UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 24, 2022

GSR II Meteora Acquisition Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-41305 |

|

87-3203989 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 840 Park Drive East

Boca Raton, Florida |

|

33432 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(561) 532-4682

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

| |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one share of Class A common stock, one warrant and one sixteenth of one right |

|

GSRMU |

|

The Nasdaq Stock Market LLC |

| Class A common stock, par value $0.0001 per share |

|

GSRM |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

GSRMW |

|

The Nasdaq Stock Market LLC |

| Rights, each whole right entitling the holder to receive one share of Class A common stock |

|

GSRMR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

| Item 1.01 |

Entry Into A Material Definitive Agreement. |

Transaction Agreement

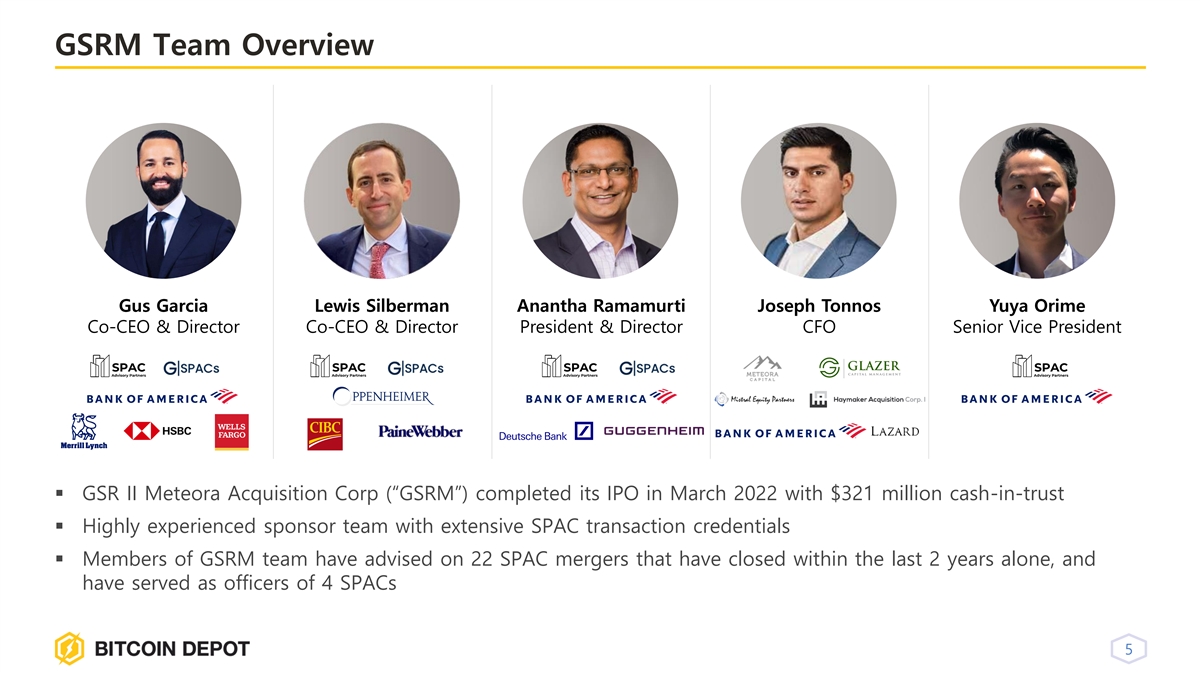

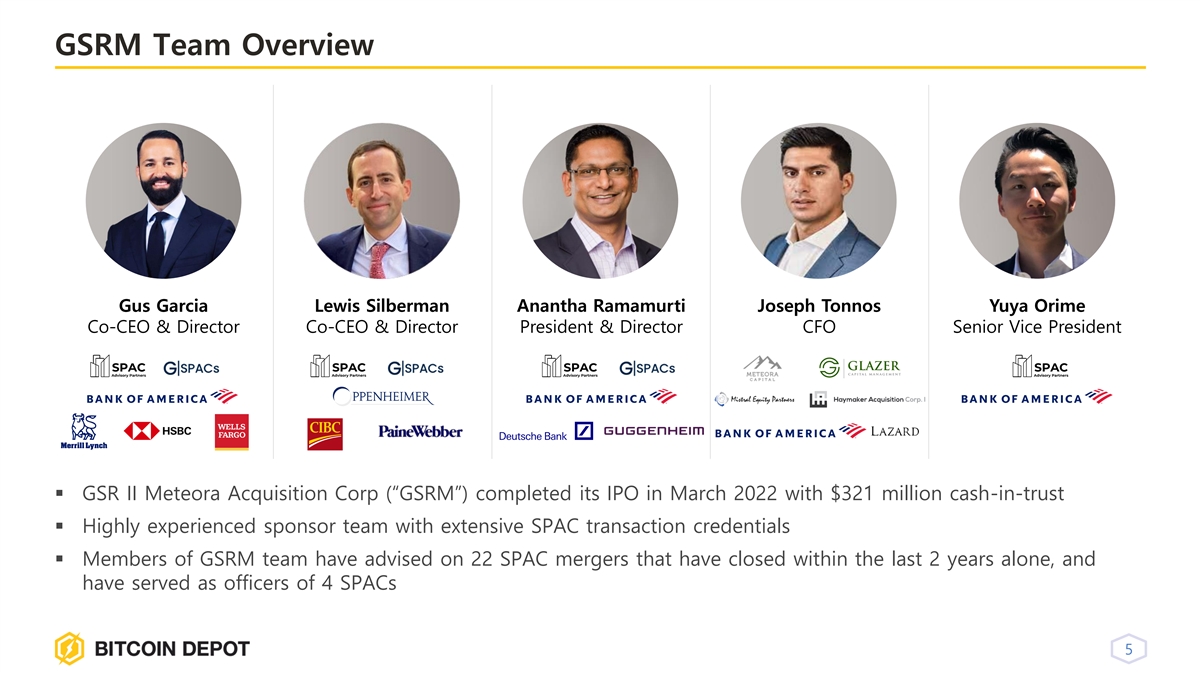

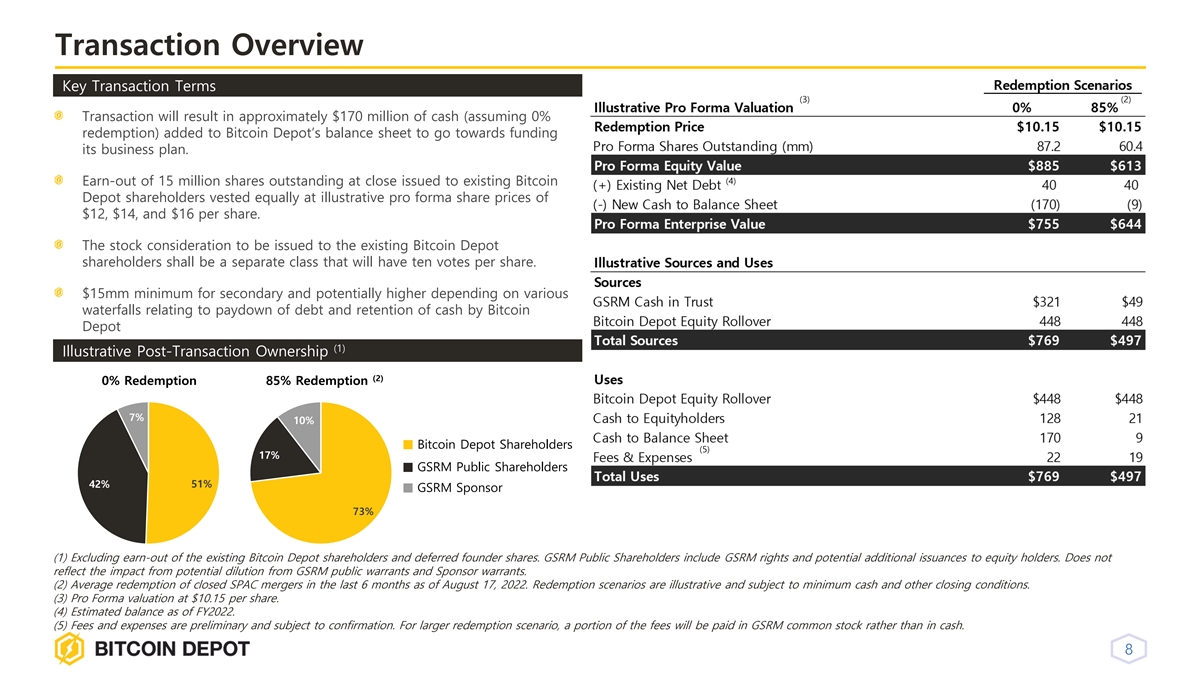

On August 24,

2022, GSR II Meteora Acquisition Corp., a Delaware corporation (the “Company,” “us” or “our”), entered into a Transaction Agreement (as it may be amended, supplemented or otherwise modified from

time to time, the “Transaction Agreement”), by and among the Company, GSR II Meteora Sponsor LLC, a Delaware limited liability company (“Sponsor”, and together with the Company, “GSR Entities”), BT

Assets, Inc., a Delaware corporation (“BT Assets”), and Lux Vending, LLC, a Georgia limited liability company and a wholly owned subsidiary of BT Assets (“Lux Vending”). The transactions contemplated by the

Transaction Agreement as described below are hereinafter referred to as the “Business Combination” and the closing date of the Business Combination is hereinafter referred to as the “Closing.” All of the terms used,

but not defined herein shall have the meanings ascribed to such terms in the Transaction Agreement.

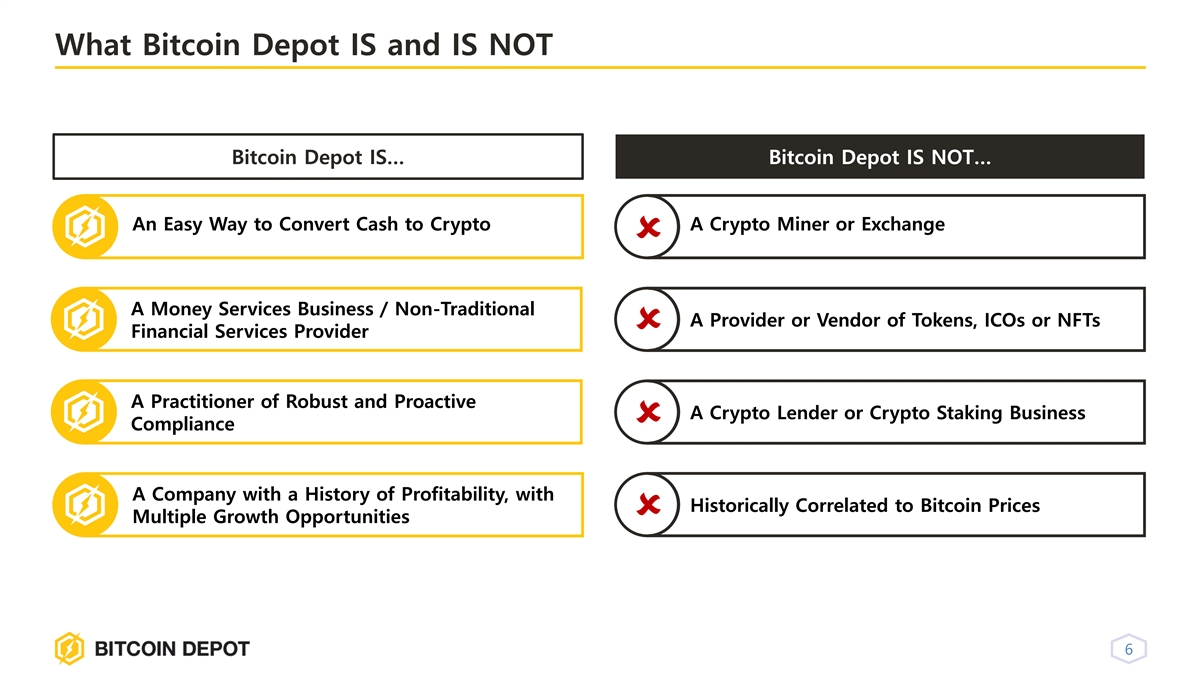

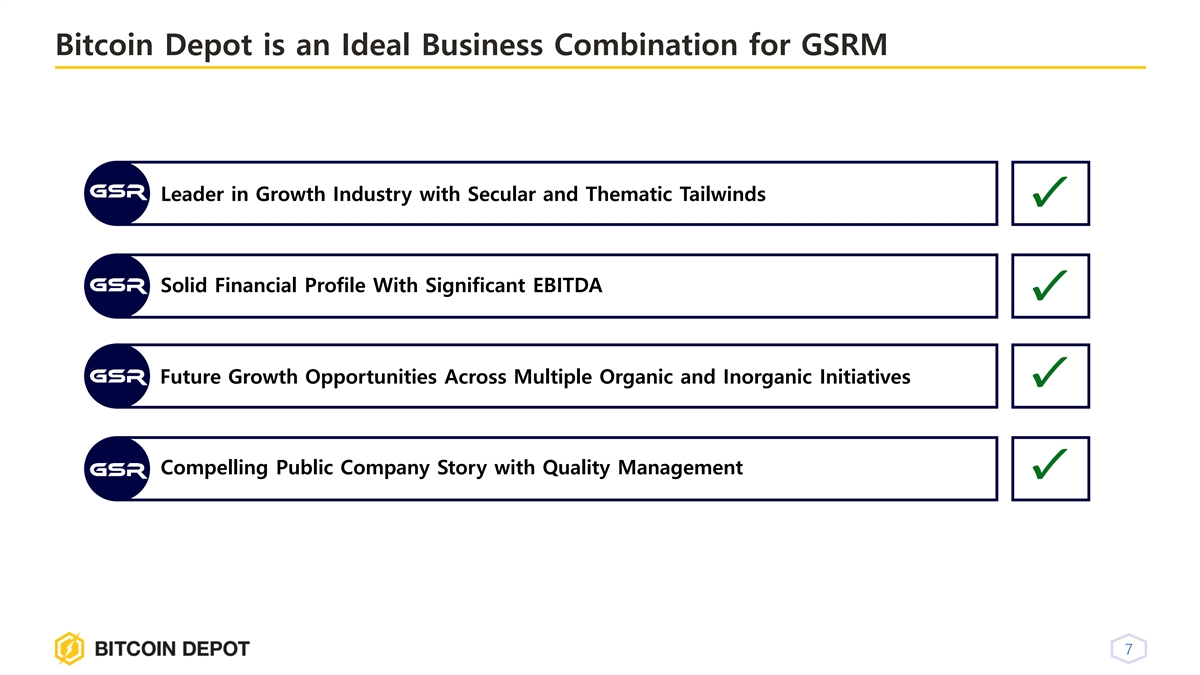

In connection with the Business

Combination, the Company will be renamed “Bitcoin Depot Inc.” or another name to be determined by the BT Entities (defined below) in their reasonable discretion (“PubCo”).

The Transaction Agreement and the transactions contemplated thereby were approved by the board of directors of the Company and the leadership

team of BT Assets.

The Business Combination

Upon the terms and subject to the conditions of the Transaction Agreement, in accordance with the Delaware General Corporation Law, and prior

to or at the Closing, the GSR Entities and the BT Entities will enter into the following transactions:

| |

(i) |

Lux Vending will merge with and into a newly-formed Delaware limited liability company known as “Bitcoin

Depot Operating LLC” (“BT OpCo”, and together with BT Assets, “BT Entities”); |

| |

(ii) |

BT Assets will sell, transfer, assign, convey and deliver to PubCo and PubCo will purchase and accept from BT

Assets, the Purchased Common Units in exchange for certain cash consideration (the “Over the Top Consideration”). |

| |

(iii) |

PubCo will assign, transfer, contribute and deliver to BT OpCo certain cash consideration (the

“Contribution Amount”), and BT OpCo will issue and deliver to PubCo (i) at the Closing, the Contribution Common Units, and (ii) at the Closing and immediately following the effectiveness of the BT OpCo A&R LLC

Agreement, certain Matching Warrants and PubCo Earn-Out Units. The Over the Top Consideration and the Contribution Amount will be distributed in accordance with the Cash Distribution Waterfall as set forth in

the Transaction Agreement. |

Following the foregoing transactions, and assuming no redemptions, BT Assets and its

affiliated entities, including Brandon Mintz, the founder, Chief Executive Officer and controlling stockholder of BT Assets, are expected to own a majority of the outstanding Common Units and the outstanding BT

Earn-Out Units and a supermajority of the outstanding voting shares of PubCo, and PubCo will own the remainder of the outstanding Common Units and BT Earn-Out Units. The

Business Combination is expected to close in the first quarter of 2023, following the receipt of the required approvals by the Company’s stockholders and the fulfillment of other customary closing conditions, including a minimum cash condition.

Transaction Consideration

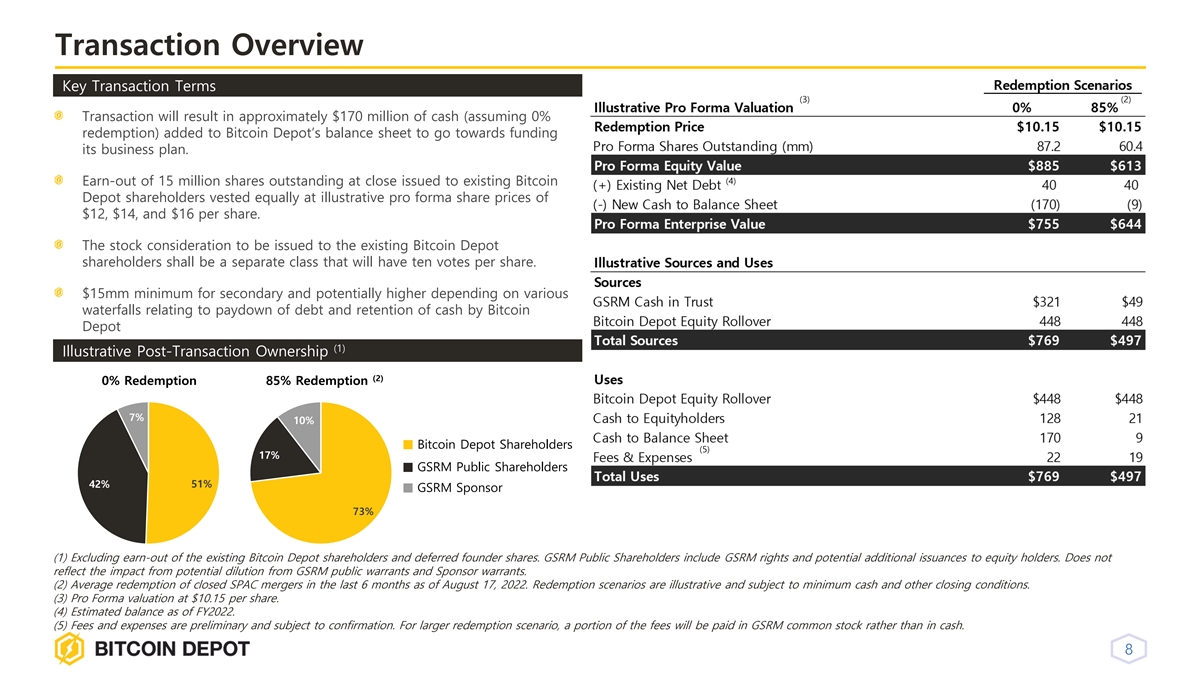

As of the

date of this filing, the Company has approximately $310 million in its Trust Account, net of deferred underwriting fees of approximately $11.1 million, which will be used as cash consideration in connection with the Business Combination.

In addition, the Transaction Agreement permits the Company to raise additional equity financing prior to the Closing, subject to certain terms and conditions.

Representations and Warranties; Covenants

The Transaction Agreement contains representations, warranties and covenants of each of the parties thereto that are customary for transactions

of this type, including with respect to corporate organization and authorization, third party consents, capitalization, financial statements, material contracts, tax matters, compliance with laws, employee and benefits matters and intellectual

property, among others. Effective immediately following the Closing, PubCo’s board of directors shall be comprised of seven directors, two of whom shall be designated by the Sponsor and five of whom shall be designated by BT Assets prior to the

Closing.

Conditions to Each Party’s Obligations

The Closing is subject to certain customary conditions, including, but not limited to, (i) the requisite approvals of the stockholders of

the Company, (ii) the expiration or termination of any applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (if applicable), (iii) the PubCo Class A Common Stock being approved for listing

on Nasdaq and (iv) performance of each parties’ covenants to be performed under the Transaction Agreement in all material respects.

Termination

The Transaction Agreement

may be terminated under certain customary and limited circumstances prior to the Closing, including, (i) by BT Assets and the Company, (ii) by BT Assets or the Company if any Governmental Authority shall have enacted any Governmental Order

which has become final and non-appealable and has the effect of making consummation of the Business Combination illegal or otherwise preventing or prohibiting consummation of the Business Combination,

(iii) by BT Assets if the Company Stockholder Approval is not obtained by reason of the failure to obtain the required vote at the Company’s Stockholders’ Meeting, (iv) by BT Assets after there has been a Modification in

Recommendation, (v) by the Company upon the failure to meet specified deadlines for the filing of the Proxy Statement, subject to certain conditions, (vi) prior to the Closing, by the Company if (A) there is any breach of any

representation, warranty, covenant or agreement on the part of the BT Entities set forth in the Transaction Agreement such that certain conditions to closing cannot be satisfied and such breach is not cured within the cure period window or

(B) the Closing has not occurred on or before February 28, 2023, unless the Company is then in

material breach of the Transaction Agreement, or (vii) prior to the Closing, by the Company if (A) there is any breach of any representation, warranty, covenant or agreement on the part

of the Company or Sponsor set forth in the Transaction Agreement such that certain conditions to closing cannot be satisfied and such breach is not cured within the cure period window or (B) the Closing has not occurred on or before the

Agreement end date, unless any of the BT Entities is then in material breach of the Transaction Agreement.

If the Transaction Agreement

is validly terminated, none of the parties to the Transaction Agreement will have any liability or any further obligation under the Transaction Agreement other than customary confidentiality obligations and other miscellaneous provisions, except in

the case of fraud or willful and material breach of the Transaction Agreement.

The foregoing description of the Transaction Agreement and

the Business Combination does not purport to be complete and is qualified in its entirety by the terms and conditions of the Transaction Agreement, a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The

Transaction Agreement contains representations, warranties and covenants that the respective parties made to each other as of the date of the Transaction Agreement or other specific dates. The assertions embodied in those representations, warranties

and covenants were made for purposes of the contract among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating such agreement. The representations, warranties and

covenants in the Transaction Agreement are also modified in important part by the underlying disclosure schedules which are not filed publicly with the U.S. Securities and Exchange Commission (the “SEC”) and which are subject to a

contractual standard of materiality different from that generally applicable to stockholders and were used for the purpose of allocating risk among the parties rather than establishing matters as facts. The Company does not believe that these

schedules contain information that is material to an investment decision.

Sponsor Support Agreement

Concurrently with the execution of the Transaction Agreement, the Sponsor, the Company and BT Assets entered into a sponsor support agreement

(the “Sponsor Support Agreement”), pursuant to which the Sponsor agrees, among other things, (i) to vote at any meeting of the Company’s stockholders, and in any action by written consent of the Company’s

stockholders, all of its Company equity securities in favor of the adoption and approval of the Transaction Agreement, the transactions contemplated thereby, and the other approvals contemplated to be sought with respect thereto; (ii) be bound

by certain other covenants and agreements related to the Business Combination and (iii) be bound by certain transfer restrictions with respect to such securities and on the terms and subject to the conditions set forth in the Sponsor Support

Agreement.

The foregoing description of the Sponsor Support Agreement does not purport to be complete and is qualified in its entirety by

the terms and conditions of the Sponsor Support Agreement filed as Exhibit 10.1 hereto and incorporated by reference herein.

Registration Rights

Agreement

At the Closing, Sponsor and BT Assets, among others (collectively, the “Holders”), and the Company will

amend and restate the Registration Rights Agreement, dated as of February 24, 2022, by and between the Company and Sponsor (as amended and restated, the “Registration Rights Agreement”), pursuant to which, among other things,

PubCo will agree to use commercially reasonable efforts to file a registration statement for a shelf registration on Form S-1 or Form S-3 within 45 days following

Closing and the Holders will be granted certain customary registration rights with respect to the securities of PubCo.

The foregoing

description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the form of Registration Rights Agreement, a copy of which is filed as Exhibit 10.2 hereto and

incorporated by reference herein.

Tax Receivable Agreement

At the Closing, the Company and the BT Entities will enter into a Tax Receivable Agreement (the “Tax Receivable Agreement”).

Pursuant to the Tax Receivable Agreement, the Company will generally be required to pay BT Assets 85% of the amount of savings, if any, in U.S. federal, state, local, and foreign income taxes that the Company realizes, or is deemed to realize, as a

result of certain tax attributes, including:

| |

• |

|

existing tax basis in certain assets of BT OpCo, including assets that will eventually be subject to depreciation

or amortization, once placed in service, attributable to BT OpCo Common Units acquired by the Company at the Closing and thereafter in accordance with the terms of the A&R LLC Agreement (as defined below); |

| |

• |

|

tax basis adjustments resulting from the Company’s acquisition of BT OpCo Common Units from BT Assets at the

Closing and thereafter pursuant to the terms of the A&R LLC Agreement (including any such adjustments resulting from certain payments made by the Company under the Tax Receivable Agreement); |

| |

• |

|

disproportionate tax-related allocations made to the Company as a result

of Section 704(c) of the U.S. Internal Revenue Code of 1986, as amended; and |

| |

• |

|

tax deductions in respect of interest payments deemed to be made by the Company in connection with the Tax

Receivable Agreement. |

The foregoing description of the Tax Receivable Agreement does not purport to be complete and is

qualified in its entirety by the terms and conditions of the form of Tax Receivable Agreement filed as Exhibit 10.3 hereto and incorporated by reference herein.

Amended and Restated Limited Liability Company Agreement of BT OpCo

At the Closing, the Company, BT OpCo and BT Assets will enter into an Amended and Restated Limited Liability Company Agreement of BT OpCo (the

“A&R LLC Agreement”) setting forth the rights and obligations of the members of BT OpCo, and pursuant to which, among other things, BT OpCo will be controlled by PubCo, as managing member. In addition, the A&R LLC

Agreement contains customary provisions for operating partnerships held by a public company, including providing for PubCo to maintain a one-to-one ratio between its

outstanding PubCo Class A Common Stock and the number of Common Units held by PubCo.

The foregoing description of the A&R LLC

Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the form of A&R LLC Agreement filed as Exhibit 10.4 hereto and incorporated by reference herein.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K with respect to the

issuance of PubCo’s common stock pursuant to the Transaction Agreement is incorporated by reference herein. The common stock issuable pursuant to the Transaction Agreement will not be registered under the Securities Act of 1933, as amended (the

“Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

| Item 7.01 |

Regulation FD Disclosure. |

On August 25, 2022, the Company and BT Assets issued a press release announcing their entry into the Transaction Agreement. The press

release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

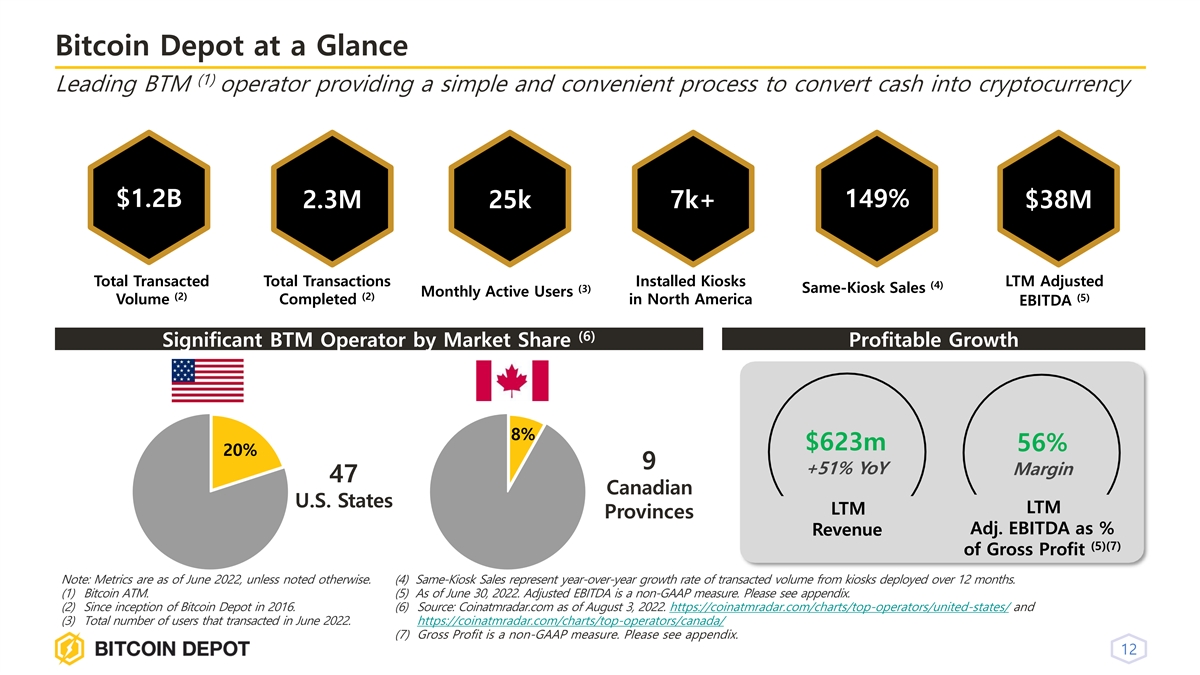

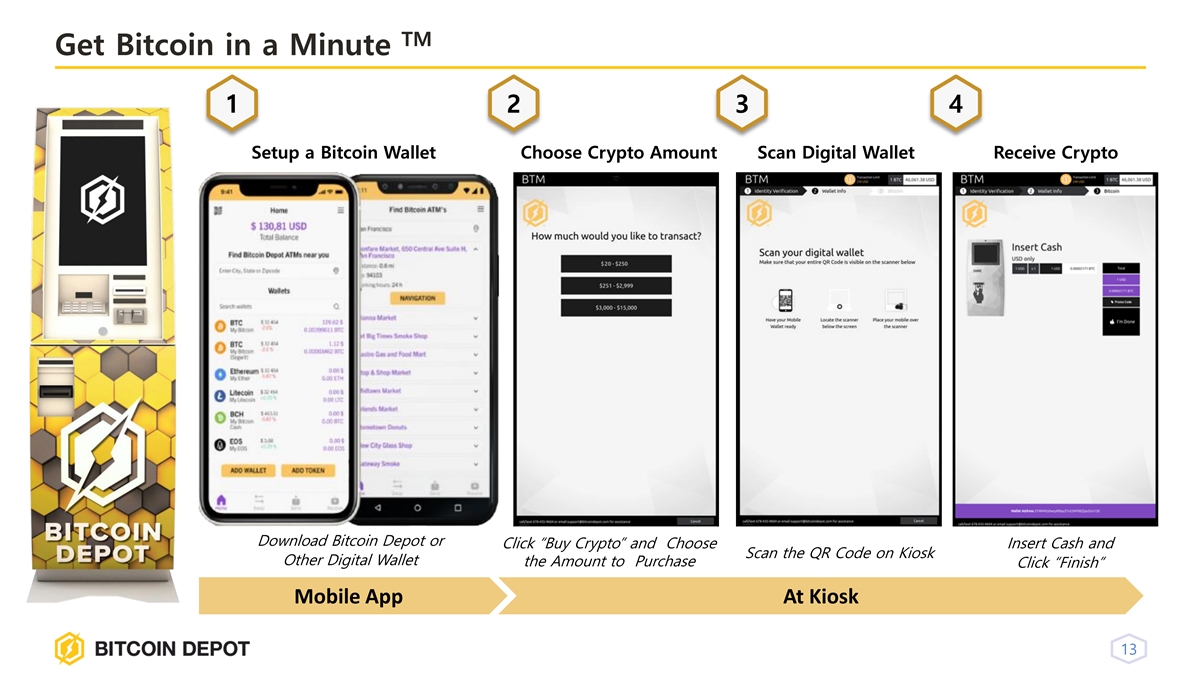

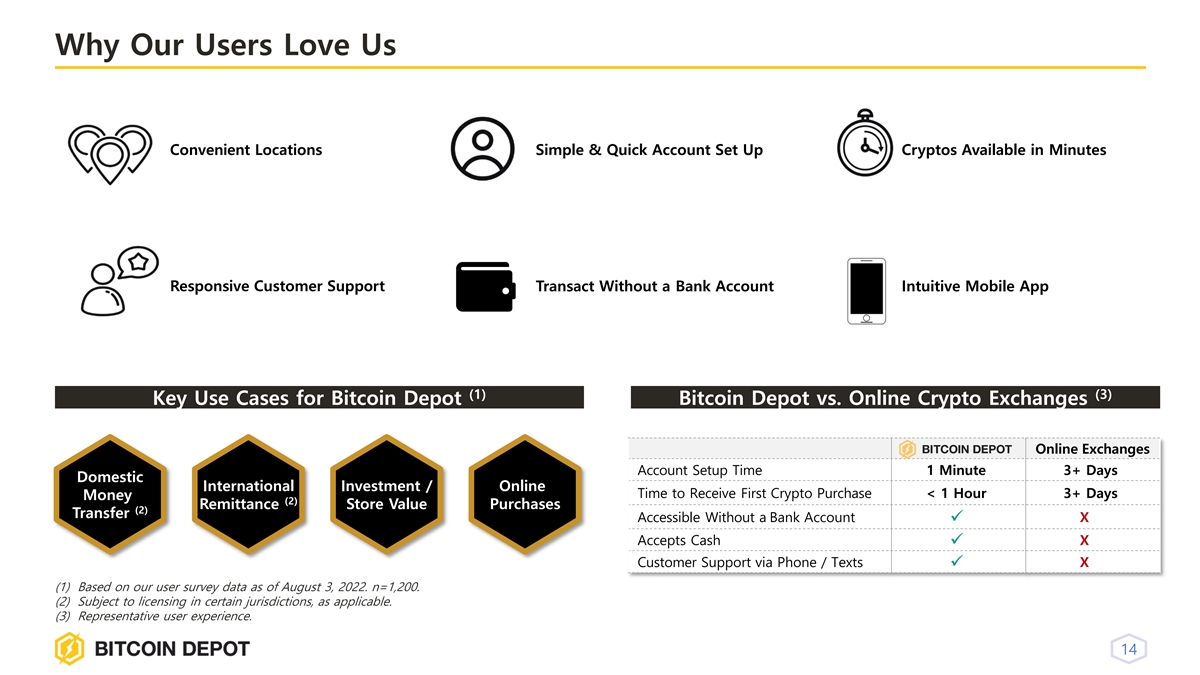

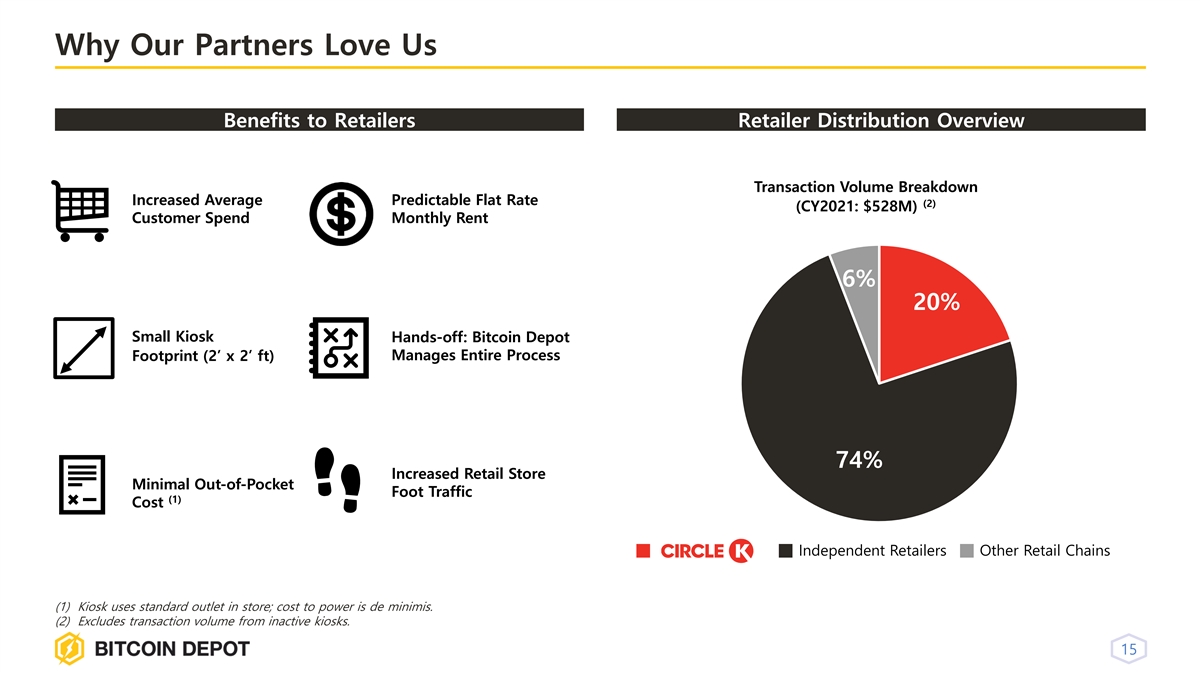

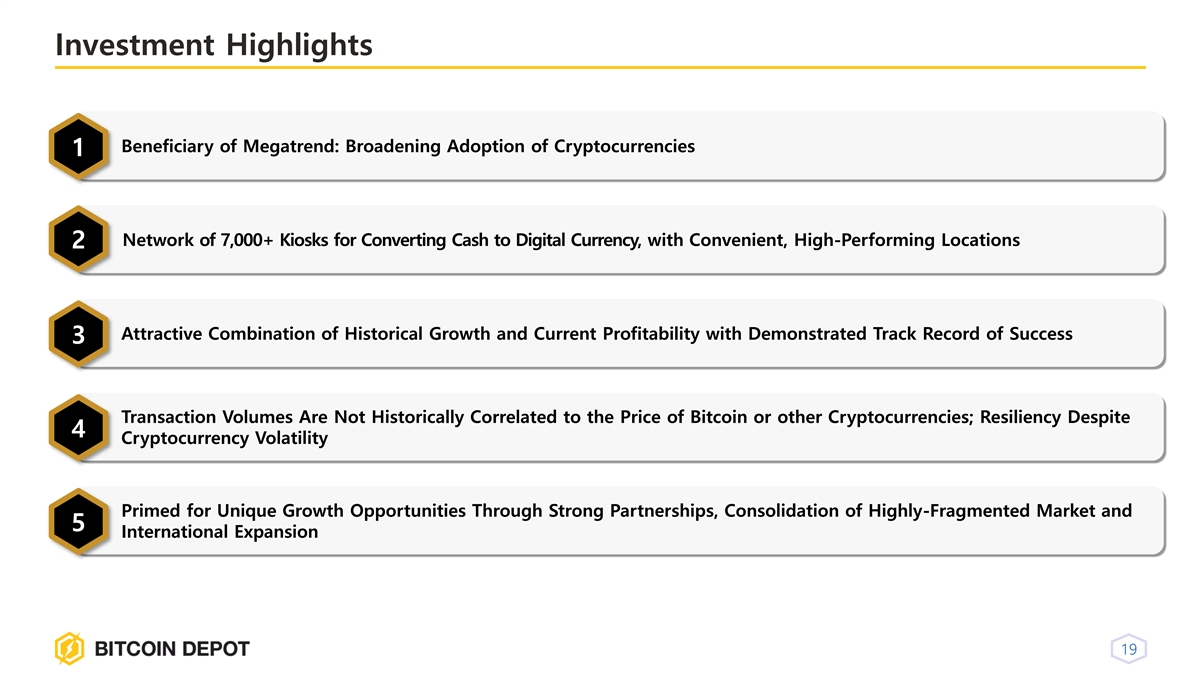

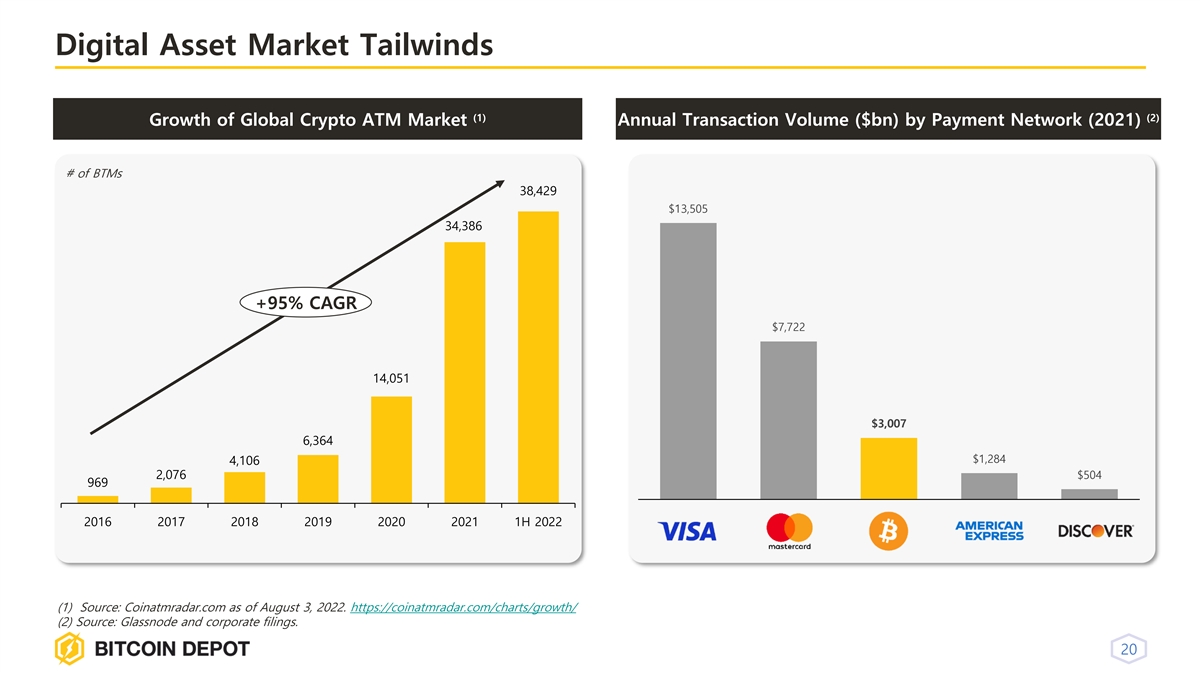

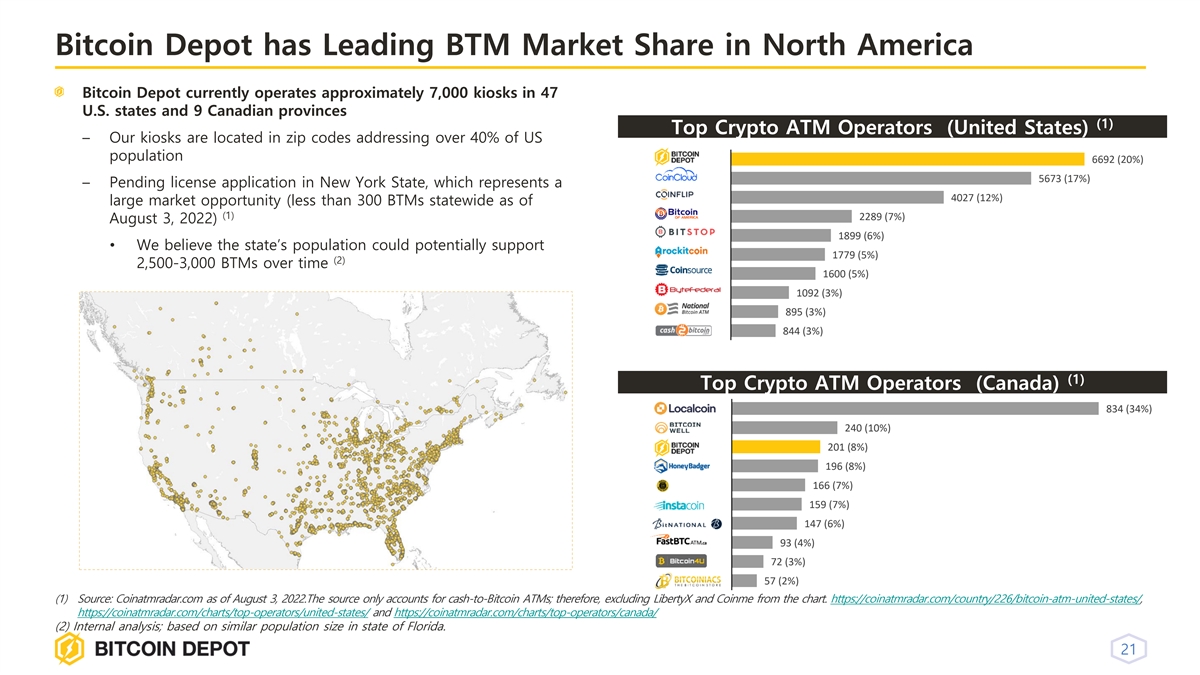

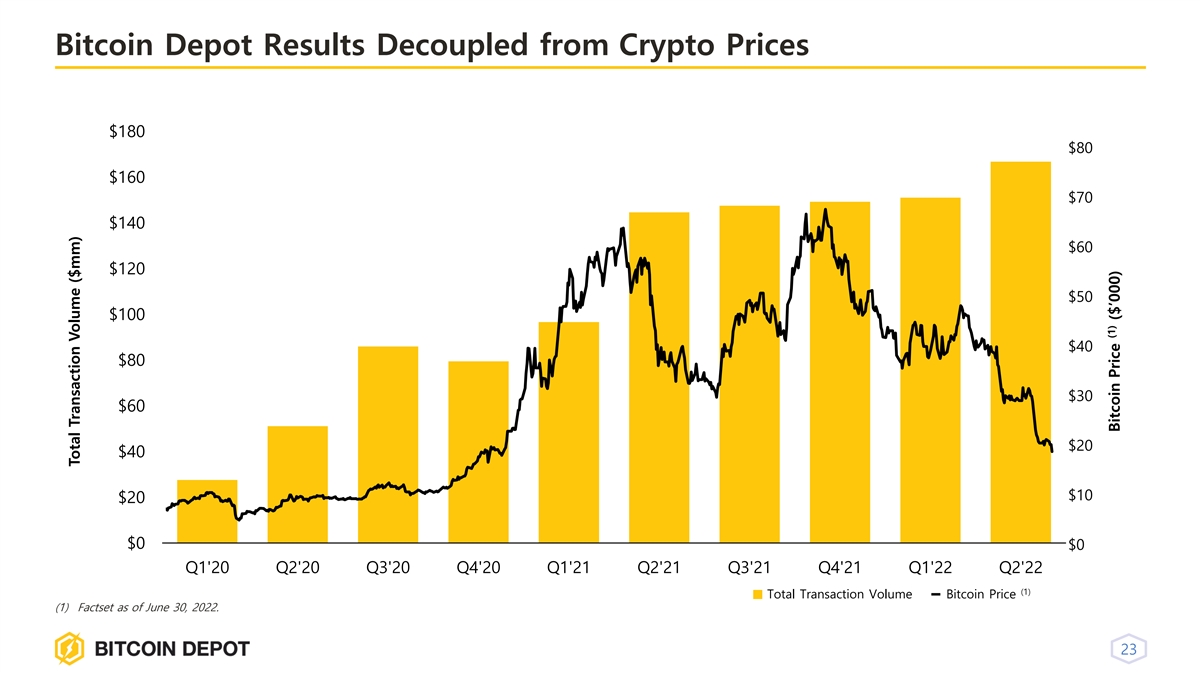

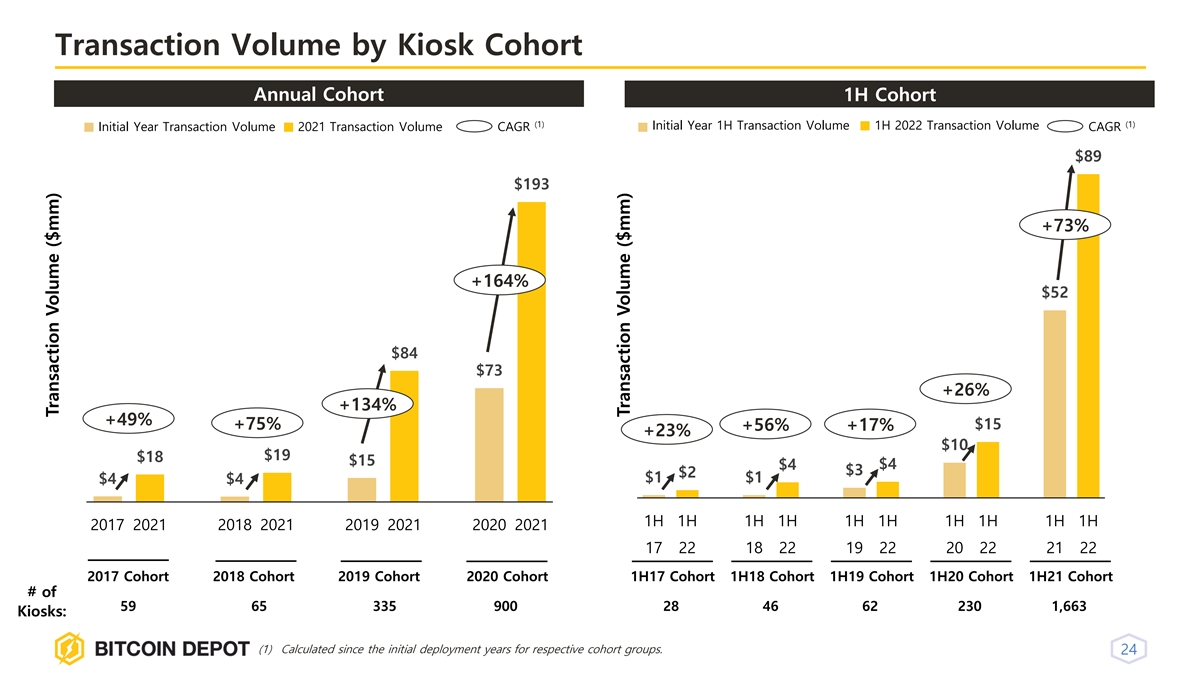

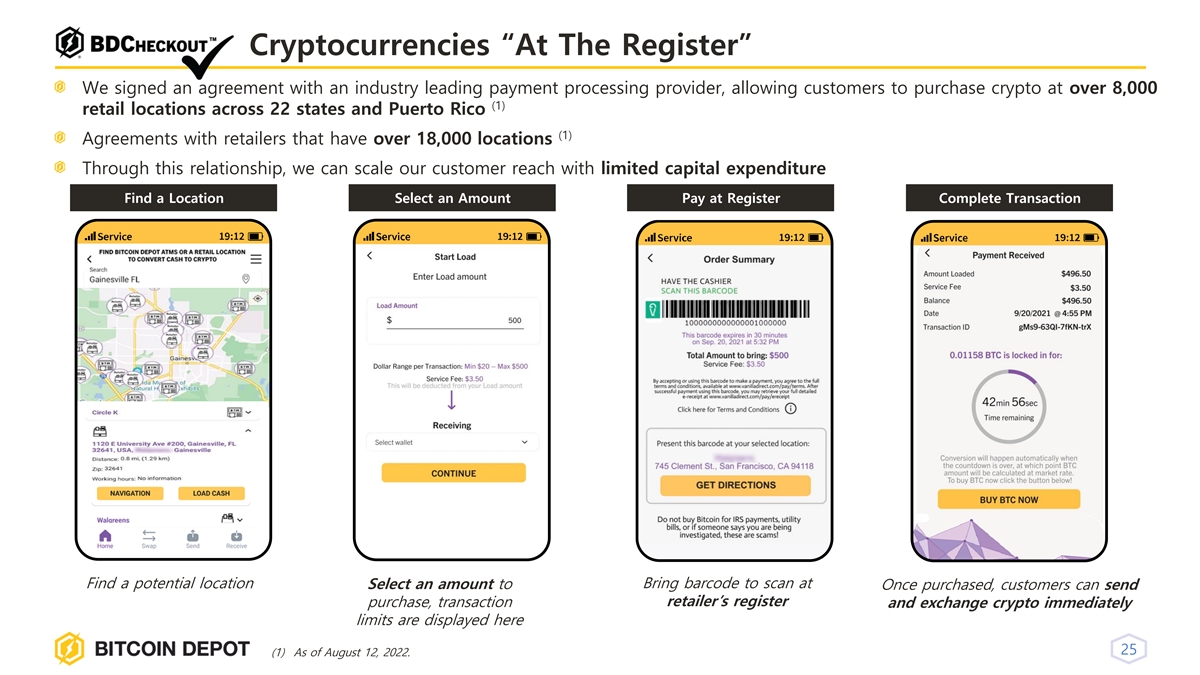

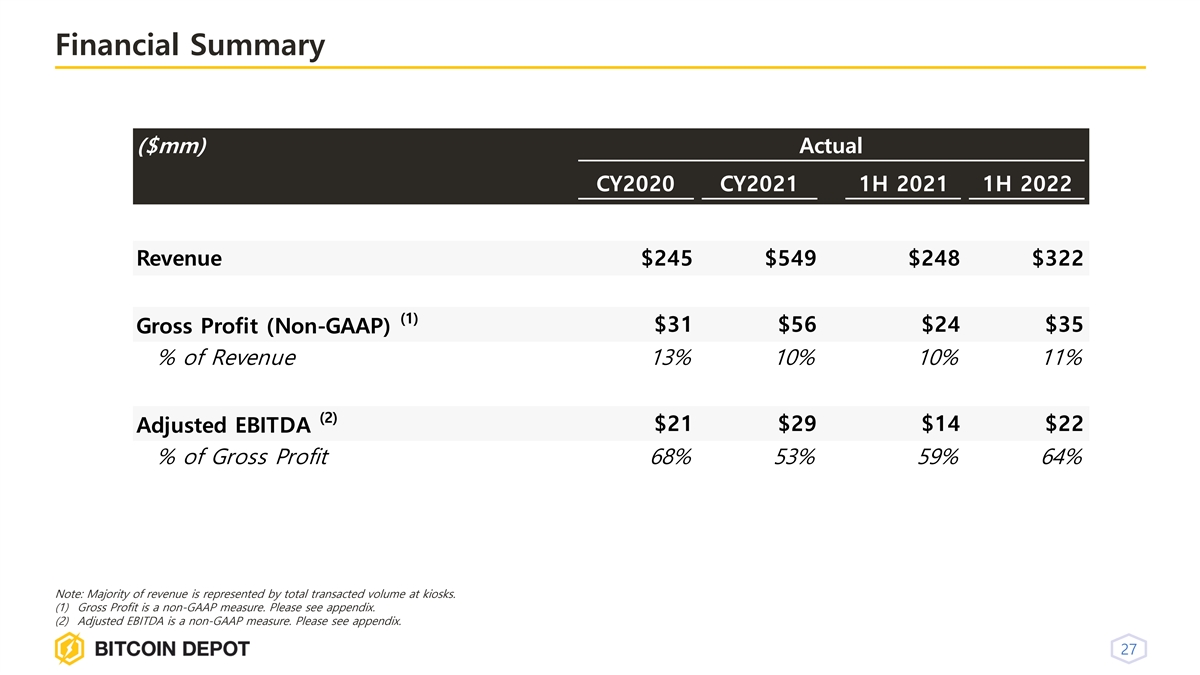

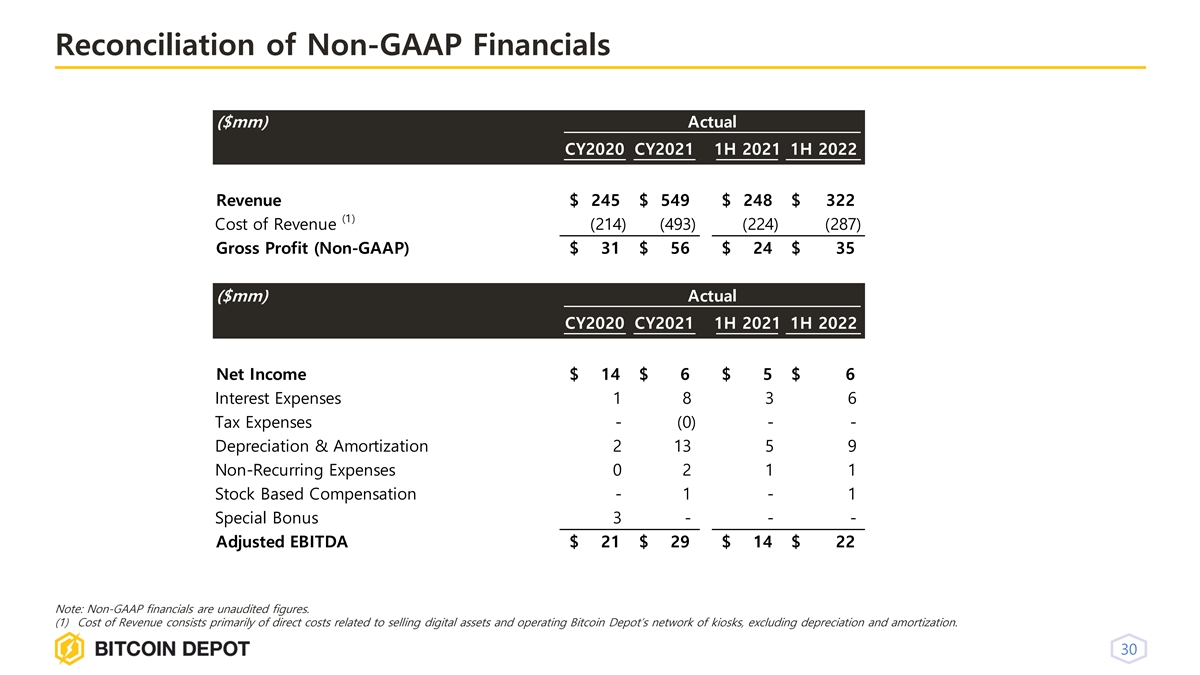

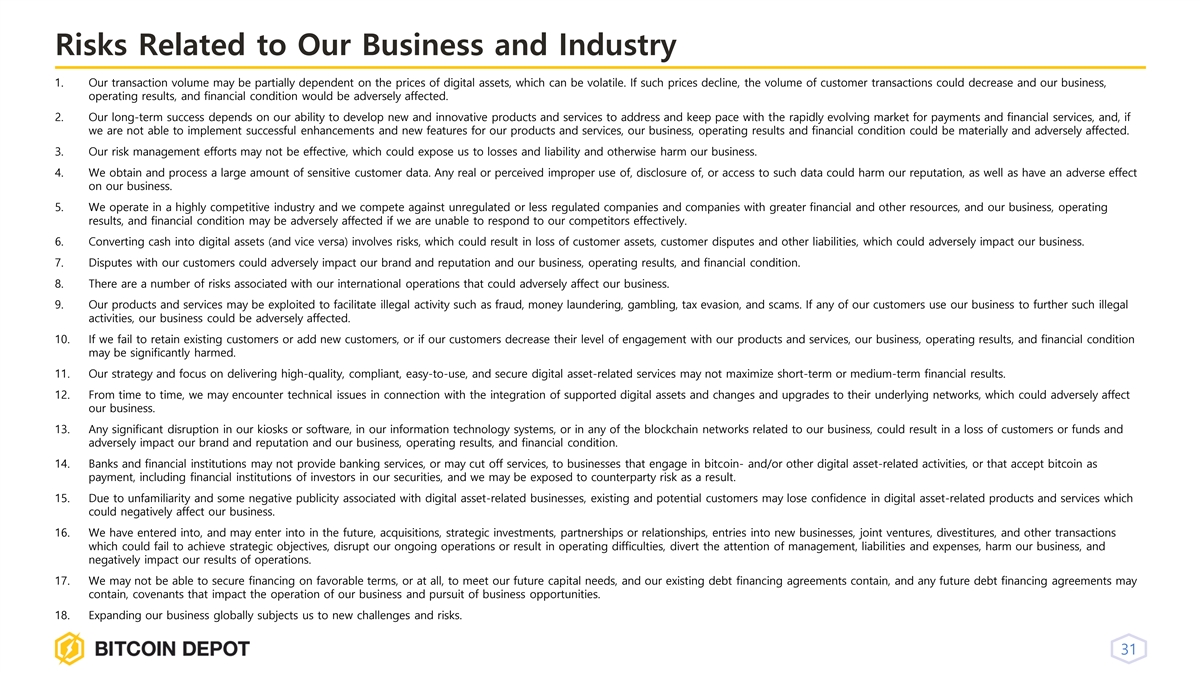

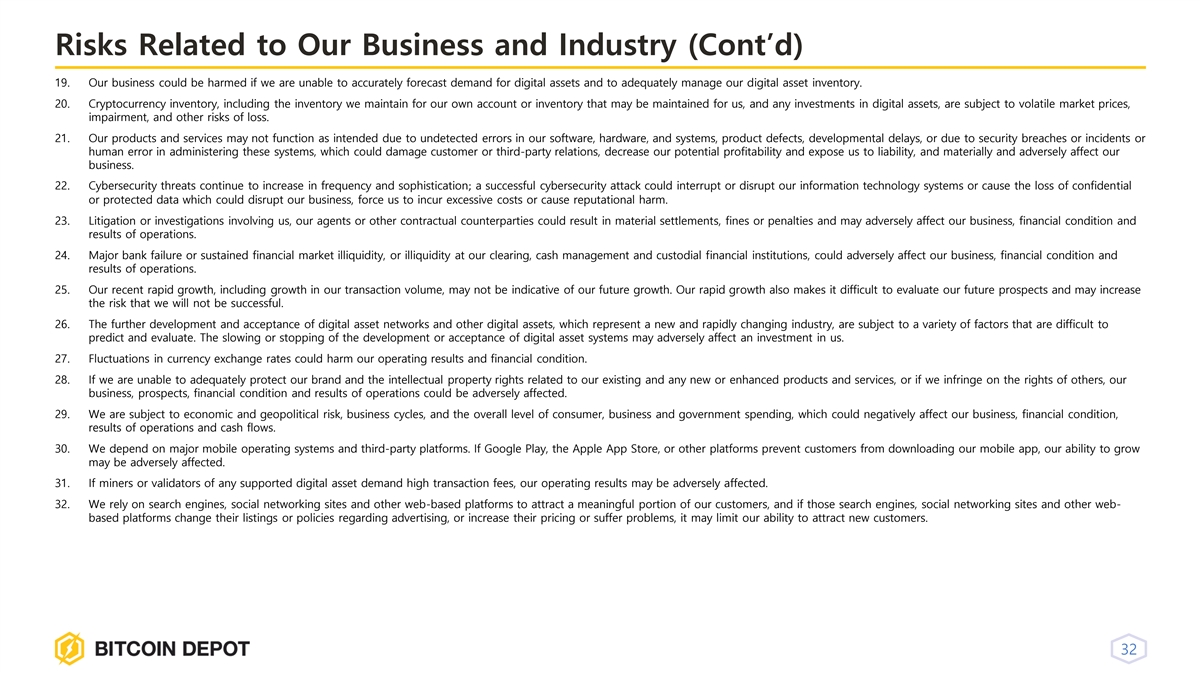

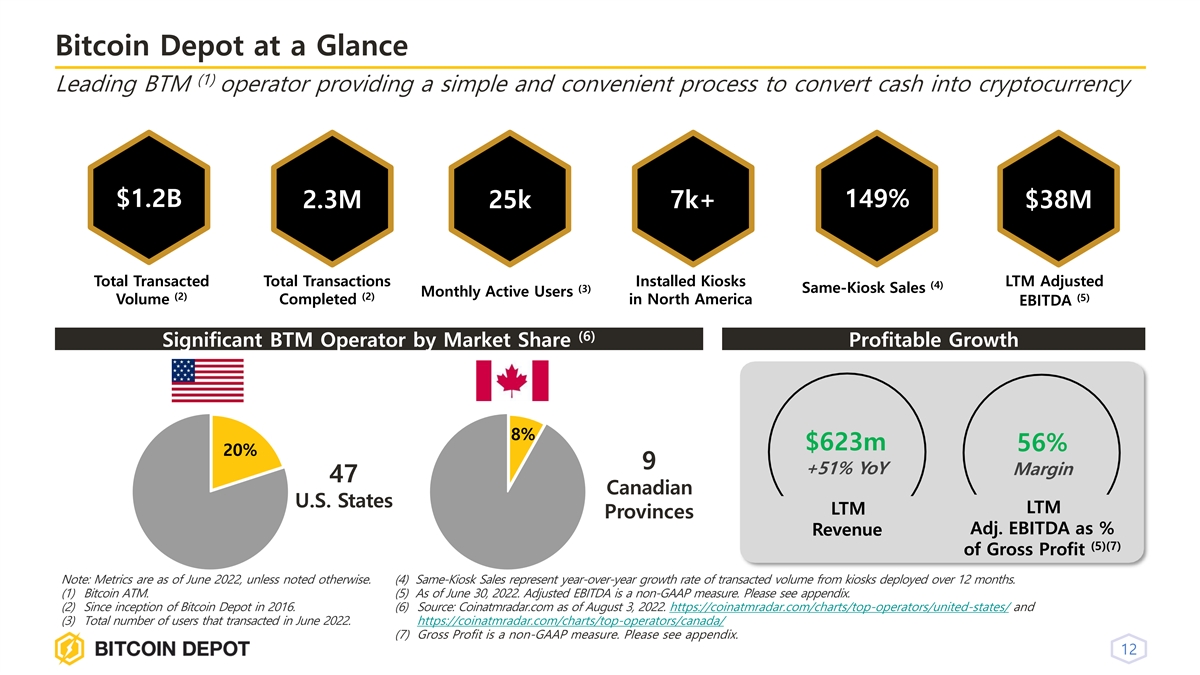

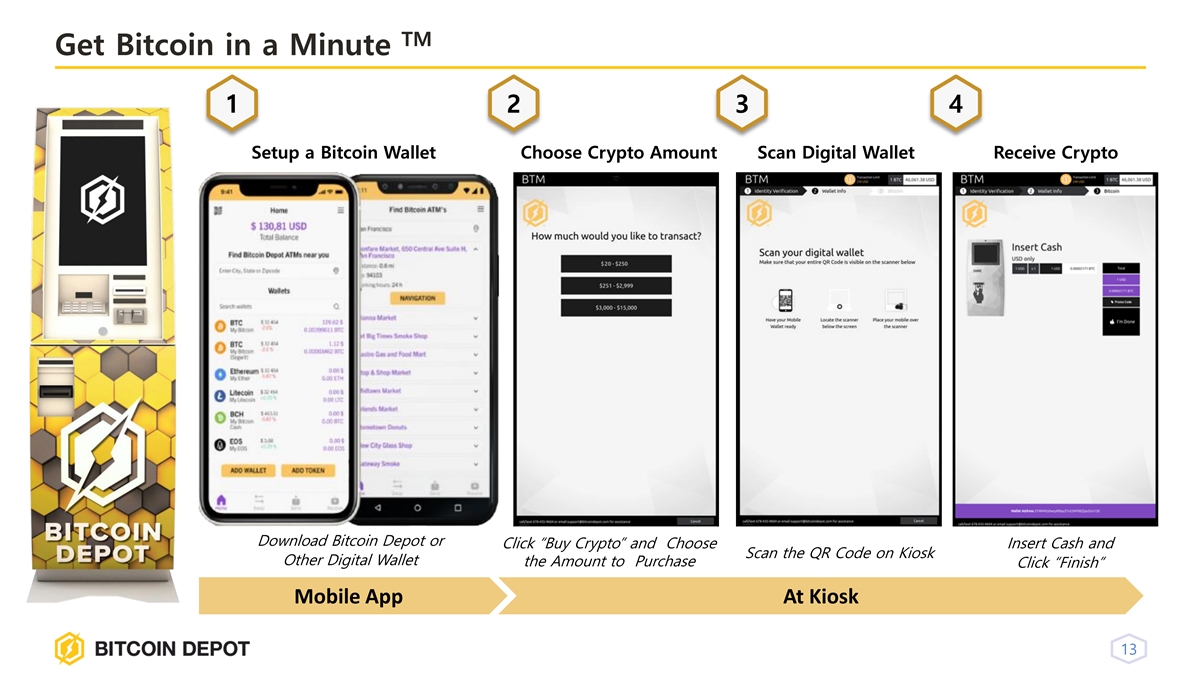

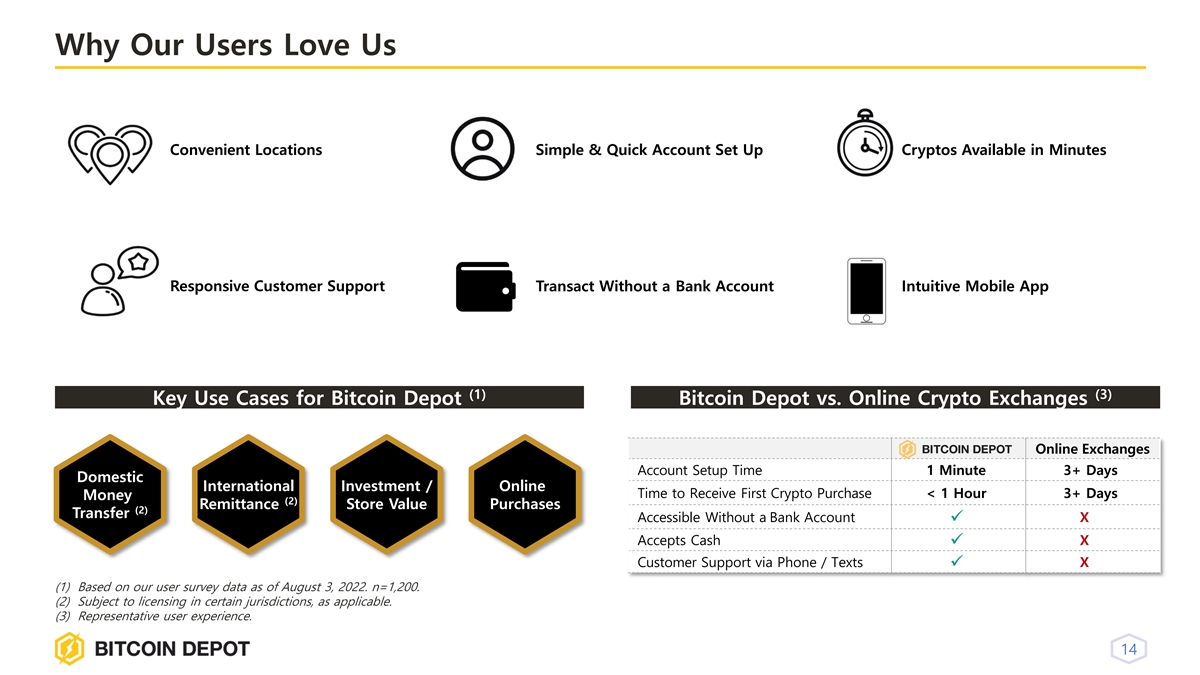

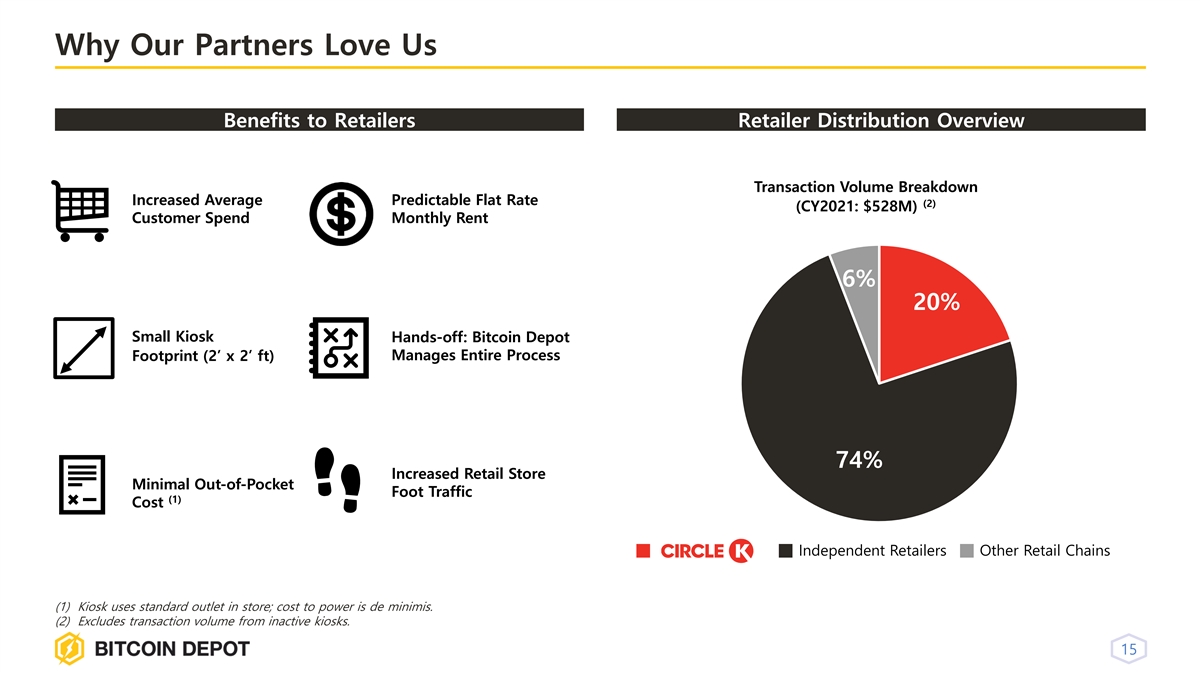

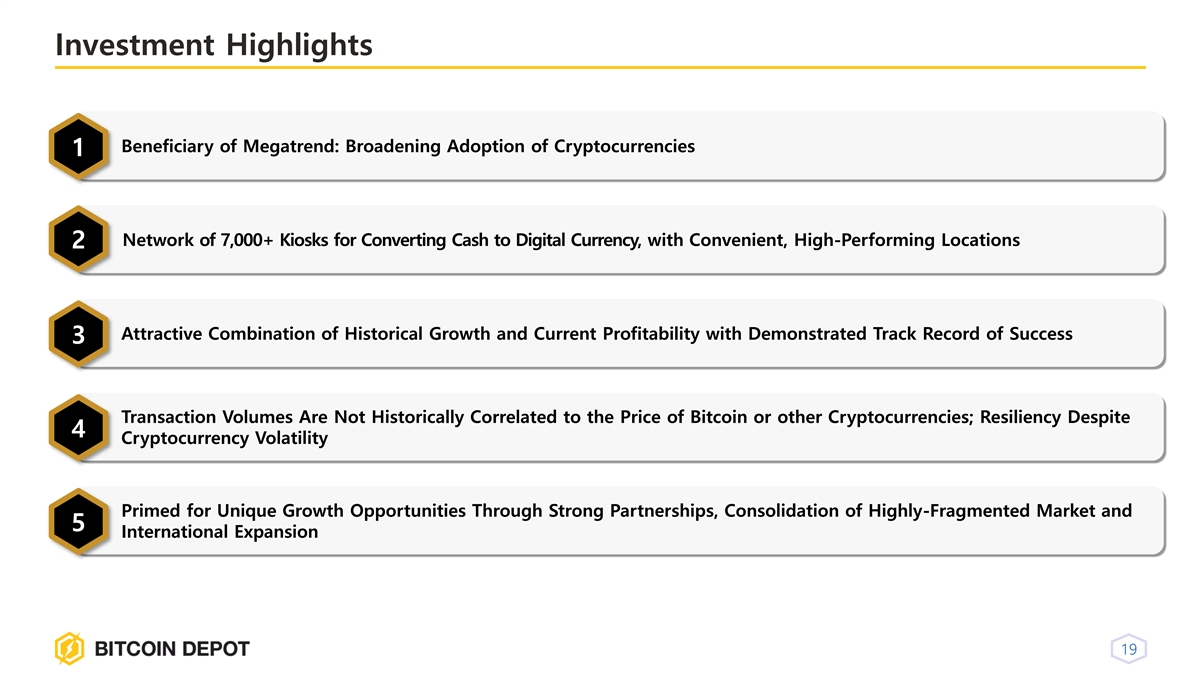

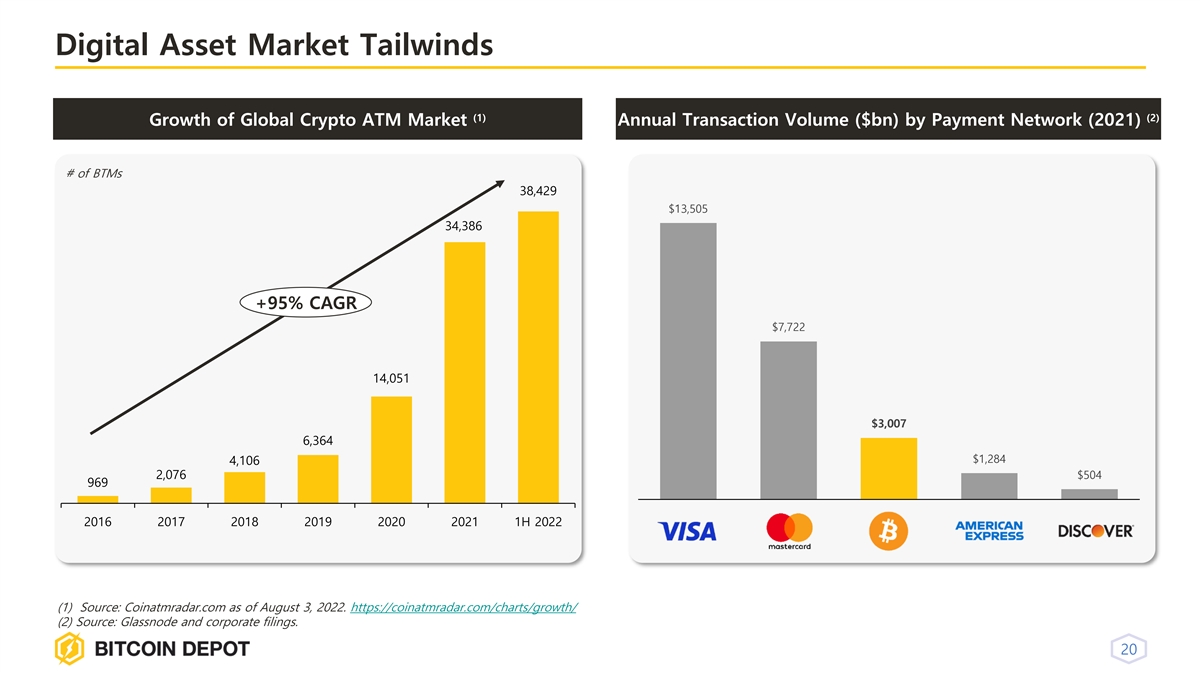

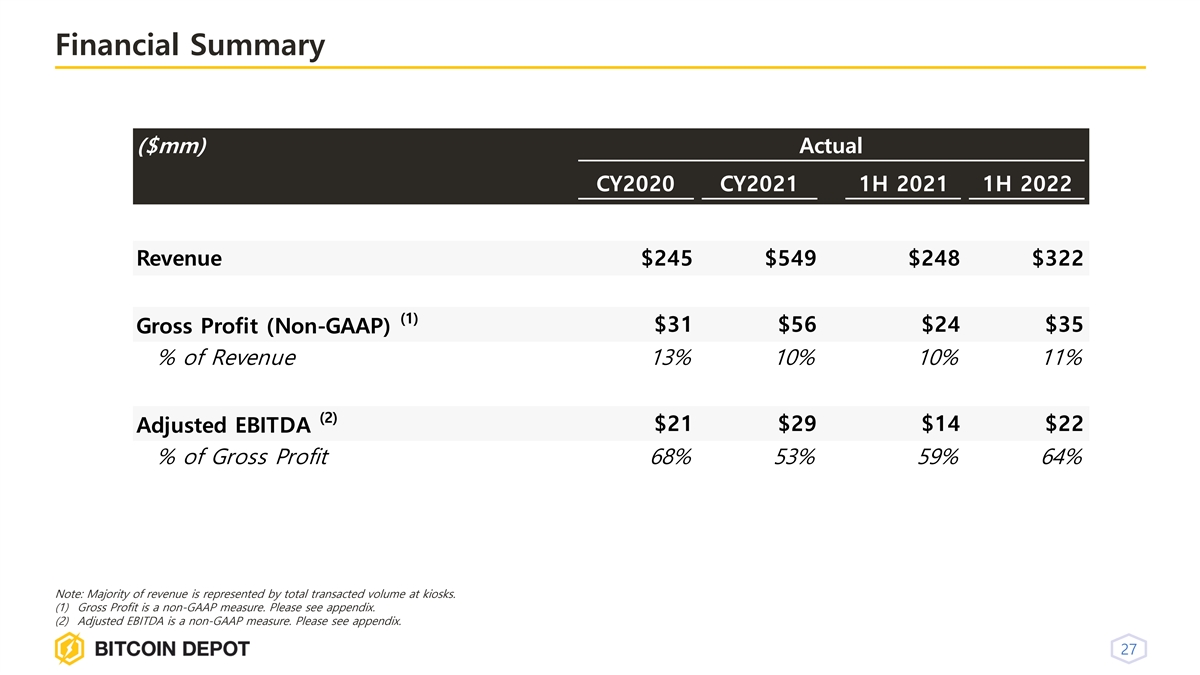

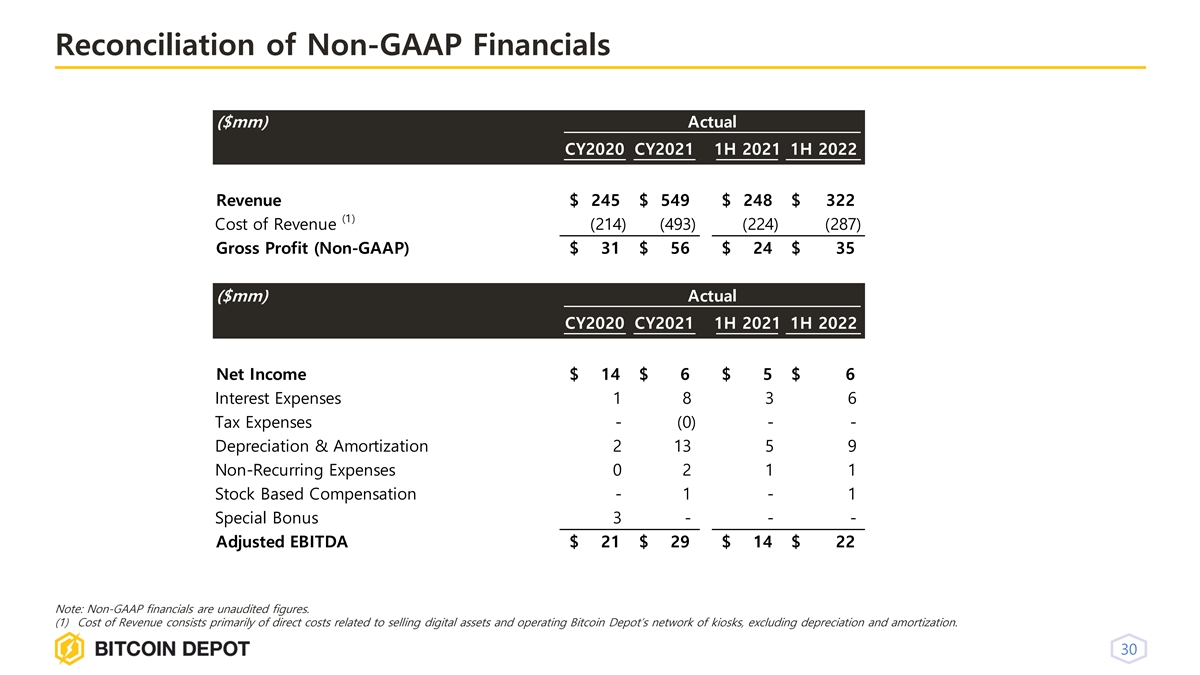

Furnished as Exhibit 99.2 hereto and incorporated into

this Item 7.01 by reference is the investor presentation that the Company and BT Assets have prepared for use in connection with the announcement of the Business Combination.

The foregoing (including Exhibits 99.1 and 99.2) is being furnished pursuant to Item 7.01

and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be

incorporated by reference in any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filings. This Current Report will not be deemed an admission of materiality of any of the information in

this Item 7.01, including Exhibits 99.1 and 99.2.

Additional Information

In connection with the Business Combination, the Company intends to file a preliminary proxy statement of the Company with the SEC, copies of

which will be mailed (if and when available) to all Company stockholders once definitive. The Company also plans to file other documents with the SEC regarding the Business Combination. The Company will mail copies of the definitive proxy statement

and other relevant documents to its stockholders as of the record date established for voting on the Business Combination. This communication is not a substitute for the definitive proxy statement or any other document that the Company will send to

its stockholders in connection with the Business Combination. The Company’s stockholders and other interested persons are advised to read, once available, the preliminary proxy statement and any amendments thereto and, once available, the

definitive proxy statement, as well as all other relevant materials filed or that will be filed with the SEC, in connection with the Company’s solicitation of proxies for its special meeting of stockholders to be held to approve, among other

things, the Business Combination, because these documents will contain important information about the Company, BT Assets and the Business Combination. Stockholders may also obtain a copy of the preliminary or definitive proxy statement, once

available, as well as other documents filed with the SEC regarding the Business Combination and other documents filed with the SEC by the Company, without charge, at the SEC’s website located at www.sec.gov or by directing a request to Cody

Slach or Alex Kovtun, (949) 574-3860, GSRM@gatewayir.com.

Participants in the Solicitation

The Company, BT OpCo and certain of their respective directors, executive officers and other members of management and employees, under SEC

rules, may be deemed to be participants in the solicitation of proxies of the Company’s stockholders in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the

solicitation of the Company’s stockholders in connection with the Business Combination will be set forth in the Company’s proxy statement when it is filed with the SEC. Investors and security holders may obtain more detailed

information regarding the names of the Company’s directors and executive officers and a description of their interests in the Company in the Company’s filings with the SEC, including the Company’s prospectus dated February 24,

2022 relating to its initial public offering, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov. To the extent such holdings of Company’s securities may have changed since that time, such

changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the participants in the proxy statement and a description of their direct and indirect interests will be

contained in the proxy statement and other relevant materials to be filed with the SEC when they become available. Stockholders, potential investors and other interested persons should read the proxy statement carefully when it becomes available

before making any voting or investment decisions. Free copies of these documents may be obtained from the sources indicated above.

Forward-Looking

Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,”

“plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or

indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. These forward-looking statements include, but are not limited to, statements regarding

estimates and forecasts of financial and performance metrics and expectations and timing related to potential benefits, terms and timing of the Business Combination. These statements are based on various assumptions, whether or not identified

herein, and on the current expectations of BT Assets’, Lux Vending’s and the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of BT Assets, Lux Vending and the Company. These

forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate

the Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Business

Combination or that the approval of the shareholders of the Company is not obtained; failure to realize the anticipated benefits of the Business Combination; risks relating to the uncertainty of the projected financial information with respect to BT

OpCo; future global, regional or local economic and market conditions; the development, effects and enforcement of laws and regulations; BT OpCo’s ability to manage future growth; BT OpCo’s ability to develop new products and solutions,

bring them to market in a timely manner, and make enhancements to its platform; the effects of competition on BT OpCo’s future business; the amount of redemption requests made by the Company’s public stockholders; the ability of the

Company or the combined company to issue equity or equity-linked securities in connection with the Business Combination or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries;

and those factors described or referenced in the Company’s final initial public offering prospectus dated February 24, 2022 and its most recent Quarterly Report on Form 10-Q for the quarter ended

June 30, 2022, in each case, under the heading “Risk Factors,” and other documents of the Company filed, or to be filed, from time to time with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual

results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither BT Assets, Lux Vending nor the Company presently know or that BT Assets, Lux Vending and the Company currently

believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect BT Assets’, Lux Vending’s and the Company’s expectations,

plans or forecasts of future events and views as of the date hereof. BT Assets, Lux Vending and the Company anticipate that subsequent events and developments will cause BT Assets’, Lux Vending’s and the Company’s assessments to

change. However, while BT Assets, Lux Vending and the Company may elect to update these forward-looking statements at some point in the future, BT Assets, Lux Vending and the Company specifically disclaim any obligation to do so except as otherwise

required by applicable law. These forward-looking statements should not be relied upon as representing BT Assets, Lux Vending and the Company’s assessments as of any date subsequent to the date hereof. Accordingly, undue reliance should not be

placed upon the forward-looking statements.

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and shall not constitute an offer to

sell, nor a solicitation of an offer to buy, any securities in connection with the proposed Business Combination or otherwise, or the solicitation of a proxy, consent or authorization in any jurisdiction pursuant to the Business Combination or

otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction or otherwise in

contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom, and otherwise in accordance with applicable law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 2.1* |

|

Transaction Agreement, dated as of August 24, 2022, by and among GSR II Meteora Acquisition Corp., GSR II Meteora Sponsor LLC, BT Assets, Inc., and Lux Vending, LLC. |

|

|

| 10.1 |

|

Sponsor Support Agreement, dated as of August 24, 2022, by and among GSR II Meteora Acquisition Corp., GSR II Meteora Sponsor LLC, and Lux Vending, LLC. |

|

|

| 10.2 |

|

Form of Amended and Restated Registration Rights Agreement. |

|

|

| 10.3 |

|

Form of Tax Receivable Agreement. |

|

|

| 10.4 |

|

Form of Amended and Restated LLC Agreement. |

|

|

| 99.1 |

|

Press Release, dated August 25, 2022. |

|

|

| 99.2 |

|

Investor Presentation. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded with the Inline XBRL document) |

| * |

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of

Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally to the SEC upon request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: August 25, 2022

|

|

|

| GSR II METEORA ACQUISITION CORP. |

|

|

| By: |

|

/s/ Gus Garcia |

| Name: |

|

Gus Garcia |

| Title: |

|

Co-Chief Executive Officer |

Exhibit 2.1

Execution Version

TRANSACTION AGREEMENT

by and among

GSR II

METEORA ACQUISITION CORP,

GSR II METEORA SPONSOR LLC,

LUX VENDING, LLC,

AND

BT ASSETS, INC.

dated as of August 24, 2022

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I |

|

| CERTAIN DEFINITIONS |

|

|

|

|

| Section 1.1 |

|

Definitions |

|

|

2 |

|

| Section 1.2 |

|

Construction |

|

|

18 |

|

| Section 1.3 |

|

Knowledge |

|

|

19 |

|

|

| ARTICLE II |

|

| TRANSACTIONS; CLOSING |

|

|

|

|

| Section 2.1 |

|

Unit Purchase |

|

|

19 |

|

| Section 2.2 |

|

Cash Distribution Waterfall |

|

|

20 |

|

| Section 2.3 |

|

Closing |

|

|

21 |

|

| Section 2.4 |

|

Earn-Out Consideration |

|

|

21 |

|

| Section 2.5 |

|

PubCo Common Stock Issuance to BT Assets |

|

|

23 |

|

| Section 2.6 |

|

Treatment of Phantom Equity |

|

|

23 |

|

| Section 2.7 |

|

Closing Deliverables |

|

|

24 |

|

| Section 2.8 |

|

Closing Payments |

|

|

25 |

|

|

| ARTICLE III |

|

| REPRESENTATIONS AND WARRANTIES OF THE BT COMPANIES |

|

|

|

|

| Section 3.1 |

|

Company Organization |

|

|

27 |

|

| Section 3.2 |

|

Subsidiaries |

|

|

27 |

|

| Section 3.3 |

|

Due Authorization |

|

|

27 |

|

| Section 3.4 |

|

No Violation |

|

|

28 |

|

| Section 3.5 |

|

Governmental Authorizations |

|

|

28 |

|

| Section 3.6 |

|

Capitalization |

|

|

28 |

|

| Section 3.7 |

|

Financial Statements |

|

|

30 |

|

| Section 3.8 |

|

Undisclosed Liabilities |

|

|

31 |

|

| Section 3.9 |

|

Litigation and Proceedings |

|

|

31 |

|

| Section 3.10 |

|

Legal Compliance |

|

|

31 |

|

| Section 3.11 |

|

Contracts; No Defaults |

|

|

32 |

|

| Section 3.12 |

|

BT Benefit Plans |

|

|

34 |

|

| Section 3.13 |

|

Labor Relations; Employees |

|

|

36 |

|

| Section 3.14 |

|

Taxes |

|

|

37 |

|

| Section 3.15 |

|

Real Property |

|

|

40 |

|

| Section 3.16 |

|

Environmental, Health and Safety |

|

|

40 |

|

| Section 3.17 |

|

Intellectual Property |

|

|

41 |

|

| Section 3.18 |

|

Data Privacy; Personal Data |

|

|

43 |

|

| Section 3.19 |

|

Absence of Changes |

|

|

44 |

|

| Section 3.20 |

|

Anti-Corruption Compliance |

|

|

44 |

|

| Section 3.21 |

|

Insurance |

|

|

45 |

|

i

|

|

|

|

|

|

|

| Section 3.22 |

|

Subscription-Related Representations |

|

|

45 |

|

| Section 3.23 |

|

Information Supplied |

|

|

46 |

|

| Section 3.24 |

|

Brokers’ Fees |

|

|

46 |

|

| Section 3.25 |

|

No Outside Reliance |

|

|

46 |

|

| Section 3.26 |

|

Indebtedness; Cash; Transaction Expenses |

|

|

46 |

|

| Section 3.27 |

|

No Additional Representation or Warranties |

|

|

46 |

|

|

| ARTICLE IV |

|

| REPRESENTATIONS AND WARRANTIES OF BT ASSETS |

|

|

|

|

| Section 4.1 |

|

Company Organization |

|

|

47 |

|

| Section 4.2 |

|

Due Authorization |

|

|

47 |

|

| Section 4.3 |

|

No Violation |

|

|

48 |

|

| Section 4.4 |

|

Governmental Authorizations |

|

|

48 |

|

| Section 4.5 |

|

Title to Units of BT OpCo |

|

|

48 |

|

| Section 4.6 |

|

Solvency |

|

|

48 |

|

| Section 4.7 |

|

Reserved |

|

|

49 |

|

| Section 4.8 |

|

Brokers’ Fees |

|

|

49 |

|

| Section 4.9 |

|

No Outside Reliance |

|

|

49 |

|

| Section 4.10 |

|

Tax Matters |

|

|

49 |

|

|

| ARTICLE V |

|

| REPRESENTATIONS AND WARRANTIES OF PUBCO |

|

|

|

|

| Section 5.1 |

|

Company Organization |

|

|

50 |

|

| Section 5.2 |

|

Due Authorization |

|

|

50 |

|

| Section 5.3 |

|

No Violation |

|

|

51 |

|

| Section 5.4 |

|

Governmental Authorizations |

|

|

51 |

|

| Section 5.5 |

|

Capitalization of PubCo |

|

|

52 |

|

| Section 5.6 |

|

Internal Controls; Listing; Financial Statements |

|

|

53 |

|

| Section 5.7 |

|

No Undisclosed Liabilities |

|

|

54 |

|

| Section 5.8 |

|

Litigation and Proceedings |

|

|

55 |

|

| Section 5.9 |

|

Taxes |

|

|

55 |

|

| Section 5.10 |

|

SEC Filings |

|

|

55 |

|

| Section 5.11 |

|

Trust Account |

|

|

56 |

|

| Section 5.12 |

|

Investment Company Act; JOBS Act |

|

|

56 |

|

| Section 5.13 |

|

Absence of Changes |

|

|

57 |

|

| Section 5.14 |

|

Anti-Corruption Compliance |

|

|

57 |

|

| Section 5.15 |

|

Indebtedness; Transaction Expenses |

|

|

58 |

|

| Section 5.16 |

|

Business Activities |

|

|

58 |

|

| Section 5.17 |

|

Nasdaq Stock Market Quotation |

|

|

58 |

|

| Section 5.18 |

|

Proxy Statement |

|

|

59 |

|

| Section 5.19 |

|

Takeover Statutes and Charter Provisions |

|

|

59 |

|

| Section 5.20 |

|

Brokers’ Fees |

|

|

59 |

|

| Section 5.21 |

|

No Outside Reliance |

|

|

59 |

|

| Section 5.22 |

|

No Additional Representation or Warranties |

|

|

60 |

|

ii

|

|

|

|

|

|

|

|

| ARTICLE VI |

|

| COVENANTS OF THE BT ENTITIES |

|

|

|

|

| Section 6.1 |

|

Conduct of Business |

|

|

60 |

|

| Section 6.2 |

|

Inspection |

|

|

63 |

|

| Section 6.3 |

|

Closing Spreadsheet |

|

|

63 |

|

| Section 6.4 |

|

Acquisition Proposals |

|

|

64 |

|

| Section 6.5 |

|

Support of Transaction |

|

|

65 |

|

| Section 6.6 |

|

Confidentiality |

|

|

65 |

|

| Section 6.7 |

|

Indemnification and Insurance |

|

|

66 |

|

| Section 6.8 |

|

BitAccess Buyout |

|

|

68 |

|

| Section 6.9 |

|

Preparation and Delivery of Quarterly Financial Statements |

|

|

68 |

|

| Section 6.10 |

|

BT OpCo Organizational Documents |

|

|

69 |

|

| Section 6.11 |

|

BT Information Supplied |

|

|

69 |

|

|

| ARTICLE VII |

|

| COVENANTS OF PUBCO |

|

|

|

|

| Section 7.1 |

|

Trust Account Proceeds and Related Available Equity |

|

|

69 |

|

| Section 7.2 |

|

Equity Line |

|

|

70 |

|

| Section 7.3 |

|

Nasdaq Listing |

|

|

70 |

|

| Section 7.4 |

|

No Solicitation by PubCo |

|

|

70 |

|

| Section 7.5 |

|

PubCo Conduct of Business |

|

|

71 |

|

| Section 7.6 |

|

PubCo Public Filings |

|

|

72 |

|

| Section 7.7 |

|

PIPE Subscription |

|

|

72 |

|

| Section 7.8 |

|

Support of Transaction |

|

|

72 |

|

| Section 7.9 |

|

Post-Closing Directors and Officers of PubCo |

|

|

73 |

|

| Section 7.10 |

|

PubCo Information Supplied |

|

|

73 |

|

|

| ARTICLE VIII |

|

| JOINT COVENANTS |

|

|

|

|

| Section 8.1 |

|

Regulatory Approvals; Other Filings |

|

|

73 |

|

| Section 8.2 |

|

Preparation of Proxy Statement; Stockholders’ Meeting and Approvals |

|

|

74 |

|

| Section 8.3 |

|

Tax Matters |

|

|

78 |

|

| Section 8.4 |

|

Section 16 Matters |

|

|

79 |

|

| Section 8.5 |

|

Equity Plan |

|

|

79 |

|

| Section 8.6 |

|

Refinance |

|

|

80 |

|

| Section 8.7 |

|

Personal Guarantee |

|

|

80 |

|

| Section 8.8 |

|

Personal Data |

|

|

80 |

|

|

| ARTICLE IX |

|

| CONDITIONS TO OBLIGATIONS |

|

|

|

|

| Section 9.1 |

|

Conditions to Obligations of PubCo and the BT Entities |

|

|

81 |

|

| Section 9.2 |

|

Conditions to Obligations of PubCo |

|

|

82 |

|

| Section 9.3 |

|

Conditions to the Obligations of the BT Entities |

|

|

83 |

|

iii

|

|

|

|

|

|

|

|

| ARTICLE X |

|

| TERMINATION/EFFECTIVENESS |

|

|

|

|

| Section 10.1 |

|

Termination |

|

|

83 |

|

| Section 10.2 |

|

Effect of Termination |

|

|

85 |

|

|

| ARTICLE XI |

|

| MISCELLANEOUS |

|

|

|

|

| Section 11.1 |

|

Trust Account Waiver |

|

|

85 |

|

| Section 11.2 |

|

Waiver |

|

|

86 |

|

| Section 11.3 |

|

Notices |

|

|

86 |

|

| Section 11.4 |

|

Assignment |

|

|

87 |

|

| Section 11.5 |

|

Rights of Third Parties |

|

|

87 |

|

| Section 11.6 |

|

Expenses |

|

|

88 |

|

| Section 11.7 |

|

Governing Law |

|

|

88 |

|

| Section 11.8 |

|

Headings; Counterparts |

|

|

88 |

|

| Section 11.9 |

|

BT Companies and PubCo Disclosure Letters |

|

|

88 |

|

| Section 11.10 |

|

Entire Agreement |

|

|

89 |

|

| Section 11.11 |

|

Amendments |

|

|

89 |

|

| Section 11.12 |

|

Publicity |

|

|

89 |

|

| Section 11.13 |

|

Severability |

|

|

89 |

|

| Section 11.14 |

|

Jurisdiction; Waiver of Jury Trial. |

|

|

90 |

|

| Section 11.15 |

|

Enforcement |

|

|

90 |

|

| Section 11.16 |

|

Non-Recourse |

|

|

90 |

|

| Section 11.17 |

|

Non-Survival of Representations, Warranties and Covenants |

|

|

91 |

|

| Section 11.18 |

|

Conflicts and Privilege |

|

|

91 |

|

iv

|

|

|

| Exhibits |

|

|

|

|

| Exhibit A |

|

PubCo Charter |

| Exhibit B |

|

PubCo Bylaws |

| Exhibit C |

|

Pre-Closing Restructuring Plan |

| Exhibit D |

|

Registration Rights Agreement |

| Exhibit E |

|

Sponsor Support Agreement |

| Exhibit F |

|

Form of Tax Receivable Agreement |

| Exhibit G |

|

Form of BT OpCo A&R LLC Agreement |

BT Disclosure Letter

PubCo Disclosure Letter

v

TRANSACTION AGREEMENT

This Transaction Agreement (this “Agreement”), dated as of August 24, 2022 (the “Execution

Date”), is made and entered into by and among GSR II Meteora Acquisition Corp, a Delaware corporation (“PubCo”), GSR II Meteora Sponsor LLC, a Delaware limited liability company

(“Sponsor”, and together with PubCo, “GSR Entities”), BT Assets, Inc., a Delaware corporation (“BT Assets”), and Lux Vending, LLC, a Georgia limited liability company and a

wholly owned subsidiary of BT Assets (“BT OpCo”, and together with BT Assets, “BT Entities”).

RECITALS

WHEREAS,

PubCo is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses;

WHEREAS, PubCo desires to, subject to the terms and conditions set forth in this Agreement, contribute, pay and deliver to BT OpCo and

BT Assets the PubCo Available Cash, without interest, and BT Assets or BT OpCo, as applicable, shall in consideration therefor issue or sell and deliver to PubCo, at the Closing (i) certain Common Units of BT OpCo and (ii) immediately

following the effectiveness of the BT OpCo A&R LLC Agreement, certain BT OpCo Matching Warrants and the PubCo Earn-Out Units, free from any Encumbrances and subject to the terms and conditions set forth in

this Agreement;

WHEREAS, prior to or at the Closing (and in any case prior to the Unit Purchase), PubCo will enter into a

series of reorganizations, including, (i) amending and restating the certificate of incorporation of PubCo to be substantially in the form attached as Exhibit A (the “PubCo Charter”) and (ii) amending and

restating the bylaws of PubCo to be substantially in the form attached as Exhibit B (the “PubCo Bylaws”, and such transactions the “PubCo Pre-Closing

Restructuring”);

WHEREAS, prior to or at the Closing (and in any case prior to the Unit Purchase), the BT Entities

will enter into a series of reorganizations, including, the merger of BT OpCo with and into a newly-formed Delaware limited liability company known as “Bitcoin Depot Operating LLC” (the “BT Surviving Entity” and

such transactions, the “BT Pre-Closing Restructuring”, and together with the PubCo Pre-Closing Restructuring, the “Pre-Closing Restructuring Plan”); provided that BT Entities and PubCo may make amendments to the Pre-Closing Restructuring Plan, as attached

hereto as Exhibit C after the Execution Date subject to the prior written consent of the other party (not to be unreasonably conditioned, withheld or delayed);

WHEREAS, prior to the Closing, and as an inducement to PubCo to enter into this Agreement and consummate the Transactions (including

the Unit Purchase), each of the Key Employees is entering into an employment agreement with BT OpCo and PubCo in a form mutually agreed by PubCo and BT Assets (each, an “Employment Agreement”), each of which shall be

effective as of the Closing;

WHEREAS, concurrently with the execution and delivery of this Agreement, the Sponsor, BT OpCo, and

PubCo have entered into the Sponsor Support Agreement, a copy of which is attached as Exhibit E (the “Sponsor Support Agreement”);

1

WHEREAS, at the Closing and immediately following the effectiveness of the BT OpCo

A&R LLC Agreement, PubCo shall issue the Share Transaction Consideration to BT Assets for par value as set forth in this Agreement; and

WHEREAS, each of the Board of Directors of BT Assets, the sole member of BT OpCo, and the Board of Directors of PubCo has unanimously

(i) determined that it is advisable for and in the best interests of such party and its equityholder(s) to enter into this Agreement and the Transactions (as defined below), and (ii) approved the execution and delivery of this Agreement

and the documents contemplated by this Agreement and the Transactions.

NOW, THEREFORE, in consideration of the foregoing

and the respective representations, warranties, covenants and agreements set forth in this Agreement and intending to be legally bound, the parties agree as follows:

ARTICLE I

CERTAIN

DEFINITIONS

Section 1.1 Definitions.

(a) As used in this Agreement, the following terms have the following meanings:

“Acquisition Proposal” means, as to any Person, other than the Transactions and other than the acquisition or

disposition of equipment or other tangible personal property in the ordinary course of business, any offer or proposal relating to: (a) any acquisition or purchase, direct or indirect, of (i) 15% or more of the consolidated assets of such

Person and its Subsidiaries or (ii) 15% or more of any class of equity or voting securities of (x) such Person or (y) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, 15% or more of the

consolidated assets of such Person and its Subsidiaries; (b) any tender offer (including a self-tender offer) or exchange offer that, if consummated, would result in any Person beneficially owning 15% or more of any class of equity or voting

securities of (i) such Person or (ii) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, 15% or more of the consolidated assets of such Person and its Subsidiaries; or (c) a merger,

consolidation, share exchange, business combination, sale of substantially all the assets, reorganization, recapitalization, liquidation, dissolution or other similar transaction involving (i) such Person or (ii) one or more Subsidiaries

of such Person holding assets constituting, individually or in the aggregate, 15% or more of the consolidated assets of such Person and its Subsidiaries.

“Action” means any claim, action, suit, charge, audit, examination, assessment, arbitration, mediation or inquiry, or

any proceeding or investigation, by or before any Governmental Authority.

“Affiliate” means, with respect to any

specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, whether through one or more intermediaries or otherwise. The term “control” (including the terms

“controlling”, “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the

ownership of voting securities, by Contract or otherwise.

2

“Aggregate Phantom Equity Cash Consideration” means the aggregate

Phantom Equity Cash Consideration payable in respect of the cancellation of the Phantom Equity Awards held by the Phantom Equity Holders immediately prior to the Closing, pursuant to the Phantom Equity Plan and Section 2.6,

as set forth on the Closing Spreadsheet.

“Aggregate Phantom Equity Consideration” means the total dollar value of

the consideration payable in respect of the cancellation of the Phantom Equity Awards held by the Phantom Equity Holders immediately prior to the Closing pursuant to the Phantom Equity Plan and Section 2.6, as set forth on

the Closing Spreadsheet.

“Aggregate Phantom Equity Non-Cash

Consideration” means, the aggregate number of PubCo Class A Common Stock issuable in respect of the cancellation of the Phantom Equity Awards held by the Phantom Equity Holders immediately prior to the Closing pursuant to the

Phantom Equity Plan and Section 2.6, as set forth on the Closing Spreadsheet.

“Alternative Business

Combination Proposal” means any offer, inquiry, proposal or indication of interest (whether written or oral, binding or non-binding, and other than an offer, inquiry, proposal or indication of

interest with respect to the Transactions), relating to a Business Combination.

“Anti-Bribery Laws” means the

anti-bribery provisions of the Foreign Corrupt Practices Act of 1977, Canada’s Corruption of Foreign Public Officials Act and Criminal Code, and all other applicable anti-corruption and bribery Laws (including the U.K. Bribery Act 2010 or

other Laws of other countries implementing the OECD Convention on Combating Bribery of Foreign Officials).

“Antitrust

Laws” means the United States Sherman Antitrust Act of 1890, the United States Clayton Act of 1914, the HSR Act, the United States Federal Trade Commission Act of 1914, and all other domestic and foreign Laws, including foreign merger

control and other competition Laws, issued by a Governmental Authority that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or lessening of competition through

merger or acquisition.

“BitAccess Equity Plan” means the BitAccess Inc. Stock Option Plan.

“BitAccess Option” means each outstanding and unexercised option to purchase BitAccess capital stock granted under the

BitAccess Equity Plan.

“BT Assets Disclosure Breach” means the failure of a BT Entity to furnish to PubCo all

information concerning itself, its Subsidiaries, officers, directors, managers, stockholders, and other equityholders and information regarding such other matters as may be reasonably necessary or advisable (including any approval or consent of an

independent auditor of a BT Entity) or as may be reasonably requested by PubCo in connection with the preparation and filing of the Proxy Statement, or any amendment thereto, on a timely basis to permit the filing or amendment of the same on or

prior to a specified time.

“BT Companies” means BT OpCo and all of its Subsidiaries.

3

“BT Company Interests” means all of the outstanding equity interests

of the BT Companies.

“BT Earn-Out Units” means, the following units of BT

OpCo: (i) 5,000,000 Class 1 Earn-Out Units of BT OpCo (“BT OpCo Class 1 Earn-Out Units”), (ii) 5,000,000

Class 2 Earn-Out Units of BT OpCo (“BT OpCo Class 2 Earn-Out Units”), and (iii) 5,000,000 Class 3 Earn-Out Units of BT OpCo (“BT OpCo Class 3 Earn-Out Units”).

“BT Intellectual Property” means, collectively, the Owned Intellectual Property and the Licensed Intellectual

Property.

“BT Material Adverse Effect” means any event, series of events, condition, state of facts, development,

change, circumstance, occurrence or effect (collectively, “Events”) that has had, or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on (i) the business, results of

operations or financial condition of the BT Companies, taken as a whole or (ii) the ability of the BT Entities to consummate the Transactions; provided, however, that in no event would any of the following, alone or in

combination, be deemed to constitute, or be taken into account in determining whether there has been or will be, a “BT Material Adverse Effect”: (a) any change in applicable Laws or GAAP or any interpretation of such Laws or GAAP following

the Execution Date, (b) any change in interest rates or economic, political, business or financial market conditions generally (including, without limitation, (1) any change in the price or relative value of any Token, or other digital

currency or cryptocurrency, including but not limited to Bitcoin or (2) any change in trading volume of any Token, or other digital currency or cryptocurrency, or any halt or suspension in trading of any such Token, or other digital currency or

cryptocurrency on any digital currency exchange, in each case, including but not limited to Bitcoin), (c) the taking of any action expressly required by or, with respect to Sections 8.1, 8.2 or 8.4, permitted to be taken under

this Agreement, (d) any natural disaster (including hurricanes, storms, tornados, flooding, earthquakes, volcanic eruptions or similar occurrences), pandemic (including COVID-19, or any COVID-19 Measures or any change in such COVID-19 Measures or interpretations following the Execution Date), acts of nature or change in climate, or any declaration of a

national emergency by any Governmental Authority, (e) any acts of terrorism or war, the outbreak or escalation of hostilities, geopolitical conditions, local, national or international political conditions, or social conditions, (f) any

failure in and of itself of the BT Entities or any of their respective Subsidiaries to meet any projections or forecasts, provided that the exception in this clause (f) shall not prevent or otherwise affect a determination that any

change, effect or development underlying such change has resulted in or contributed to a BT Material Adverse Effect, (g) any Events generally applicable to the industries or markets in which the BT Entities or any of their respective

Subsidiaries operate, (h) any action taken by, or at the request of, or with the express consent of PubCo; provided, that in the case of each of clauses (a), (b), (d), (e) and (g), any such Event to the

extent it disproportionately affects the BT Entities or any of their respective Subsidiaries relative to other participants in the industries in which such Persons operate shall not be excluded from the determination of whether there has been, or

would reasonably be expected to be, a BT Material Adverse Effect.

“BT OpCo Common Units” means Common Units of BT

OpCo.

4

“BT OpCo Matching Warrants” means warrants to purchase a number of

units of BT OpCo equal to the number of shares of PubCo Class A Common Stock that may be purchased upon the exercise in full of all PubCo Warrants outstanding immediately following the Closing.

“BT Transaction Bonus Payments” means all amounts payable pursuant to the arrangements listed on the “BT

Transaction Bonus Payments Schedule” of Section 1.1 of the BT Disclosure Letter.

“BT Transaction Bonus

Termination Agreement” means a BT Transaction Bonus termination agreement in the form mutually agreed upon between the BT Entities and PubCo prior to the Closing.

“BT Transaction Expenses” means any reasonable and documented out-of-pocket fees and expenses paid or payable by the BT Entities or any of their respective Subsidiaries or any of their respective Affiliates (whether or not billed or accrued for) as a result of or in

connection with the negotiation, documentation and consummation of the Transactions, including (A) all fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, data room

administrators, attorneys, accountants and other advisors and service providers, (B) change-in-control payments, transaction bonuses, retention payments, severance

or similar compensatory payments pursuant to any written arrangements entered into prior to the Closing, payable by the BT Entities or any of their Subsidiaries to any current or former employee, independent contractor, officer, director or other

individual service provider of the BT Entities or any of their Subsidiaries as a result of the Transactions (whether alone or together with any other event), but excluding, for the avoidance of doubt, (x) any such payments that arise from

employment-related actions taken by PubCo, the BT Entities or any of their respective Subsidiaries or Affiliates following the Closing and (y) the BT Transaction Bonus Payments and the Aggregate Phantom Equity Consideration, including the

employer portion of payroll Taxes arising therefrom, (C) up to $1,000,000 of the sum of the BT Transaction Bonus Payments and the employer portion of payroll Taxes arising from the aggregate amount of the BT Transaction Bonus Payments (whether

paid in cash or equity), (D) up to $1,000,000 of the sum of the Aggregate Phantom Equity Cash Consideration and the employer portion of payroll Taxes arising from the Aggregate Phantom Equity Consideration (whether paid in cash or equity), and

(E) any and all filing fees payable by the BT Entities or any of their Subsidiaries or any of their Affiliates to Governmental Authorities in connection with the Transactions.

“Business Combination” has the meaning set forth in the PubCo Governing Documents as in effect on the Execution Date.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New

York are authorized or required by Law to close.

“CARES Act” means (i) the Coronavirus Aid, Relief, and

Economic Security Act (Pub. L. 116-136) and any administrative or other guidance published with respect to the CARES Act by any Governmental Authority (including IRS Notices

2020-22 and 2020-65), or any other Law or executive order or executive memorandum (including the Memorandum on Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster, dated August 8, 2020) intended to address the consequences of COVID-19 (in each case, including any comparable provisions of

5

state, local or non-U.S. Law and including any related or similar orders or declarations from any Governmental Authority) and (ii) any extension of,

amendment, supplement, correction, revision or similar treatment to any provision of the CARES Act, the Families First Coronavirus Response Act of 2020 (H.R. 6201), and “Division N - Additional Coronavirus Response and Relief” of the

Consolidated Appropriations Act, 2021 (H.E. 133) contained in the Consolidated Appropriations Act, 2021, H.R. 133.

“Change of

Control” has the meaning set forth in the BT OpCo A&R LLC Agreement.

“Code” means the Internal

Revenue Code of 1986.

“Contracts” means any contracts, agreements, subcontracts, leases, commitments and

undertakings, whether written or oral.

“Contribution Common Units” means a number of OpCo Common Units equal to

(i) the number of shares of PubCo Common Stock, other than PubCo Class E Common Stock, outstanding at the Closing and not held by BT Assets, multiplied by (ii) the Contribution Amount, divided by (iii) the amount of

PubCo Available Cash.

“COVID-19” means the novel coronavirus, SARS-CoV-2 or COVID-19 (and all related strains and sequences), including any resurgence or any evolutions or mutations of COVID-19, and/or related or associated epidemics, pandemics, disease outbreaks or public health emergencies.

“COVID-19 Measures” means any quarantine, “shelter in place,”

“stay at home,” workforce reduction, social distancing, shut down, closure, sequester, safety or similar Law, directive, guidelines or recommendations promulgated by any industry group or any Governmental Authority, including the Centers

for Disease Control and Prevention and the World Health Organization, in each case, in connection with or in response to COVID-19, including the CARES Act and Families First Act.

“COVID-19 Tax Measure” means any legislation or order enacted or issued by any

Governmental Authority with respect to any Tax matter in response to COVID-19 (including, without limitation, the CARES Act).

“Data Room” means the virtual data room titled “BTM” hosted by DataSite at: https://americas.datasite.com.

“Data Subject” means any “person,” “individual,” or “data subject” as defined by

the applicable Privacy Laws.

“Designated Jurisdiction” means any country or territory to the extent that such

country or territory is the subject of any Sanction.

“Disclosure Letter” means, as applicable, the BT Disclosure

Letter or the PubCo Disclosure Letter.

“Dollars” or “$” means lawful money of the United

States.

6

“Earn-Out

Units” means the BT Earn-Out Units and the PubCo Earn-Out Units.

“Environmental Laws” means any and all Laws relating to the protection of the environment or natural resources,

pollution or worker health or safety, including as it relates to Hazardous Materials exposure.

“ERISA Affiliate”

means any corporation or trade or business, whether or not incorporated, that together with any of the BT Companies would, at any relevant time, be deemed to be a single employer pursuant to Section 4001(b) of ERISA or Section 414(b), (c),

(m) or (o) of the Code.

“Event” has the meaning specified in the definition of BT Material Adverse Effect.

“Exchange Act” means the Securities Exchange Act of 1934.

“Founder” means Brandon Mintz.

“GAAP” means generally accepted accounting principles in the United States as in effect from time to time.

“Governing Documents” means the legal agreements and instruments by which any Person (other than an individual)

establishes its legal existence or which govern its internal affairs. For example, the “Governing Documents” of a corporation are its certificate of incorporation and by-laws, the “Governing

Documents” of a limited partnership are its limited partnership agreement and certificate of limited partnership, the “Governing Documents” of a limited liability company are its operating agreement and certificate of formation and

the “Governing Documents” of an exempted company are its memorandum and articles of association.

“Governmental

Authority” means any federal, national, state, provincial, territorial or municipal government, or any political subdivision of such government, and any agency, commission, department, board, bureau, official, minister, arbitral body

(public or private), tribunal or court, whether national, state, provincial, local, foreign or multinational, exercising executive, legislative, judicial, regulatory or administrative functions of a nation, state, province or municipal government,

or any political subdivision of such authority, including any authority having governmental or quasi-governmental powers, domestic or foreign.

“Governmental Order” means any order, judgment, injunction, decision, decree, writ, stipulation, determination,

directive or award, in each case, entered or issued by or with any Governmental Authority.

“Governmental Permit”

means any consent, franchise, approval, registration, variance, license, permit, grant, certificate, registration or other authorization or approval of a Governmental Authority or pursuant to any Law.

“Hazardous Materials” means any material, substance, chemical, contaminant, pollutant or waste for which liability or

standards of conduct may be imposed, or that is listed, classified or regulated pursuant to Environmental Laws, including petroleum or petroleum products, asbestos or asbestos-containing materials, mold, lead, radioactive materials, polychlorinated

biphenyls, or per- or polyfluoroalkyl substances.

7

“Indebtedness” means, with respect to any Person, (a) all

indebtedness for borrowed money, including accrued interest, (b) capitalized lease obligations under GAAP, (c) letters of credit, bank guarantees, bankers’ acceptances and other similar instruments, (d) obligations evidenced by

bonds, debentures, notes and similar instruments, (e) interest rate protection agreements and currency obligation swaps, hedges or similar arrangements, (f) all obligations to pay the deferred and unpaid purchase price of property, goods,

services and equipment which have been delivered, including “earn outs” and “seller notes”, and (g) all breakage costs, prepayment or early termination premiums, penalties, or other fees or expenses payable as a result of

the Transactions in respect of any of the items in the foregoing clauses (a) through (g), and (h) all Indebtedness of another Person referred to in clauses (a) through (g) above guaranteed directly or

indirectly, jointly or severally, by such Person.

“Intellectual Property” means: (i) patents, patent

applications and continuations, continuations-in-part, extensions, divisions, reissues, reexaminations of such Intellectual Property, and patent disclosures, industrial

designs, and other intellectual property rights in inventions (whether or not patentable or reduced to practice); (ii) trademarks, service marks, trade dress, trade names, logos, internet domain names, social media handles, and other indicia of

source of origin, together with the goodwill associated with any of the foregoing; (iii) intellectual property rights in works of authorship, data and databases, as well as copyrights and mask works; (iv) intellectual property rights in or

to Software and other technology (including source code and object code); (v) trade secrets and other intellectual property rights in Proprietary Information; (vi) registrations, issuances, and applications for any of the foregoing; and

(vii) all other intellectual property rights in any jurisdiction throughout the world.

“Investment Company

Act” means the Investment Company Act of 1940.

“IRS” means the Internal Revenue Service.

“IT Systems” means computers, Software, hardware, servers, workstations, routers, hubs, switches, data communications

lines, firmware, networks and all other information technology equipment owned, leased or licensed by the BT Companies and used in their business.

“Key Employees” means Brandon Mintz, Scott Buchanan and Mark Smalley.

“Law” means any statute, law, common law, ordinance, rule, regulation, code or Governmental Order, in each case, of

any Governmental Authority.

“Leased Real Property” means all real property leased, licensed, subleased or

otherwise used or occupied by any of the BT Companies.

“Licensed Intellectual Property” means Intellectual

Property that any of the BT Companies license from a third party.

“Lien” means all liens, judgments, charges,

easements, servitudes, mortgages, deeds of trust, pledges, hypothecations, encumbrances, security interests, options, licenses, leases, subleases, restrictions, title retention devices (including the interest of a seller or lessor under any

conditional sale agreement or capital lease, or any financing lease having substantially the same economic effect as any of the foregoing), collateral assignments, claims or other encumbrances of

8

any kind whether consensual, statutory or otherwise, and whether filed, recorded or perfected under applicable Law (including any restriction on the voting of any security, any restriction on the

transfer of any security or other asset, any restriction on the receipt of any income derived from any asset, any restriction on the use of any asset and any restriction on the possession, exercise or transfer of any other attribute of ownership of

any asset, but in any event excluding restrictions under applicable securities Laws).

“made available” means that

documents were posted in the Data Room at or prior to 5:00 p.m., New York time, on the date that is one (1) day prior to the Execution Date and were not removed from the Data Room on or prior to the Execution Date.

“Minimum Condition PubCo Available Cash” means, an amount equal to (i) the PubCo Available Cash, minus

(ii) any amount of the outstanding BT Transaction Expenses (other than any amount not paid in cash in respect of clauses (C) and (D) of the definition of the BT Transaction Expenses) payable in accordance with the Closing Spreadsheet and

Section 2.2(a), minus (iii) any amount of the BT Closing Indebtedness payable in accordance with the Closing Spreadsheet and Section 2.2(b) (provided, that, in no event

shall the BitAccess Contribution Amount be greater than $6,000,000 for purposes of this definition).

“OFAC” means

the U.S. Office of Foreign Assets Control.

“Open Source Software” means any Software that is distributed as

“free software,” “open source software,” “shareware”, including the GNU General Public License (GPL), GNU Lesser General Public License (LGPL), Mozilla Public License (MPL), or any other license for Software that meets

the “Open Source Definition” promulgated by the Open Source Initiative.

“Owned Intellectual Property”

means all Intellectual Property owned by the BT Companies.

“Permitted Liens” means (i) mechanic’s,

materialmen’s and similar Liens arising in the ordinary course of business with respect to any amounts (A) not yet due and payable or which are being contested in good faith through (if then appropriate) appropriate proceedings and

(B) for which adequate accruals or reserves have been established in accordance with GAAP, (ii) Liens for Taxes (A) not yet due and payable or which are being contested in good faith through appropriate proceedings and (B) for

which adequate accruals or reserves have been established in accordance with GAAP, (iii) defects or imperfections of title, easements, encroachments, covenants,

rights-of-way, conditions, matters that would be apparent from a physical inspection of such real property, restrictions and other similar charges or encumbrances that

do not materially interfere with the present use of the Leased Real Property, (iv) with respect to any Leased Real Property (A) the interests and rights of the respective lessors with respect to any Leased Real Property, including any

statutory landlord liens and any Lien thereon, (B) any Lien permitted under the Real Property Lease, and (C) any Liens encumbering the real property of which the Leased Real Property is a part, (v) zoning, building, entitlement and

other land use and environmental regulations promulgated by any Governmental Authority that do not materially interfere with the current use of the Leased Real Property, (vi) non-exclusive licenses of

Intellectual Property, (vii) ordinary course purchase money Liens and Liens securing rental payments under operating or capital lease arrangements for amounts not yet due or payable, (viii) other Liens arising in the ordinary course of

business and not incurred in connection with the borrowing of money and on a basis consistent with past practice in connection with workers’ compensation, unemployment insurance or other types of social security and (ix) all other Liens

that would not, individually or in the aggregate, reasonably be expected to result in a BT Material Adverse Effect.

9

“Person” means any individual, firm, corporation, partnership,

limited liability company, incorporated or unincorporated association, joint venture, joint stock company, bank, trust company, trust or other entity, whether or not a legal entity, Governmental Authority or any department, agency or political

subdivision of such Governmental Authority.

“Personal Data” means any information which identifies or could

reasonable be used to identify, whether alone or in combination with other information, a natural Person, or other information that constitutes “personal information” or “personal data” under applicable Privacy Laws.

“Personal Data Processor” means any person other than an employee of any BT Company (or the applicable Data Subject)

that processes or has access to any Personal Data processed by or on behalf of any BT Company.

“Phantom Equity Award

Termination Agreement” means a Phantom Equity Holder’s Phantom Equity Award termination agreement in the form mutually agreed upon between the BT Entities and PubCo prior to the Closing.

“Phantom Equity Awards” means the awards under the Phantom Equity Plan.

“Phantom Equity Holder” means each Person who has been granted a Phantom Equity Award under the Phantom Equity Plan.

“Phantom Equity Plan” means the Lux Vending, LLC d/b/a Bitcoin Depot 2021 Participation Plan.

“Pre-Closing Tax Period” means any taxable period (or portion of such period)

ending on or before the Closing Date.

“Privacy Agreements” means all Personal Data and privacy related policies

(e.g., privacy and data security policies, acceptable use policies, terms of service, etc., including all Privacy Policies) and other Contracts to which any BT Company is a party whereby such BT Company makes commitments to a third party regarding

the processing of Personal Data.

“Privacy Laws” means all Laws concerning or otherwise applicable to data

security, data privacy and cyber security, including Federal Trade Commission Act; the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003; the Children’s Online Privacy

Protection Act; the California Consumer Privacy Act of 2018; the Computer Fraud and Abuse Act; the Electronic Communications Privacy Act; the Family Educational Rights and Privacy Act; and all other similar international, federal, state, provincial,

and local Laws, and in each case, the rules implemented under such Laws.

10

“Privacy Policy” means an externally facing policy of any BT Company

in connection with the collection of information provided by or on behalf of individuals that is labelled as a “Privacy Policy,” is reached on a web site by a link that includes the label “Privacy” or that is a written policy or

disclosure that describes how Personal Data will be held, used, processed or disclosed.

“Privacy Token” means any

Token that includes, as a feature of such Token, the concealment from public disclosure of the public keys for the source or destination wallet in respect of any transaction undertaken in connection with such Token.

“Proprietary Information” means all trade secrets and all other confidential or proprietary information, including

confidential or proprietary know-how, inventions, methodologies, processes, techniques, research and development information, specifications, algorithms, financial, technical, marketing and business data,

sales, pricing and cost information, customer information and supplier lists.

“PubCo Available Cash” means, in

respect of PubCo, an amount equal to the (i) cash available in the Trust Account, minus (ii) any amounts required to satisfy the PubCo Share Redemption Amount, plus (iii) any proceeds from the consummation of the PIPE

Subscription, plus (iv) any amounts drawn by PubCo in connection with the Closing under the Equity Line (for the avoidance of doubt, any amounts undrawn under the Equity Line in connection with the Closing shall not constitute PubCo

Available Cash), minus (v) any unpaid PubCo Transaction Expenses payable in cash as of the Closing.

“PubCo

Class A Common Stock” means Class A Common Stock of PubCo, par value $0.0001 per share, each share of which is entitled to one vote per share according to the PubCo Charter.

“PubCo Class B Common Stock” means Class B Common Stock of PubCo, par value

$0.0001 per share, each share of which is entitled to one vote per share according to the PubCo Charter.

“PubCo

Class E Common Stock” means Class E Common Stock of PubCo, par value $0.0001 per share, which shall be non-voting according to the PubCo Charter.