Exhibit 99.1

Largest Crypto ATM Operator Eyes Acquisitions, Global Expansion

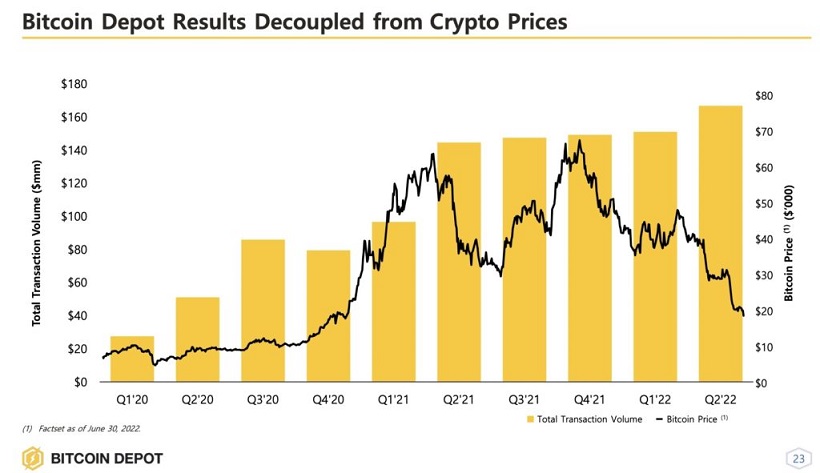

| • | Crypto ATM operator’s transaction volumes are not correlated to bitcoin’s price, CEO says |

| • | Bitcoin Depot seeks New York license, a state it thinks can support several thousand more machines |

By Ben Strack

August 31, 2022 at 12:23 PM EDT

The largest crypto ATM operator, which revealed its intent to go public last week, sees opportunities to acquire smaller players in the space and expand internationally following its planned listing on the Nasdaq.

Bitcoin Depot CEO Brandon Mintz told Blockworks he expects the public listing — via a pending combination with special purpose acquisition company GSR II Meteora Acquisition Corp. — could occur in the first quarter of next year.

Founded in 2016, the Atlanta-based company offers a way to convert cash into bitcoin, ether and litecoin via its roughly 7,000 ATMs in the US and Canada.

Bitcoin Depot’s transaction volumes have not historically been correlated to the price of crypto or seen significant impacts based on bull or bear market cycles, the executive added. It eclipsed an all-time high $160 million of transaction volumes during the second quarter of 2022, company data shows, despite the price of bitcoin plummeting to around $20,000.

The company has generated $623 million of revenue and $6 million of net income in the previous 12 months, as of June 30.

“Even if the [bitcoin] price drops 10% tomorrow, we don’t expect to see a lot of change,” Mintz said.

“We have grown consistently over time, so we think with that growth and the ability to elevate our profile, attract talent and acquire companies, it’s the perfect time to go public,” he added.