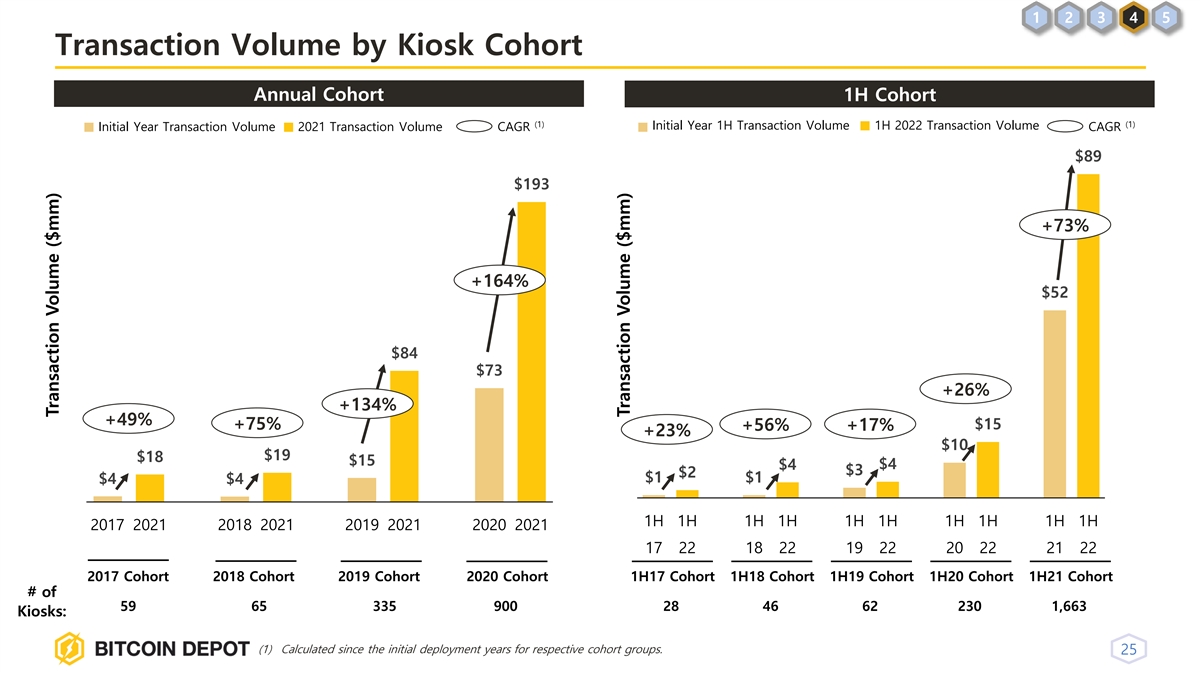

1 2 3 4 5 Transaction Volume by Kiosk Cohort Annual Cohort 1H Cohort (1) (1) Initial Year 1H Transaction Volume 1H 2022 Transaction Volume Initial Year Transaction Volume 2021 Transaction Volume CAGR CAGR $89 $193 +73% +164% $52 $84 $73 +26% +134% +49% +75% $15 +56% +17% +23% $10 $19 $18 $15 $4 $4 $3 $2 $1 $1 $4 $4 1H 1H 1H 1H 1H 1H 1H 1H 1H 1H 2017 2021 2018 2021 2019 2021 2020 2021 17 22 18 22 19 22 20 22 21 22 2017 Cohort 2018 Cohort 2019 Cohort 2020 Cohort 1H17 Cohort 1H18 Cohort 1H19 Cohort 1H20 Cohort 1H21 Cohort # of 59 65 335 900 28 46 62 230 1,663 Kiosks: (1) Calculated since the initial deployment years for respective cohort groups. 25 Transaction Volume ($mm) Transaction Volume ($mm)

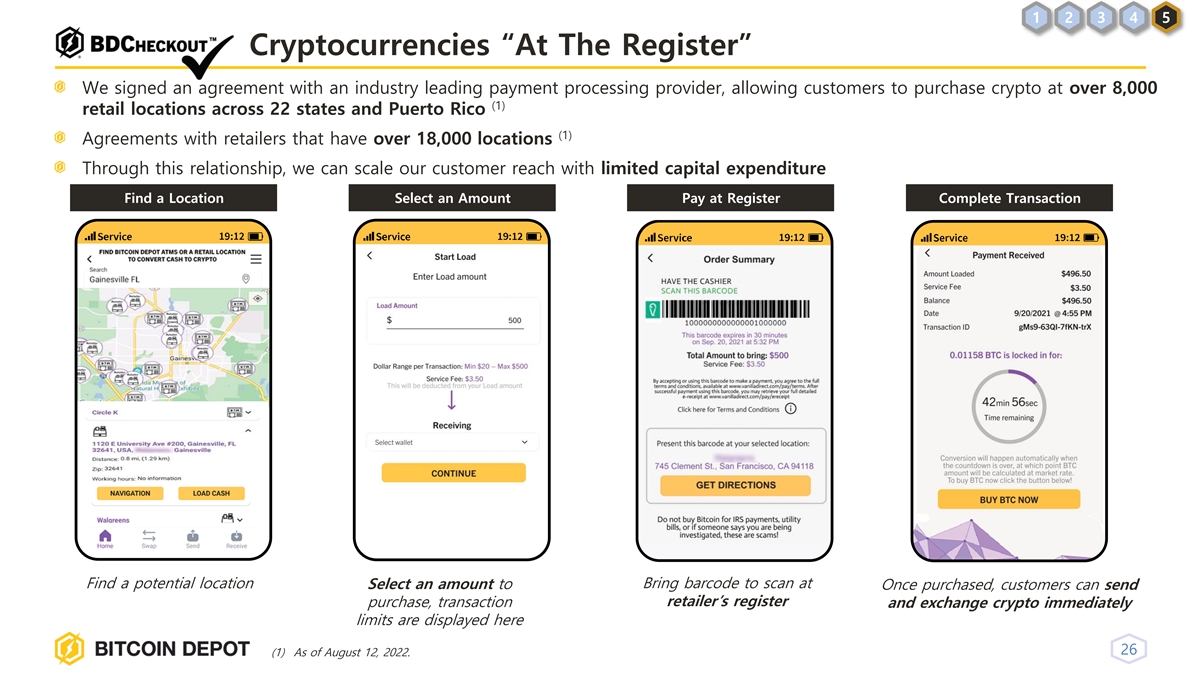

1 2 3 4 5 Cryptocurrencies “At The Register” We signed an agreement with an industry leading payment processing provider, allowing customers to purchase crypto at over 8,000 (1) retail locations across 22 states and Puerto Rico (1) Agreements with retailers that have over 18,000 locations Through this relationship, we can scale our customer reach with limited capital expenditure Find a Location Select an Amount Pay at Register Complete Transaction Find a potential location Select an amount to Bring barcode to scan at Once purchased, customers can send retailer’s register purchase, transaction and exchange crypto immediately limits are displayed here 26 (1) As of August 12, 2022.

1 2 3 4 5 Multiple Future Growth Opportunities Credit/Debit International Industry Transactions Expansion Consolidation on BTMs Additional Consumer- Buy/Sell Cryptos B2B Software Facing Financial on Traditional and Data Solutions Services Cash ATMs Note: Majority of these initiatives are not included in the projections. 27

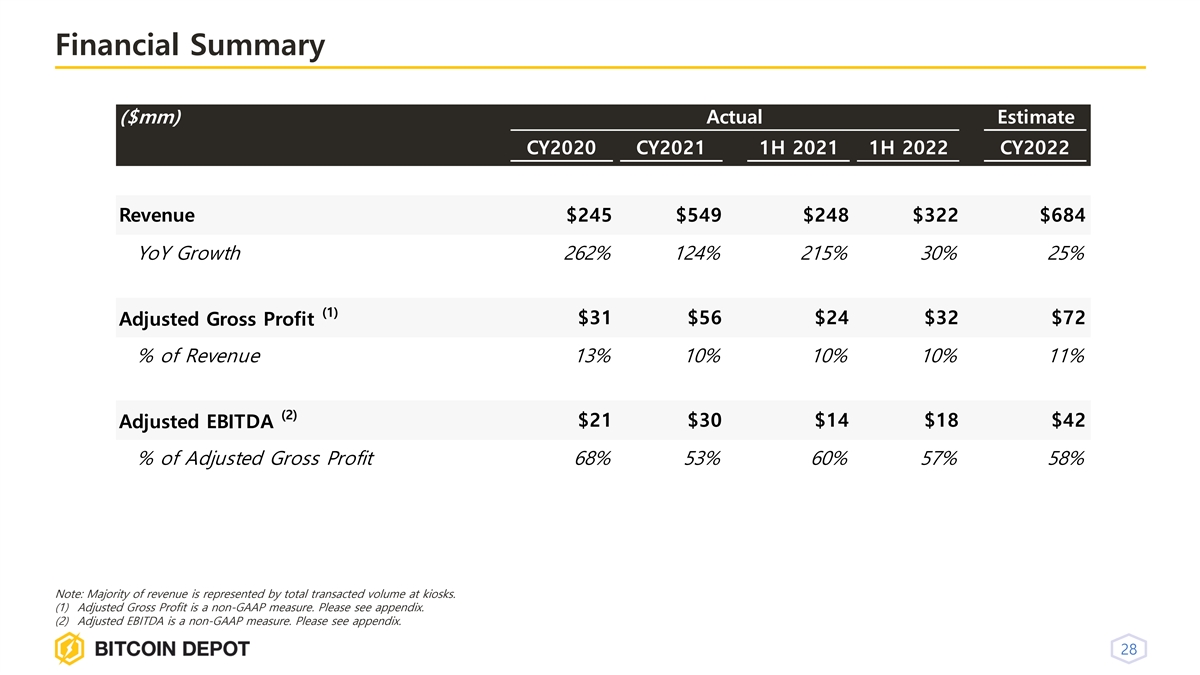

Financial Summary ($mm) Actual Estimate CY2020 CY2021 1H 2021 1H 2022 CY2022 Revenue $245 $549 $248 $322 $684 YoY Growth 262% 124% 215% 30% 25% (1) $31 $56 $24 $32 $72 Adjusted Gross Profit % of Revenue 13% 10% 10% 10% 11% (2) $21 $30 $14 $18 $42 Adjusted EBITDA % of Adjusted Gross Profit 68% 53% 60% 57% 58% Note: Majority of revenue is represented by total transacted volume at kiosks. (1) Adjusted Gross Profit is a non-GAAP measure. Please see appendix. (2) Adjusted EBITDA is a non-GAAP measure. Please see appendix. 28

Transaction Overview 29

Transaction Overview Key Transaction Terms (3) (2) Transaction will result in approximately $170 million of cash (assuming 0% redemption) added to Bitcoin Depot’s balance sheet to go towards funding its business plan. (4) Earn-out of 15 million shares outstanding at close issued to existing Bitcoin Depot shareholders vested equally at illustrative pro forma share prices of $12, $14, and $16 per share. The stock consideration to be issued to the existing Bitcoin Depot shareholders shall be a separate class that will have ten votes per share. $15mm minimum for secondary and potentially higher depending on various waterfalls relating to paydown of debt and retention of cash by Bitcoin Depot (1) Illustrative Post-Transaction Ownership (2) 0% Redemption 80% Redemption 7% 10% Bitcoin Depot Shareholders (5) 19% GSRM Public Shareholders 42% 51% GSRM Sponsor 71% (1) Excluding earn-out of the existing Bitcoin Depot shareholders and deferred founder shares. GSRM Public Shareholders include GSRM rights and potential additional issuances to equity holders. Does not reflect the impact from potential dilution from GSRM public warrants and Sponsor warrants. (2) Average redemption of 15 recently closed SPAC mergers as of September 27, 2022. Redemption scenarios are illustrative and subject to minimum cash and other closing conditions. (3) Pro Forma valuation at $10.15 per share. (4) Estimated balance as of FY2022. (5) Fees and expenses are preliminary and subject to confirmation. (Applied a mid-point of estimated range of $19 to $28) Estimated figures include outstanding debt that need to be paid off in connection with the consummation of this transaction and BitAccess Contribution amount. For larger redemption scenario, a portion of the fees will be paid in GSRM common stock rather than in cash. 30

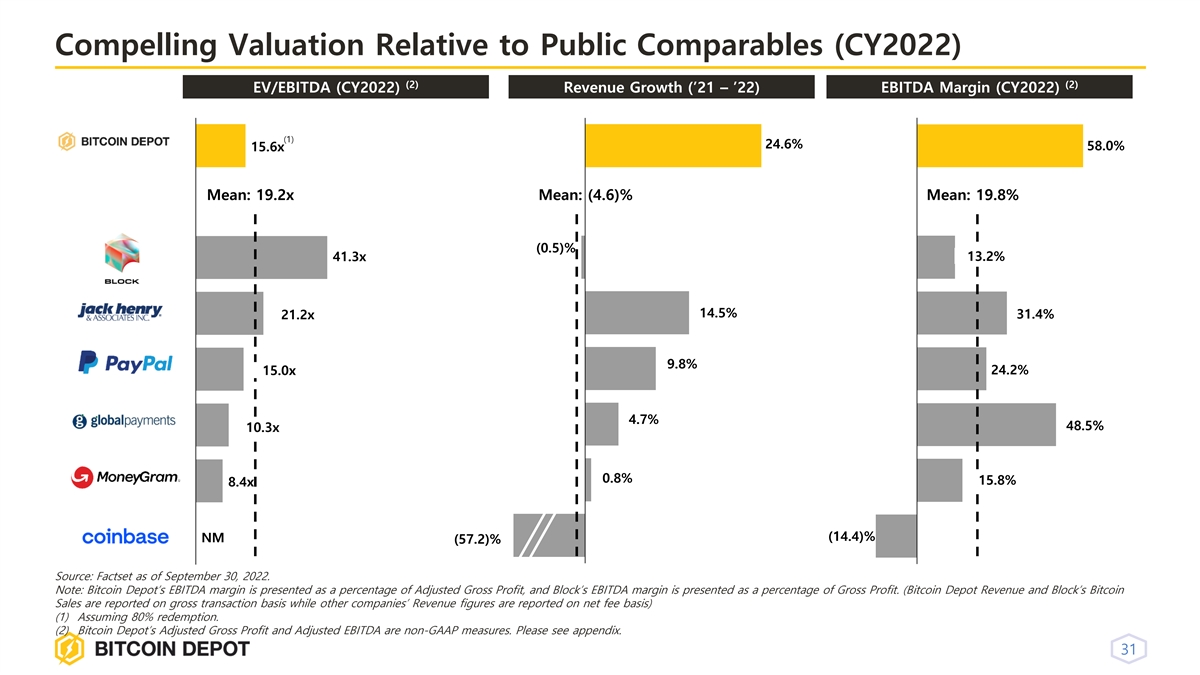

Compelling Valuation Relative to Public Comparables (CY2022) (2) (2) EV/EBITDA (CY2022) Revenue Growth (’21 – ’22) EBITDA Margin (CY2022) (1) 24.6% 58.0% 15.6x Mean: 19.2x Mean: (4.6)% Mean: 19.8% (0.5)% 41.3x 13.2% 13.2% 14.5% 21.2x 31.4% 21.2x 9.8% 15.0x 15.0x 24.2% 4.7% 48.5% 10.3x 10.3x 0.8% 15.8% 15.8% 8.4x (14.4)% NM (57.2)% Source: Factset as of September 30, 2022. Note: Bitcoin Depot’s EBITDA margin is presented as a percentage of Adjusted Gross Profit, and Block’s EBITDA margin is presented as a percentage of Gross Profit. (Bitcoin Depot Revenue and Block’s Bitcoin Sales are reported on gross transaction basis while other companies’ Revenue figures are reported on net fee basis) (1) Assuming 80% redemption. (2) Bitcoin Depot’s Adjusted Gross Profit and Adjusted EBITDA are non-GAAP measures. Please see appendix. 31

Key Business Takeaways Mainstreaming of Cryptocurrency and Digital Assets #1 Bitcoin ATM Operator in North America with Approximately 7,000 Kiosks Key Retail Relationships, Highlighted by Circle K Multiple Service Offerings and Geographic Expansion Opportunities Driving Growth Meaningful Revenue Scale and Currently Profitable 32

Appendix 33

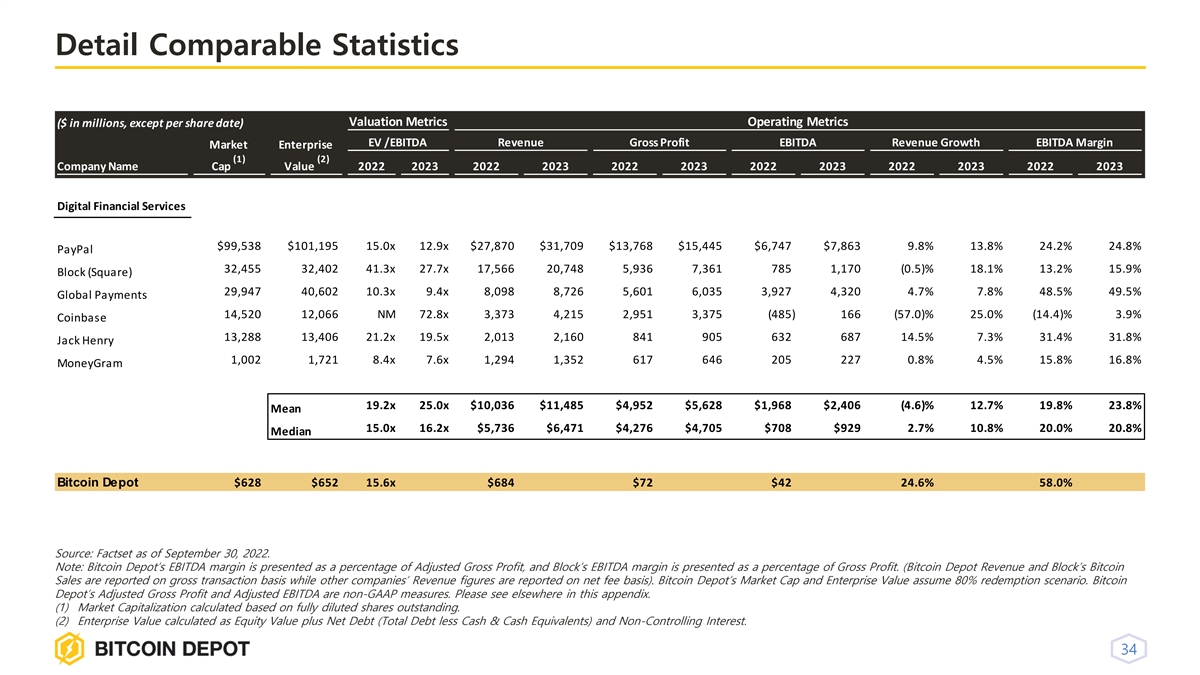

Detail Comparable Statistics Valuation Metrics Operating Metrics ($ in millions, except per share date) EV /EBITDA Revenue Gross Profit EBITDA Revenue Growth EBITDA Margin Market Enterprise (1) (2) Company Name Cap Value 2022 2023 2022 2023 2022 2023 2022 2023 2022 2023 2022 2023 Digital Financial Services $99,538 $101,195 15.0x 12.9x $27,870 $31,709 $13,768 $15,445 $6,747 $7,863 9.8% 13.8% 24.2% 24.8% PayPal 32,455 32,402 41.3x 27.7x 17,566 20,748 5,936 7,361 785 1,170 (0.5)% 18.1% 13.2% 15.9% Block (Square) 29,947 40,602 10.3x 9.4x 8,098 8,726 5,601 6,035 3,927 4,320 4.7% 7.8% 48.5% 49.5% Global Payments 14,520 12,066 NM 72.8x 3,373 4,215 2,951 3,375 (485) 166 (57.0)% 25.0% (14.4)% 3.9% Coinbase 13,288 13,406 21.2x 19.5x 2,013 2,160 841 905 632 687 14.5% 7.3% 31.4% 31.8% Jack Henry 1,002 1,721 8.4x 7.6x 1,294 1,352 617 646 205 227 0.8% 4.5% 15.8% 16.8% MoneyGram 19.2x 25.0x $10,036 $11,485 $4,952 $5,628 $1,968 $2,406 (4.6)% 12.7% 19.8% 23.8% Mean 15.0x 16.2x $5,736 $6,471 $4,276 $4,705 $708 $929 2.7% 10.8% 20.0% 20.8% Median Bitcoin Depot $628 $652 15.6x $684 $72 $42 24.6% 58.0% Source: Factset as of September 30, 2022. Note: Bitcoin Depot’s EBITDA margin is presented as a percentage of Adjusted Gross Profit, and Block’s EBITDA margin is presented as a percentage of Gross Profit. (Bitcoin Depot Revenue and Block’s Bitcoin Sales are reported on gross transaction basis while other companies’ Revenue figures are reported on net fee basis). Bitcoin Depot’s Market Cap and Enterprise Value assume 80% redemption scenario. Bitcoin Depot’s Adjusted Gross Profit and Adjusted EBITDA are non-GAAP measures. Please see elsewhere in this appendix. (1) Market Capitalization calculated based on fully diluted shares outstanding. (2) Enterprise Value calculated as Equity Value plus Net Debt (Total Debt less Cash & Cash Equivalents) and Non-Controlling Interest. 34

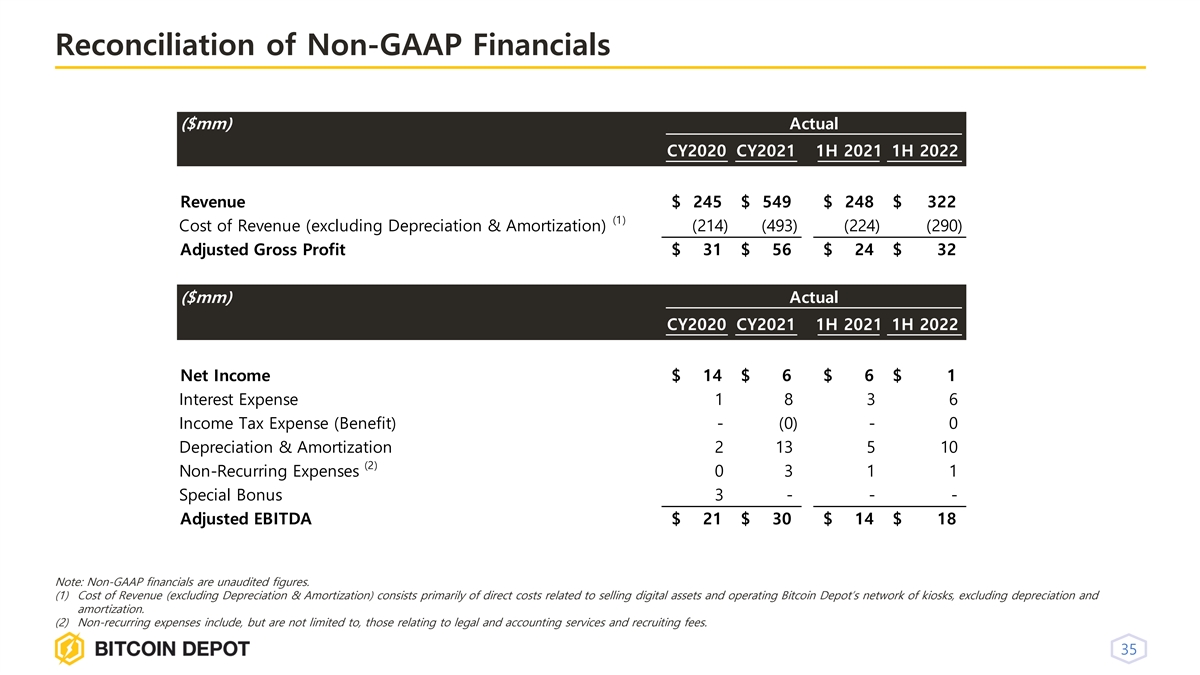

Reconciliation of Non-GAAP Financials ($mm) Actual CY2020 CY2021 1H 2021 1H 2022 Revenue $ 245 $ 549 $ 248 $ 322 (1) Cost of Revenue (excluding Depreciation & Amortization) ( 214) (493) ( 224) (290) Adjusted Gross Profit $ 31 $ 56 $ 24 $ 32 ($mm) Actual CY2020 CY2021 1H 2021 1H 2022 Net Income $ 14 $ 6 $ 6 $ 1 Interest Expense 1 8 3 6 Income Tax Expense (Benefit) - (0) - 0 Depreciation & Amortization 2 13 5 10 (2) Non-Recurring Expenses 0 3 1 1 Special Bonus 3 - - - Adjusted EBITDA $ 21 $ 30 $ 14 $ 18 Note: Non-GAAP financials are unaudited figures. (1) Cost of Revenue (excluding Depreciation & Amortization) consists primarily of direct costs related to selling digital assets and operating Bitcoin Depot’s network of kiosks, excluding depreciation and amortization. (2) Non-recurring expenses include, but are not limited to, those relating to legal and accounting services and recruiting fees. 35

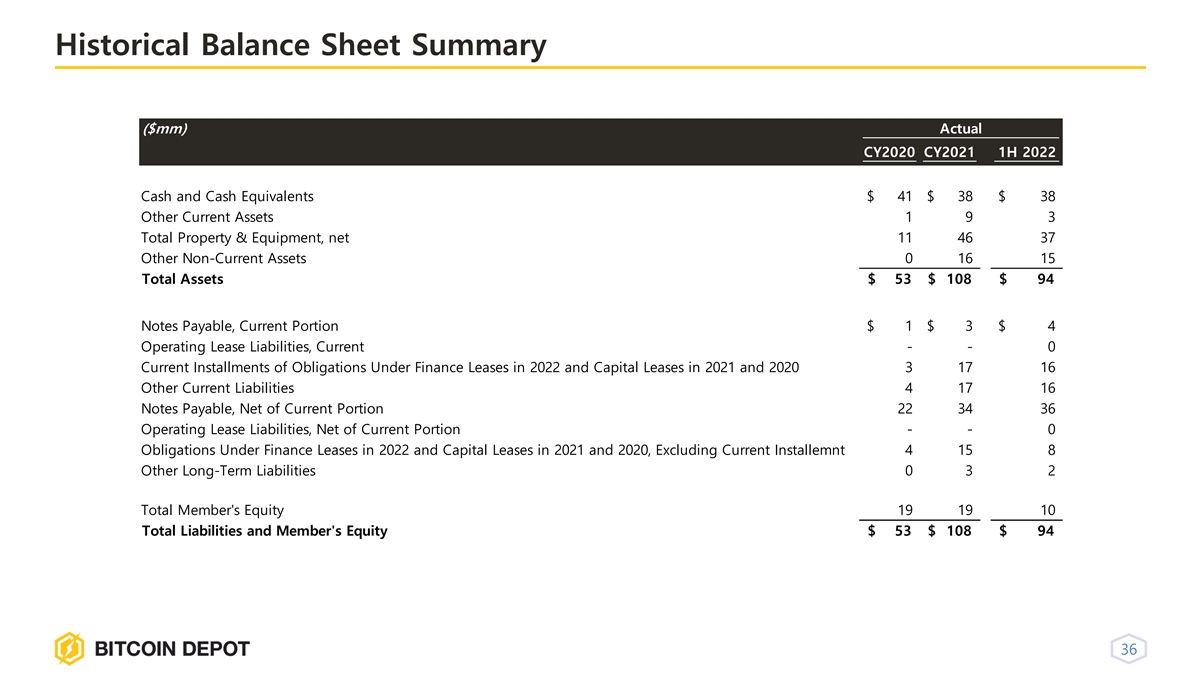

Historical Balance Sheet Summary ($mm) Actual CY2020 CY2021 1H 2022 Cash and Cash Equivalents $ 41 $ 38 $ 38 Other Current Assets 1 9 3 Total Property & Equipment, net 11 46 37 Other Non-Current Assets 0 16 15 Total Assets $ 53 $ 108 $ 94 Notes Payable, Current Portion $ 1 $ 3 $ 4 Operating Lease Liabilities, Current - - 0 Current Installments of Obligations Under Finance Leases in 2022 and Capital Leases in 2021 and 2020 3 17 16 Other Current Liabilities 4 17 16 Notes Payable, Net of Current Portion 22 34 36 Operating Lease Liabilities, Net of Current Portion - - 0 Obligations Under Finance Leases in 2022 and Capital Leases in 2021 and 2020, Excluding Current Installemnt 4 15 8 Other Long-Term Liabilities 0 3 2 Total Member's Equity 19 19 10 Total Liabilities and Member's Equity $ 53 $ 108 $ 94 36