UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the annual period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

|

(Address of principal executive offices) |

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

|

|||

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☐ |

Large accelerated filer |

☐ |

Accelerated filer |

|

|

|

|

☒ |

Smaller reporting company |

||

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2023 was $

As of April 9, 2024, the registrant had

Bitcoin Depot Inc.

Annual Report on Form 10-K

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

4 |

|

Item 1A. |

17 |

|

Item 1B. |

60 |

|

Item 1C. |

60 |

|

Item 2. |

61 |

|

Item 3. |

62 |

|

Item 4. |

62 |

|

|

|

|

PART II |

|

|

Item 5. |

62 |

|

Item 6. |

63 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

64 |

Item 7A. |

82 |

|

Item 8. |

82 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

124 |

Item 9A. |

124 |

|

Item 9B. |

125 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

125 |

|

|

|

PART III |

|

|

Item 10. |

125 |

|

Item 11. |

129 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

132 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

135 |

Item 14. |

141 |

|

|

|

|

PART IV |

|

|

Item 15. |

142 |

|

Item 16. |

144 |

1

2

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our and our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Bitcoin Depot Inc. (the “Company” or “Bitcoin Depot”). Some risks of achieving any of these forward-looking statements include:

If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that we do not presently know or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect our expectations, plans or forecasts of future events and views as of the date hereof. We anticipate that subsequent events and developments will cause our assessments to change. We specifically disclaim any obligation to update these forward-looking statements except as otherwise required by applicable law. These forward-looking statements should not be relied upon as representing our assessment as of any date subsequent to the date hereof.

These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. As a result of a number of known and unknown risks and uncertainties, actual results or our performance of the Company may be materially different from those expressed or implied by these forward-looking statements.

3

You should read this Annual Report on Form 10-K and the documents that we reference in and have filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PART I

Item 1. Business

Our Business

Business Overview

Bitcoin Depot owns and operates the largest network of BTMs (or, "kiosks") across North America where customers can buy and sell Bitcoin. Bitcoin Depot helps power the digital economy for users of cash.

Our mission is to bring Crypto to the Masses TM. Digital means and systems dominate the way that consumers send money, make purchases, and invest; however, we believe that many people still utilize cash as their primary means of initiating a transaction, either as a necessity or as a preference. These individuals have largely been excluded from the digital financial system and associated technological advancements in our global and digitally interconnected society. Bitcoin Depot’s simple and convenient process to convert cash into Bitcoin via our BTMs and full-service mobile app enables not only these users, but also the broader public, to access the digital financial system.

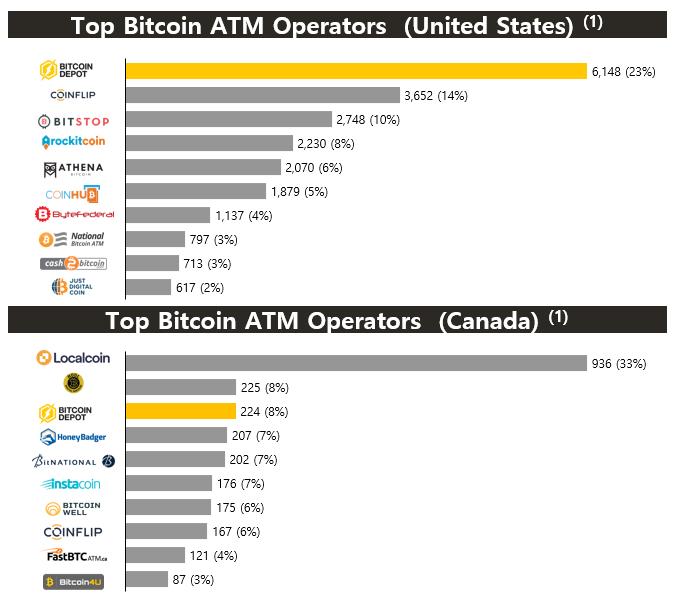

As of December 31, 2023, our offerings included approximately 6,300 BTMs in retailer locations throughout the U.S. and Canada, our BDCheckout product, which is accepted at approximately 5,700 retail locations, and our mobile app. We maintain the leading position among cash-to-Bitcoin BTM operators in the U.S., representing an approximate 23% market share in the U.S., and a leading position in Canada. Our BTMs offer one-way exchange of cash-to-Bitcoin, with the limited exception of approximately 29 BTMs (representing less than 1% of our total kiosks as of December 31, 2023) which also provide customers the ability to sell Bitcoin to us in exchange for cash. Currently, we do not have plans to expand our users’ ability to sell Bitcoin to us in exchange for cash. We also operate a leading BTM device and transaction processing system, BitAccess, which provides software and operational capabilities to third-party BTM operators, which generates software revenue for the Company.

The charts below illustrate the number of BTMs and corresponding market shares for the leading BTM operators in the U.S. and Canada, as of December 31, 2023: (Note data is delayed from our actual active kiosks, please see Section 7, Management discussion and analysis for additional information regarding kiosk information.)

4

(1) Source: Coinatmradar.com as of December 31, 2023. Figures only account for cash-to-Bitcoin ATMs, which results in the exclusion of LibertyX.

5

Our diverse retail locations and intuitive transaction process make us a convenient option for our users, and our predictable minimum monthly rent payments to our retail partners where our kiosks are located make us an attractive option for these retailers. We have locations across the U.S. and Canada at, among others, the following type of retailers:

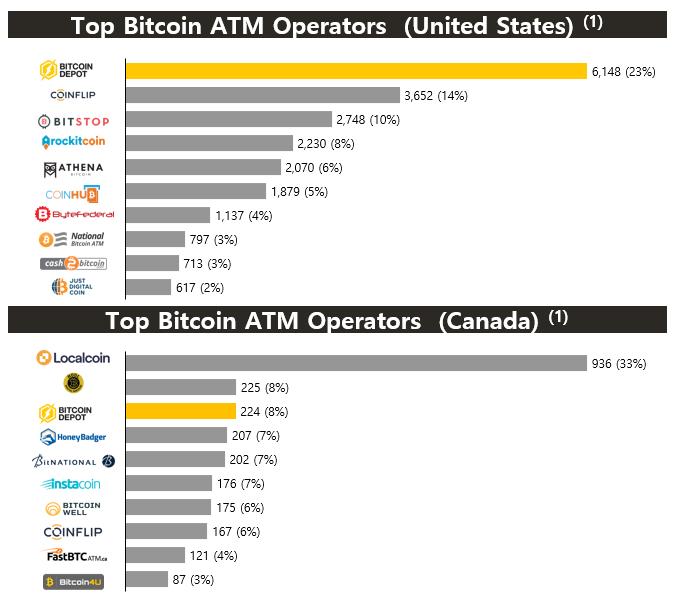

The following map illustrates the number of BTMs we operate by U.S. state and Canadian province as of March 11, 2024:

Both our revenue and transaction volumes have historically grown despite volatility in market prices for Bitcoin and other cryptocurrencies and we expect this trend to continue as Bitcoin becomes increasingly accepted across the world.

Our focus on robust compliance procedures and ease of use of our BTMs has helped create a powerful compounding effect: the convenience and quality of our platform provides a seamless experience for users transacting at our BTMs; thereby driving increased traffic and business at our retail partners; attracting more retailers to partner with us; and in turn driving even more users to our BTMs. Our scale and leadership position has enabled us to develop a deeper understanding of our users’ needs and continually innovate and launch new products and services, such as BDCheckout, further enhancing the value of our platform.

6

From our inception in July 2016 through December 31, 2023, we have completed more than 3.3 million user transactions, equating to approximately $2.3 billion in total transaction value. During the year ended December 31, 2023, we averaged approximately 21,824 monthly active users, which we define as the total number of unique customers. For the year ended December 31, 2023, we generated approximately $689.0 million of revenue, $88.6 million of gross profit (12.9% of gross profit margin), $1.5 million of net income and $56.3 million in Adjusted EBITDA (non-GAAP), which represented 14.7% of Adjusted Gross Profit Margin (non-GAAP) for the same period. For the year ended December 31, 2022, we generated approximately $646.8 million of revenue, $53.5 million of gross profit (8.3% of gross profit margin), $3.5 million of net income and $41.2 million in Adjusted EBITDA (non-GAAP), which represented 11.2% of Adjusted Gross Profit Margin (non-GAAP) for the same period. See the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non- GAAP Financial Measures” for information regarding our use of Gross Profit Margin, Adjusted EBITDA and Adjusted Gross Profit and a reconciliation of such measures.

Our Products

As of December 31, 2023, we operated a portfolio of approximately 6,300 owned and leased kiosks across 48 U.S. states and 10 Canadian provinces. Within the United States, our kiosks and BDCheckout access points are located in zip codes containing approximately 52% of the U.S. population. While we are currently not operating kiosks in New York or Puerto Rico, we have obtained a license (or equivalent) to operate in Puerto Rico and have applied for the license required to operate in New York. See “—Government Regulation—Money transmission and virtual currency business activity” for more information.

BTM

Our kiosks are located in convenience stores, gas stations, pharmacies, grocery chains and shopping malls across North America. Our largest deployment across a single retail chain is with Circle K, which accounted for approximately 1,300 of our total number of deployed kiosks as of December 31, 2023. We continuously monitor our BTM performance at each location, and at various times we relocate our BTMs to more profitable locations. The majority of our contracts contractually, allow us to move our BTMs with a limited notification to our retail partners. At December 31, 2023, we had approximately 900 BTMs with our logistics providers to redeploy to new locations.

Our kiosks are primarily manufactured and supplied by Genmega, a leading global ATM company. Our BTM suppliers load the operating software on to the kiosks prior to deployment. Because utilization is below that of typical cash ATMs, we believe that that the functional life of our kiosks is extended relative to manufacturer specifications. We have contracted with a network of providers to service our kiosks on an as-needed basis to support kiosk up-time, but our kiosks have typically not required frequent repair or maintenance.

We have found that a key factor affecting transaction volumes at any particular kiosk is its location. Our strategy in deploying our BTMs is to identify locations that are expected to generate high visibility and high transaction volume. Site selection for kiosk deployment is also determined based on an analysis of historical business trends, demographic data, and a determination of the proximity and density of competitors’ kiosks. The approximately 1,300 kiosks deployed at Circle K stores are a prime example of the types of locations that we seek when deploying our BTMs. In addition to the Circle K locations, we have also entered into agreements with a number of other retail partners.

Our retail deployments are secured through negotiation with our retail partners. Contract terms are generally similar across the portfolio of retail partners, such as payment terms, service level agreements, rent, placement, and access. These contracts provide a recurring and stable source of revenue for our retail partners over a typical initial term of approximately five years, although our terms vary because of negotiations at the time of execution. As of December 31, 2023, our contracts with our top 10 retail partners had a weighted average remaining life of 1.7 years. Many of our contracts include auto-renewal features providing for additional one-year terms following the expiration of the initial term. Such contracts may be terminated at either party’s option by giving proper notice in accordance with the subject contract. All contracts with over a 12-month term allow for kiosks to be removed at our discretion, except in one agreement. This agreement is associated with 25 BTMs, which has restrictions on the first nine months of the kiosk placement. The Company has recognized a floor space lease associated with these BTMs. This overall flexibility to move our BTMs allows us to not record a liability on the balance sheet related to these retail location leases.

The software that resides on the kiosk is designed to provide an intuitive user interface for our users. Upon using a Bitcoin Depot kiosk for the first time, users will be prompted to provide certain information for account creation and verification. Users are required to select from three ranges of cash amounts to be inserted in the kiosk for purchasing Bitcoin. The user then provides the address of their digital wallet by scanning a QR code; the user can create and use a Bitcoin Depot-branded wallet (un-hosted and non-custodial), or their other existing digital wallet. Bitcoin Depot’s branded wallet is facilitated through an unaffiliated third party. Bitcoin Depot

7

utilizes this wallet infrastructure to offer users the ability to use an un-hosted non-custodial wallet within the Bitcoin Depot mobile app or through other third-party apps which allow access to non-custodial wallets. Bitcoin Depot is not liable for any losses users may experience because Bitcoin Depot does not have access to users’ wallets or their private keys. Cash is then inserted by the user into the kiosk, and the kiosk will confirm the dollar amount and other details of the transaction, including quantity of Bitcoin being purchased. Once the transaction is complete, the Bitcoin is electronically delivered to the user’s digital wallet and the user is provided with a physical receipt as well as a receipt via SMS text.

Prior to the time at which a user inserts cash in the BTM to purchase Bitcoin, Bitcoin Depot has control of such Bitcoin, and maintains such control until the transaction is completed at the kiosk and Bitcoin Depot initiates a transaction on the blockchain to send Bitcoin to the user. Bitcoin Depot never custodies a user’s Bitcoin. Bitcoin Depot takes custody of the user’s cash at the time the same is inserted into the BTM.

BDCheckout

Additionally, Bitcoin Depot sells Bitcoin without the use of kiosks at several thousand additional retailer locations through a relationship with a leading global payments technology company. This product, called BDCheckout, allows users similar functionality to our kiosks, enabling them to load cash into their accounts at the checkout counter at retailer locations, and then use those funds to purchase Bitcoin. The transaction is initiated on the Bitcoin Depot mobile app, which is available for download from major app stores for free. We believe that BDCheckout offers an attractive value proposition for retailers, providing fee income and potentially increasing shopper foot traffic, without Bitcoin Depot incurring upfront out-of-pocket hardware costs and certain operational expenses, such as rent.

The primary difference between a BDCheckout transaction and a BTM kiosk transaction is that the former is completed via interaction with a cashier at a retail location and relies more heavily on the use of the Bitcoin Depot mobile app, while the latter involves a user interfacing with a kiosk. From a third-party fee perspective, there is a $3.50 flat fee per BDCheckout transaction charged to the user in connection with the use of payment provider integrated network of retailers’ point-of-sale systems.

Bitcoin Depot’s costs associated with a BDCheckout transaction are lower than its costs associated with a BTM transaction, primarily due to significantly greater operating expenses associated with the BTMs, including cash collection fees and short-term lease payments to the retail locations where the kiosks are placed. However, the profitability of the two services is similar because of the higher markup that Bitcoin Depot applies to BTM transactions to support the higher costs associated therewith.

We regularly monitor official SEC releases and comments made by senior SEC officials, including Chairman Gensler, regarding the regulation of cryptocurrencies and related activities. Based on such statements, historical enforcement actions and existing regulations and laws, we have made the determination that our activities and the cryptocurrencies that we currently sell, which consists of only Bitcoin, do not subject us to SEC regulation, and thus we believe we are not required to be registered with the SEC as a broker dealer to support transactions which consist of only Bitcoin at our BTMs and via BDCheckout. We note that we have previously provided products and services related to Litecoin and Ethereum, however, based on a risk-based determination made after consideration of public statements by the SEC, historical enforcement actions, and existing regulations and laws in effect at the time, we have determined to limit our activities to Bitcoin only.

Industry Trends

The adoption of cryptocurrencies as a medium of exchange has grown significantly since Bitcoin’s introduction in 2009 and cryptocurrency is continuing to become more mainstream among consumers. In 2023, centralized and decentralized exchanges reported nearly $82.0 trillion, in cryptocurrency trading volume, a 6.5% decrease from 2022 levels. According to New York Digital Investment Group LLC d/b/a NYDIG, Bitcoin alone was the third largest payment network in 2022 with over $3.0 trillion in transaction volume, next only to Visa and Mastercard and ahead of American Express and Discover, and an estimated 22% of the U.S. adult population owns cryptocurrency.

Several notable developments have contributed to this growth, including broader acceptance of cryptocurrency on payment platforms, the proliferation of financial products offering investors exposure to cryptocurrencies, and market participants looking for ways to simplify transactions for the everyday consumer.

At the same time, consumers have become attracted to the accessibility and user experience of BTMs as an entry ramp into the digital financial system. Several companies began to work on BTM prototypes as early as 2013, and the BTM market has shown rapid growth since then. According to Coin ATM Radar, from January 1, 2017 to December 31, 2023, the total number of BTMs deployed grew from 968 to 33,936, representing a CAGR of approximately 84%, with the vast majority of BTMs now located in North

8

America. According to Coin ATM Radar, as of December 31, 2023, 90% of installed BTMs worldwide reside in the U.S. and Canada, in which Bitcoin Depot had a market share of 23% and 11%, respectively. Many BTMs deployed around the world initially supported transacting only in Bitcoin. Our BTMs currently support transactions in Bitcoin.

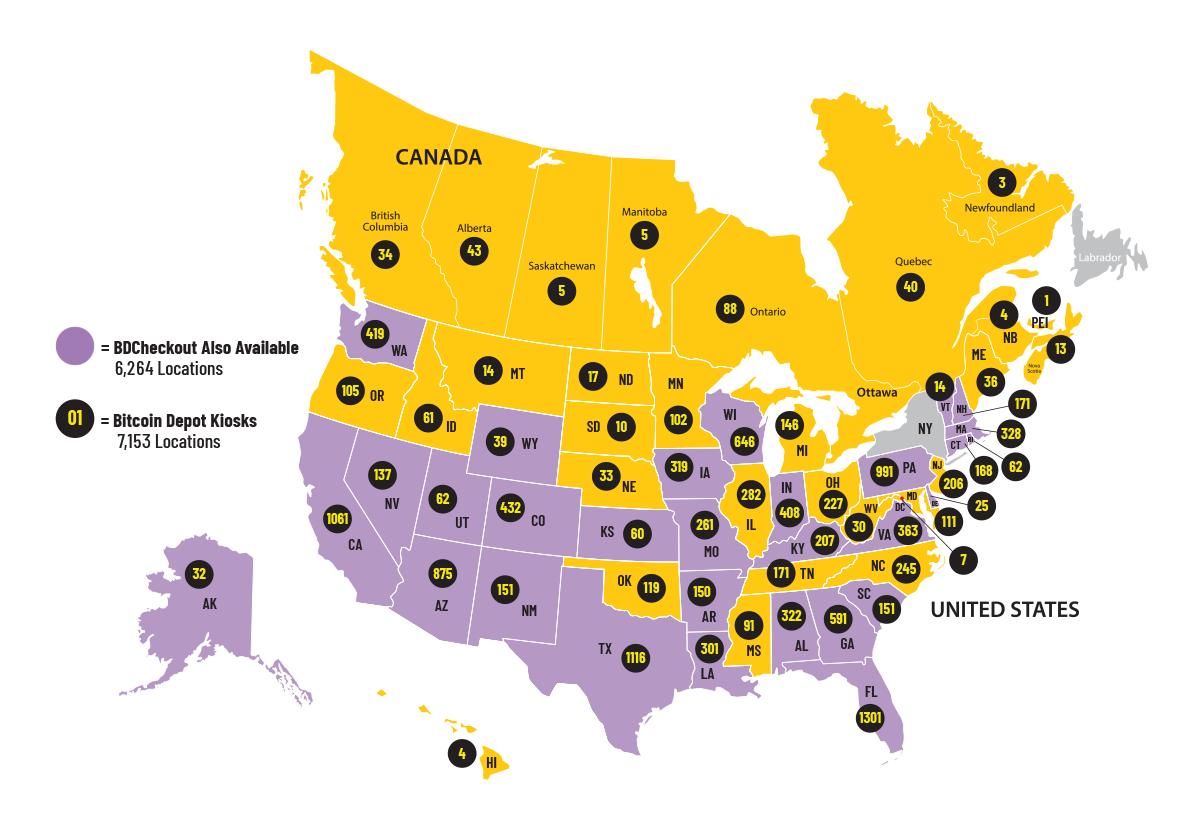

Market Opportunity

Although U.S. consumers continued to use credit cards and debit cards for a majority of their payments, market studies indicate there is still a significant desire to utilize cash for various purposes in the U.S. The 2023 Diary of Consumer Payment Choice, a study conducted by Federal Reserve Bank of San Francisco found that while it has declined over time, the share of payments in cash was 18% in 2022, which was a decrease from the data in 2021. As of October 2022, the value of currency in circulation passed $2.23 trillion, a 28% increase compared to February 2020, but with slower growth since 2021. In addition, according to a study by Travis Credit Union conducted in 2020, 29% of U.S. adults sampled prefer to use cash to purchase goods. We believe a portion of this population finds obtaining cryptocurrencies through online cryptocurrency exchanges challenging and inconvenient and prefers to directly convert their cash to cryptocurrencies. The chart below shows the proportions of various methods of payments since 2016. The 2023 Diary of Consumer Payment Choice also shows that a significant percentage of person-to-person payments continue to be made in cash, and credit cards, the percentage of these payments made with credit cards has been steadily increasing compared to the prior years. According to a user survey we conducted, many of our users report that the reason they used our BTMs was to send cryptocurrency to others. This use case can represent a more efficient means of sending money for those who are using cash to make person-to-person payments, or an alternative means of sending money for those who are using mobile apps.

Share of payment instrument use for all payments (1)

(1) Source: 2023 Findings from the Diary of Consumer Payment Choice;

For the most up-to-date figures please consult the links in the section titled “Market, Industry and Other Data.”

Our Competitive Strengths

We believe the below competitive strengths differentiate us from our competition and enhance our ability to compete.

We are the largest operator of BTMs in North America with an approximately 23% market share as of December 31, 2023, according to Coin ATM Radar. As of December 31, 2023, we have approximately 6,300 active kiosks across 48 states in the U.S. and 10

9

provinces in Canada across convenience stores, gas stations, pharmacies, grocery chains and shopping malls. Bitcoin Depot’s strategically placed network of BTMs and BDCheckout access points are located in zip codes addressing approximately 52% of the U.S. population. Our strong presence has given us increased visibility among users and retail partners and has helped drive user traffic to our kiosks.

In addition to offering intuitive user interfaces at our BTMs for transactions, we believe we offer a streamlined alternative to online exchanges for transacting in Bitcoin. Online exchanges can in certain instances require users to wait over three business days to convert money to Bitcoin, and they also require a user to have a bank account and therefore provide no cash conversion options. Our users can purchase Bitcoin without a bank account through our kiosks in typically under two minutes for new accounts and in under a minute for returning users. Our streamlined mobile app offers an easy way for our users to locate points-of-transaction, create a digital wallet, transfer Bitcoin between digital wallets and initiate BDCheckout transactions. We provide telephonic customer service almost around the clock to address questions or concerns from our users and to facilitate a smooth transaction process.

We have flexible hosting contract terms with our retail partners that offer location payments tied to a predictable minimum rate monthly rent (which, for certain locations, may be increased based on transaction volumes, thereby aligning partners’ success with our own performance). Based on our observations, our kiosks provide the benefit of driving additional foot traffic at retail locations, which as a result potentially drives additional business to our partners, thereby increasing their revenue.

We complete our customer KYC process prior to permitting a user to transact. We have invested in and maintain robust, multi-layer compliance procedures to evaluate potential users, open user accounts and monitor transactions at our BTMs. Our compliance team, comprised of 16 individuals, has over 100 years of combined experience in AML (Anti-Money Laundering), KYC (Know-Your-Customer), BSA (Bank Secrecy Act), and OFAC (Office of Foreign Assets Control) compliance. The level of user verification for any given user transacting at our kiosks is generally based on the user’s proposed transaction volume with us. Generally, verification involves collecting users’ names, email addresses, phone numbers, driver’s licenses or other ID, social security numbers and photos of each user. Further, our BTMs take photos throughout the transaction process, which allows us to verify that users match the identifying information that has been provided during the KYC process. We utilize blockchain analysis and work with various third parties for transaction monitoring, case management and regulatory filings and reporting. We prioritize proactive reporting procedures in accordance with local, state, and federal requirements. Our compliance team routinely rejects user applicants that fail authentication requirements, and bans users from transacting at our kiosks and via BDCheckout when our compliance team discovers suspicious activity or when the users violate our terms of service (which can be accessed on our website) to which users agree prior to transacting at a BTM or during the BDCheckout transaction process, as applicable. These user bans represent approximately 4% of our overall transaction volumes in a given month. We do not believe there are any material challenges related to conducting KYC at a kiosk. We believe many of our retail partners have selected us to be their BTM provider based on our focus and commitment to robust compliance.

Our revenue has not been correlated to the price of Bitcoin historically, even in light of volatile Bitcoin prices. Based on our own user surveys, a majority of our users use our products and services for non-speculative purposes, including money transfers, international remittances, and online purchases, among others.

We use a sophisticated Bitcoin management process to reduce our exposure to volatility in Bitcoin prices by maintaining a relatively low balance (typically less than $1 million) of Bitcoin at any given time, which we believe differentiates us from our competition. We do not act as an agent or exchange for users in our transactions; we maintain balances of Bitcoin from which we satisfy our users’ demand from kiosk or BDCheckout transactions. As we send users Bitcoin, we replenish our Bitcoin balance on an ongoing basis to meet user demand. Our typical practice is to purchase Bitcoin through a liquidity provider such as Cumberland DRW. We replenish our Bitcoin only through purchases from leading Bitcoin liquidity providers and do not engage in any mining of Bitcoin ourselves. Our sophisticated replenishment process enables us to satisfy our users’ Bitcoin purchases with our own Bitcoin holdings, yet maintain relatively small balances of Bitcoin to effectively manage our principal risk.

We are led by a management team that built our business from the ground up to become the largest operator of BTMs in North America. Our founder and other executive officers bring extensive multidisciplinary experience in technology and business. We

10

believe our management team has a competitive advantage in their ability to attract a highly talented pool of experienced engineers and seasoned industry professionals. We believe our management team’s expertise in this industry enables them to pursue attractive and opportunistic acquisition targets to further strengthen our competitive advantage.

Our Strategies

We intend to continue to grow our business by employing the following strategies:

We intend to continue to expand into more physical locations at our existing partners as well as build new partner relationships for further greenfield market penetration. Among existing partners, our kiosks are located in approximately 1,300 out of the over 9,000 total Circle K locations in the U.S. and Canada. Our broad footprint and user base presents us an opportunity to offer additional products and services in the future, which we believe will further strengthen and grow our user base. To expand into new geographies, we have applied for a license to operate in the state of New York, a market we believe could support thousands of kiosks, an estimate we adopted based on other states with more established BTM networks and comparable populations, such as Florida. Finally, approximately 92% of BTMs worldwide are in North America, according to Coin ATM Radar as of March 26, 2024, presenting an attractive international expansion opportunity for us. Various countries have begun accepting cryptocurrency as a legal form of payment, which we believe is going to accelerate the adoption of cryptocurrency and offer us an opportunity to establish a presence in these countries.

We operate the largest network of BTMs in North America. We have generated positive net income and cash flow from operations during every year since our inception. For the year ended December 31, 2023 and 2022, we generated revenue of approximately $689.0 million and $646.8 million, respectively, gross profit of $88.6 million and $53.5 million, respectively, and adjusted gross profit of $101.0 million and $72.3 million, respectively. We currently intend to reinvest the majority of the profits back in our business to continue to develop new products and services to address the needs of our users, such as BDCheckout, allowing us to achieve further brand recognition and brand loyalty and grow our user base.

We believe the BTM market is fragmented. We plan to opportunistically evaluate acquiring other kiosk operators and complementary businesses to support our operations and strategy. Provided we are able to secure appropriate opportunities, we intend to pursue inorganic growth in the form of strategic bolt-on acquisitions to build on our leading market position and to supplement our in-house capabilities in both hardware kiosks and software that run on these kiosks as well as any product or service that provides Bitcoin access in a retail setting. In addition, we continue to look for potential acquisitions to enhance our capabilities in areas such as cyber security and compliance, among others.

We launched BDCheckout in June 2022 and as of December 31, 2023, it is available at approximately 5,700 retail locations across North America, including convenience stores, gas stations, pharmacies, grocery chains and shopping malls. BDCheckout enables our users to load cash into their accounts at the checkout counter at retailer locations, and then use those funds to purchase Bitcoin using the same fee structure in place at our kiosks, thereby lowering our required upfront capital expenditures and operating expenses and providing us with additional revenues from the sale of Bitcoin. For more information about how we generate our revenue, please see the section of this Annual Report on Form 10-K entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Components of Results of Operations—Revenue.” We intend to fully capitalize on this by actively targeting our users with BDCheckout through online advertising and our free mobile app. We believe the expansion of BDCheckout to new locations across the U.S. and Canada will diversify our revenue streams as well as further grow our transaction volumes, revenue and profitability.

Recent Highlights

In March 2023, we announced a partnership agreement with GetGo® Café + Market, an innovative, food-first convenience store retailer with locations throughout western Pennsylvania, Ohio, northern West Virginia, Maryland and Indiana. We plan to install our BTMs into 125 GetGo® Café + Market stores in multiple metropolitan areas, strengthening our presence throughout the Midwest and Mid-Atlantic.

In September 2023, the Company entered into an On-Site Agreement, with Tanger Management, the property manager for the outlet centers located throughout the United States and Canada. The agreement anticipates the placement of BTMs in 16 mall locations.

11

In October 2023, we fostered a critical relationship, for the placement of our kiosks, with one of the foremost distributors in the ATM industry, CORD, underscoring our reputation as a formidable player in the market which has more than 3000+ ATMs in the US. We believe this partnership will expand our reach of connecting our BTMs with those that wish to own or operate BTMs.

In December 2023, we announced a partnership with MAPCO for kiosk placement, which encompasses 63 of their corporate locations. With MAPCO's expansive network of over 145+ locations spanning six states, this collaboration presents an opportunity to bolster our market presence and engage with a wider audience. Initially commencing with their corporate sites, we have laid a robust foundation for additional expansion. Furthermore, we have a strategic alliance with Majors Management that carries the potential to extend our reach to an additional 570+ franchisee locations, and 200+ corporate locations. This strategic alliance holds immense promise for expanding our market positions.

Entering January 2024, we signed a master placement agreement with EG America LLC, in one of the largest retail partner deals in the Company's history. With this agreement, we are set to install our BTMs in approximately 900+ locations, a significant leap forward in our expansion trajectory.

In February 2024, we were able to secure a deal with CEFCO for 72 out of their 200+ locations which marks a significant milestone for our company. This partnership not only expands our market reach but also diversifies us within the convenience store industry. By aligning with CEFCO, a reputable and rapidly growing chain, we gain access to a broader customer base and increase brand visibility.

Competition

We operate in a highly competitive industry with an increasing number of participants. Industries adjacent to the digital financial system are highly fragmented, quickly evolving, intensely competitive, and subject to growing global regulatory scrutiny and oversight.

There are several publicly traded companies that operate cash to Bitcoin ATMs, including Athena Bitcoin Inc. and Bitcoin Well Inc. We believe we do not have any direct, pure-play competitors, traded on major exchanges, who operate cash to Bitcoin ATMs at scale.

Several private companies and wholly-owned subsidiaries of other publicly traded companies may be considered to be our competitors, including BitNational, Bitstop, Byte Federal, Inc., Cash2Bitcoin.com, Coin Hub, Coin Flip Bitcoin ATMs, Coinme, Instacoin, Moon Inc., dba LibertyX, a division of NCR Atleos Corporation, Localcoin, NationalBitcoin ATM, and RockItCoin, among others.

Separately, given our mission to Bring Bitcoin to the Masses™ by enabling our users to transact on everyday activities using Bitcoin, from paying bills to sending money transfers to a variety of other use cases, other established payment processing and money transfer businesses may become our competitors, including PayPal, Block, Global Payments, Coinbase, Jack Henry, and MoneyGram, among others.

Sales and Marketing

Our sales team focuses principally on maintaining relationships with our existing retail partners and developing new relationships with national, regional and local retailers. The team is organized into groups that specialize in marketing to specific retail industry segments, which allows us to tailor our offering to the specific requirements of each retail partner. As of December 31, 2023, our sales and marketing teams consisted of 28 employees. Those who are exclusively focused on sales typically receive a combination of base salary and an incentive-based compensation.

In addition to targeting new business opportunities, our sales team supports our business initiatives by building and maintaining relationships with new retail partners. We seek to identify growth opportunities within each account by analyzing the retailer’s sales at each of its locations, foot traffic, and various demographic data to determine the best opportunities for new BTM placements.

Our marketing team is focused on attracting users to our BTMs as well as to our BDCheckout retail locations. Our marketing team primarily uses digital marketing tools, such as Google AdWords, to acquire and retain users but also deploys email, SEO, and physical marketing presences as applicable. Our marketing team also supports the sales team in attracting new retail partners.

Intellectual Property, Patents and Trademarks

12

Although we believe our success depends upon our technical and marketing expertise more than our proprietary rights, our future success and ability to compete depend in part upon our proprietary technology. We have registered or filed applications for our primary trademarks. Most of our technology is not patented. Instead, we rely on a combination of contractual rights, copyrights, trademarks, and trade secrets to establish and protect our proprietary technology. We generally enter into confidentiality agreements with our employees, consultants, third-party contractors, and retail partners. Access to, and distribution of, our source code is restricted, and the disclosure and use of other proprietary information is further limited. Despite our efforts to protect our proprietary rights, unauthorized parties can attempt to copy or otherwise obtain, or use our products or technology. We cannot be certain that the steps taken in this regard will be adequate to prevent misappropriation of our technology or that our competitors will not independently develop technologies that are substantially equivalent or superior to our technology in a manner that would avoid our intellectual property rights.

Research and Development

We invest in ongoing research to develop new software solutions and services and enhance existing solutions with additional functionality and features required to ensure regulatory compliance. Product-specific enhancements are largely user-driven with recommended enhancements formally gathered through survey results, strategic initiatives meetings and ongoing user contact. We also continually evaluate and implement process improvements that expedite the delivery of new products, services and enhancements to our users and reduce related costs. For instance, our research and development capabilities and efforts resulted in the successful launch and deployment of BDCheckout, recently at thousands of major retailers. Associated costs are recorded in Selling, general and administrative expense on the Consolidated Statements of Income (Loss) and Comprehensive Income (Loss) and are not material.

Our Retail Partners

In the U.S., we have contracts with approximately 56 major national and regional retailers, including convenience stores, supermarkets, drug stores, and other high-traffic retail chains, which represent approximately 2,200 BTMs. We also have BTMs in approximately 3,900 independent retail locations in the U.S. In Canada, we have contracts with one national merchant and approximately 100 independent merchants. Circle K is the largest retailer in our portfolio, representing approximately 27% and 32% of our total revenues for the year ended December 31, 2023 and 2022, respectively. The underlying retail agreement with Circle K has an initial term of five years. As of December 31, 2023, our contracts with Circle K have a weighted average remaining life of 1.5 years. Our other top ten retail partners (excluding Circle K) comprise 7.4% of our retail locations. Contracts with these nine other nine retail partners have a weighted average remaining life of 1.9 years as of December 31, 2023. Many of our contracts include auto-renewal features providing for additional one-year terms following the expiration of the initial term. Such contracts may be terminated at either party’s option by giving proper notice in accordance with the subject contract. The terms of our retail partner contracts vary because of negotiations at the time of execution. In addition, through BDCheckout, our users can now load cash into their accounts at the checkout counter at approximately 5,700 retailer locations, and then use those funds to purchase Bitcoin.

Our Vendors/Suppliers

Cumberland DRW

Cumberland DRW ("Cumberland") is one of our co-primary liquidity providers from whom we purchase Bitcoin that we sell to our users. We have had a relationship with Cumberland for over three years. Cumberland is a leading OTC liquidity provider in the digital financial system. The company has operations globally and is owned by DRW, a diversified principal trading firm with more than 25 years of experience in multiple asset classes around the world.

Abra

Abra is one of our co-primary liquidity providers from whom we purchase Bitcoin that we sell to our users. We have had a relationship with Abra for almost one year. Abra is a financial services and technology company that operates a cryptocurrency wallet service including a trading service for buying and selling cryptocurrencies and a service for earning interest on cryptocurrencies and stablecoins.

Genmega

Genmega is a global provider of kiosks and traditional cash ATMs and is currently the sole provider of our BTM kiosks. The company was founded over ten years ago and has cumulatively delivered more than 150,000 ATMs worldwide. Since 2016, Genmega has supplied more than 7,200 kiosks to us.

13

Gemini

Gemini is an American cryptocurrency exchange and custodian that allows customers to buy, sell, and store digital assets. To place orders for Bitcoin on the Gemini exchange, we are required to have USD on account and available which facilitates the purchasing process. We maintain a minimum USD balance needed for anticipated Bitcoin purchases for the day. We replenish the account with USD as needed. Gemini is the sole cryptocurrency exchange with which we hold USD balances. For the year ended December 31, 2023, our average daily USD balance held in fiat wallets on the Gemini exchange was approximately $0.5 million.

Cash Transportation

We contract with large and reputable armored courier services to transport and transfer funds to and from our kiosks. We use leading armored couriers such as Loomis, Brinks and Garda in the U.S. and Canada to collect and transport cash. Under these arrangements, the armored couriers collect cash either on a regular schedule or pickups are initiated when cash in a particular kiosk has reached a specified threshold dollar amount, which we can track on a real-time basis. The armored couriers then confirm cash counts and our bank accounts are then credited.

ATM Operations

We contract with large and reputable service providers that support the various activities of our BTMs operations related to deployment, repairs and maintenance, and wireless communications. Operations vendors include, but are not limited to, Bibbeo, Burroughs, Cennox, DropPin, Fiserv, National Services, and OptConnect. We also supplement our vendors by insourcing some field activities with several employees who travel to various markets as needed.

Lease Providers

We utilize four major lessors to finance approximately 6,000 of our BTMs. We believe these lessors are experienced in lease transactions and have adequate equity reserves. We have been able to negotiate with several lease providers and are able to receive market rates for these lease arrangements. As of December 31, 2023, we have lease commitments to acquire all the kiosks for a bargain purchase option at the end the lease term.

User Transactions

We hold an amount of Bitcoin in a hot wallet that we own and send Bitcoin to users from that wallet when transactions are completed at a BTM or through BDCheckout. We replenish our hot wallet from time to time through open market purchases of Bitcoin with certain liquidity providers. When a user buys Bitcoin from us, the purchase price is based on the spot price of Bitcoin at the time of the user’s transaction. When a user sells Bitcoin to us, such Bitcoin is held in a Bitcoin Depot hot wallet for a period of time, which could be up to several days, until such Bitcoin is later sold through a liquidity provider to fund operations or is resold to users transacting at BTM kiosks or through BDCheckout; however, the volume of transactions of this type are de minimis. Our policy for transfers from our hot wallet (the private keys to which are stored in geographically dispersed locations throughout the U.S.) that do not involve fulfilling user purchases require dual approval by our Chief Executive Officer and Chief Operating Officer. Transfers from our hot wallet to fulfill user purchases occur automatically through an application program interface that is secured by passwords and login credentials.

We do not custody Bitcoin for our kiosk users. Our relationship with our primary liquidity provider allows us to purchase Bitcoin to quickly replenish amounts sold to users, which means that we hold relatively small amounts of Bitcoin at any given time. Due to the minimal amount of Bitcoin held at any given time (typically less than $1 million), coupled with our high transaction volumes, we do not store Bitcoin in cold wallets.

Human Capital

As of December 31, 2023, we had 124 full-time employees, most of whom were in the U.S. None of our employees are represented by a labor union or covered by collective bargaining agreements, and we have not experienced any work stoppages. We believe we have a positive relationship with our employees.

We believe that our success is driven by our employees. Our human capital strategy focuses on:

14

Diversity, Equity and Inclusion: We recognize the value of diversity, equity and inclusion within our organization and strive to ensure that our workplace reflects the diverse communities in which we operate in order to promote collaboration, innovation, creativity and belonging. We are committed to recruiting and employing qualified candidates regardless of their gender or cultural background.

Employee Benefits: We believe in the importance of offering our employees competitive salaries and wages, together with comprehensive insurance options. We recognize the importance of comprehensive healthcare benefits, including medical, prescription drug, vision and dental, and employees and their family members are provided with tools and resources to assist in adopting and maintaining a healthy lifestyle. We offer medical, dental, vision, short and long-term disability, life insurance, match 401K contributions up to 3%, and pay for a ClassPass membership.

Training and Talent Development: We are committed to the education of our employees and have committed to provide our employees with a variety of learning opportunities, including, but not limited to, technical skill development, soft skills development, workplace conduct guidance, and IT security training.

Facilities

Our principal executive offices and headquarters are located in leased premises at 3343 Peachtree Road NE, Suite 750, Atlanta, Georgia, 30326, consisting of approximately 5,700 square feet. We also lease office space in Canada, located at 267 Richmond Rd, 3rd Fl., Ottawa, Ontario K1Z 6X3 and consisting of approximately 1,000 square feet. We believe that these facilities are generally suitable to meet our needs.

Seasonality and Inflation

We have typically experienced seasonality in the 4th quarter of the calendar year in our revenue and the related cost of cryptocurrency. We believe this trend is attributable to less business days in the quarter as a result of public holidays. Our costs of goods, services and labor and third-party services, have been impacted by the recent high inflationary environment. To date, we have been successful in managing these inflationary cost increases. There can be no assurance that our operating results will not continue to be affected by inflation in the future or that we will be successful in managing such cost increases.

Governmental Regulation

Currently, we operate in the U.S. and Canada in a complex and rapidly evolving regulatory environment and are subject to a wide range of laws, rules and regulations enacted by U.S. and Canadian federal, state, provincial, and local governments and regulatory authorities. At a high-level, this evolving regulatory environment currently is characterized by a heightened focus by regulators on the cryptocurrency industry and countering terrorist financing and anti-money laundering. The scope of laws, rules, and regulations that can impact our business, including many laws, rules, and regulations that were enacted prior to the creation of the digital financial system, are expansive and include certain of the requirements that apply to financial services, money transmission, privacy protection, cybersecurity, electronic payments, and securities and commodities regulation, as well as bespoke cryptocurrency laws that have been adopted in some jurisdictions. Notwithstanding the applicability of the above-described regulatory framework, currently we are not supervised or examined by any banking, securities or commodities regulator such as the Office of the Comptroller of the Currency, the Office of the Superintendent of Financial Institutions, the SEC, or the Commodity Futures Trading Commission.

We monitor changes to the regulatory environment closely and invest significant resources in our legal and compliance teams to ensure that we are able to design and maintain appropriate compliance systems and practices. However, the complexity and evolving nature of our business and the significant uncertainty surrounding the regulation of the digital financial system and related industries, require us to exercise our judgment as to whether certain laws, rules, and regulations apply to us, and it is possible that regulators may disagree with our conclusions. New or changing laws and regulations, including changes to their interpretation or implementation, as well as our failure to appreciate that the laws and regulations apply to our business, could have a material adverse impact on our business, results of operations, and financial condition.

We regularly monitor official SEC releases and comments made by senior SEC officials, including Chairman Gensler, regarding the regulation of cryptocurrencies and related activities. Based on such statements, historical enforcement actions and existing regulations and laws, we have made the determination that our activities and the cryptocurrencies that we currently sell, which consists of only Bitcoin, do not subject us to SEC regulation (other than in connection with our status as a public company) and thus we believe we are not required to be registered with the SEC to support transactions which consist of only Bitcoin at our BTMs and via BDCheckout. We note that we have previously provided products and services related to Litecoin and Ethereum, however, based on a risk-based determination made after consideration of public statements by the SEC, historical enforcement actions, and existing regulations and laws in effect at the time, we have determined to limit our activities to Bitcoin only.

15

Anti-money laundering and counter-terrorist financing

We are subject to various anti-money laundering and counter terrorist financing laws, including the BSA in the U.S. and similar laws and regulations in Canada. In the U.S. as a money services business registered with the FinCEN, the BSA requires us to develop, implement, and maintain a risk-based anti-money laundering program, provide an anti- money laundering-related training program, report suspicious activities and transactions, comply with certain reporting and recordkeeping requirements, and collect and maintain information about our users. In addition, the BSA requires us to comply with certain user due diligence requirements as part of our anti-money laundering obligations, including developing risk-based policies, procedures, and internal controls reasonably designed to verify each user’s identity. We have implemented a compliance program designed to prevent our kiosks, products and services from being used to facilitate money laundering, terrorist financing, and other illicit activity in countries, or with persons or entities, included on designated lists issued by the OFAC, and equivalent foreign authorities. Our compliance program includes policies, procedures, reporting protocols, training and internal controls, and is designed to address legal and regulatory requirements as well as to assist us in managing business risks associated with money laundering and terrorist financing.

Money transmission and virtual currency business activity

In the U.S., we have obtained licenses to operate as a money transmitter, or the equivalent, in the states where we understand such licenses or equivalent are required to conduct our business. In addition, we have applied for a BitLicense from the NYDFS. As a licensed money transmitter, we are subject to a range of legal obligations and requirements including bonding, net worth maintenance, customer notice and disclosure, reporting and recordkeeping requirements, and obligations that apply to the safeguarding of third-party funds and crypto assets. In addition, the licensed entity within our corporate structure is subject to inspection and examination by the state licensing agencies and certain actions involving that entity, such as changes in controlling equity holders, board members, and senior management, may require regulatory approval.

Privacy and protection of user data

We are subject to a number of laws, rules, directives, and regulations relating to the collection, use, retention, security, processing, and transfer of personally identifiable information about our users and employees in the jurisdictions where we operate. We are subject to privacy and information safeguarding requirements under the Gramm-Leach-Bliley Act and the California Consumer Privacy Act in the U.S., as well as the Personal Information Protection and Electronic Documents Act in Canada, which impose certain privacy protections and require the maintenance of a written, comprehensive information security program.

Our business relies on the processing of personal data in many jurisdictions and the movement of data across state and national borders. As a result, much of the personal data that we process, which may include certain financial information associated with individuals, is regulated by multiple privacy and data protection laws and, in some cases, the privacy and data protection laws of multiple jurisdictions. In many cases, these laws apply not only to third-party transactions, but also to transfers of information between or among us, our subsidiaries, and other parties with which we have commercial relationships.

Regulatory scrutiny of privacy, data protection, cybersecurity practices, and the processing of personal data is increasing in the U.S. and around the world. Regulatory authorities are continuously considering numerous new legislative and regulatory proposals and interpretive guidelines that may contain additional privacy and data protection obligations. Any expansion or changes in the application of these privacy, data protection and cybersecurity laws or other regulatory requirements could increase our compliance costs and have a material adverse impact on our business, results of operations, and financial condition.

Consumer protection

The FTC, the CFPB, and other U.S. federal, state, and local and foreign regulatory agencies regulate business activities, including money transfer services related to remittance or user-to-user transfers. These agencies, as well as certain other governmental bodies, including state attorneys general, have broad consumer protection mandates and discretion in enforcing consumer protection laws, including matters related to unfair or deceptive, and, in the case of the CFPB, abusive, acts or practices, or Unfair, deceptive, or abusive acts and practices (“UDAAPs”), and they promulgate, interpret, and enforce rules and regulations that affect our business. The CFPB has enforcement authority to prevent an entity that offers or provides financial services or products to consumers in the United States from committing or engaging in UDAAPs, including the ability to engage in joint investigations with other agencies, issue subpoenas and civil investigative demands, conduct hearings and adjudication proceedings, commence a civil action, grant relief (e.g., limit activities or functions; rescission of contracts), and refer matters for criminal proceedings.

Additional regulatory developments

16

Various regulatory authorities continue to evaluate and implement laws, rules and regulations governing a wide variety of issues, including cryptocurrencies, identity theft, account management guidelines, disclosure rules, cybersecurity, marketing, ESG performance, transparency, and reporting, including requirements related to overall corporate ESG disclosures and climate-related financial disclosures which may impact our business. For an additional discussion on the impact of governmental regulation on our business, please see “Risk Factors” included in this Annual Report on Form 10-K.

Legal Proceedings

On January 13, 2023, Canaccord Genuity Corp. (“Canaccord”) commenced proceedings against Lux Vending, LLC and Bitcoin Depot Operating LLC (collectively, for purposes of this paragraph, “Lux Vending”) in the Ontario Superior Court of Justice (the “Canaccord Claim”). The Canaccord Claim asserts that Canaccord is entitled to $23.0 million in fees alleged to be payable for breach of contract upon the closing of an alleged transaction pursuant to a previously terminated engagement letter between Lux Vending and Canaccord under which Canaccord was to provide certain financial advisory services. The claim also seeks an award for legal and other costs relating to the proceeding. Lux Vending denies the allegations made against it and intends to vigorously defend against them. The range of potential loss related to the identified claim is between $0 and the $23.0 million, the amount of damages that Canaccord is seeking in the lawsuit. The additional costs mentioned in the claim are not able to be estimated at this time. Apart from the initial exchange of pleadings, as of December 31, 2023, no further steps have been taken in the proceeding.

We are also party to various other legal proceedings and claims in the ordinary course of our business. We believe these matters will not have a material adverse effect on our consolidated financial position, results of operations or liquidity.

Corporate Information

Our principal executive office is located at 3343 Peachtree Road NE, Suite 750, Atlanta, Georgia, 30326, which is where our records are kept and the principal business address for our executive officers. Our mailing address is 2870 Peachtree Road #327, Atlanta, Georgia, 30305 and our telephone number is (678) 435-9604.

Lux Vending, LLC was incorporated as a Georgia limited liability company on June 7, 2016. In connection with the Closing, Lux Vending, LLC merged with and into Bitcoin Depot Operating LLC, a Delaware limited liability Company, with Bitcoin Depot Operating LLC surviving the merger.

Item 1A. Risk Factors

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of or that we deem immaterial may also become important factors that adversely affect our business. If any of the following risks occur, our business, operating results, financial condition, and future prospects could be materially and adversely affected. Many risks affect more than one category, and the risks are not in order of significance or probability of occurrence because they have been grouped by categories. In that event, the market price of our Class A common stock could decline, and you could lose part or all of your investment.

Summary of Risk Factors

The following is a summary of the principal risks that could adversely affect our business, operations and financial results.

Risks Related to our Business and Industry

17

18

Risks Related to Government Regulation and Privacy Matters

19

Other categories of risk discussed in more detail below include risks related to third parties, our management and employees, our capital structure and our tax receivables agreement.

Risks Related to our Business and Industry

Our transaction volume may be partially dependent on the prices of Bitcoin we sell, which can be volatile. If such prices decline, the volume of user transactions could decrease and our business, operating results, and financial condition would be adversely affected.

We generate substantially all of our revenue from the cash paid by customers to purchase Bitcoin from our kiosks. The number of user transactions and our transaction volumes may be partially dependent on the prices of Bitcoin, as well as the associated demand for buying, selling and trading Bitcoin, which can be and historically have been volatile. If such prices decline, the number of user transactions or our transaction volumes could decrease. As such, any such declines, or any declines in the price of Bitcoin or market liquidity for cryptocurrency generally, may result in lower total revenue to us. For example, from January 1, 2020 through March 2024, the trading price of Bitcoin appreciated significantly, from a low of approximately $3,800 per Bitcoin in March 2020, to a high of approximately $73,750 per Bitcoin in March 2024. The price and trading volume of any cryptocurrency, including Bitcoin, is subject to significant uncertainty and volatility, depending on a number of factors, including:

20

There is no assurance that any given cryptocurrency will maintain or increase in value or that there will be meaningful transaction volumes from our users. In the event that the price or trading of, or demand for, cryptocurrency declines, our business, operating results, and financial condition would be adversely affected.

Our long-term success depends on our ability to develop new and innovative products and services to address and keep pace with the rapidly evolving market for payments and financial services, and, if we are not able to implement successful enhancements and new features for our products and services, our business, operating results and financial condition could be materially and adversely affected.

Rapid and significant technological changes continue to confront the industries in which we operate, including developments in digital banking, mobile financial apps, ATMs and BTMs, and point-of-service solutions, as well as developments in cryptocurrency and in tokenization, which replaces sensitive data (e.g., payment card information) with symbols (tokens) to keep the data safe in the event that sensitive data is stolen or viewed by unauthorized third parties.

These new and evolving services and technologies may be superior to, impair, or render obsolete the products and services we currently offer or the technologies we currently use to provide them. Incorporating new technologies into our products and services may require substantial expenditures and take considerable time, and we may not be successful in realizing a return on these development efforts in a timely manner or at all. Our ability to develop new and innovative products and services may be inhibited by industry-wide standards, payment networks, existing and future laws and regulations, resistance to change from our users or third parties’ intellectual property rights. Our success will depend on our ability to develop new technologies and to adapt to technological changes and evolving industry standards. If we are unable to provide enhancements and new features for our products and services or to develop new and innovative products and services that achieve market acceptance or that keep pace with rapid technological developments and evolving industry standards, our business, operating results and financial condition would be materially and adversely affected.

We often rely not only on our own initiatives and innovations, but also on third parties, including some of our competitors, for the development of and access to new technologies and development of a robust market for these new products and technologies. Failure to accurately predict or to respond effectively to developments in our industry may significantly impair our business.

21

In addition, because our BitAccess software is designed to operate with a variety of systems and devices, we need to continuously modify and enhance our products and services to keep pace with changes in technologies. Any failure of our BitAccess software to continue to operate effectively with new technologies could reduce our growth opportunities, the demand for our products and services, result in dissatisfaction of our users, and materially and adversely affect our business.

Our risk management efforts may not be effective, which could expose us to losses and liability and otherwise harm our business.

We offer payments and other products and services to a large number of users. We have programs designed to vet and monitor these users and the transactions we process for them as part of our risk management efforts, but such programs require continuous improvement and may not be effective in detecting and preventing fraud and illegitimate transactions. When our services are used to process illicit transactions, and we settle those funds to users and are unable to recover them, we suffer losses and liability. Additionally, illicit transactions can also expose us to governmental and regulatory enforcement actions.

The highly automated nature of, and liquidity offered by, our services make us and our users a target for illegal or improper uses, including scams and fraud directed at our users, fraudulent or illegal sales of goods or services, money laundering, and terrorist financing. Our risk management policies, procedures, techniques, and processes may not be sufficient to identify all risks to which we are exposed, to enable us to prevent or mitigate the risks we have identified, or to identify additional risks to which we may become subject in the future. Our current business, changing and uncertain economic, geopolitical, and regulatory environment, and anticipated domestic and international growth will continue to place significant demands on our risk management and compliance efforts, and we will need to continue developing and improving our existing risk management infrastructure, techniques, and processes.

We maintain insurance policies providing general liability, umbrella and excess liability coverage, each of which has an aggregate limit between $2 million to $5 million, as well as coverage relating to cyber-related incidents, having an aggregate policy limit of approximately $2 million. Typically, these insurance policies have one-year terms, and we are able to apply for term renewal at the end of each calendar year. With respect to termination provisions included in the subject policies, we have the option to terminate each policy by providing notice to the applicable provider and fulfilling our obligation to pay the minimum earned premium due under the applicable policy. While we maintain a program of insurance coverage for various types of liabilities, we may self-insure against certain business risks and expenses where we believe we can adequately self-insure against the anticipated exposure and risk or where insurance is either not available or deemed not cost-effective.

We obtain and process a large amount of sensitive user data. Any real or perceived improper use of, disclosure of, or access to such data could harm our reputation, as well as have an adverse effect on our business.

We obtain and process large amounts of sensitive data, including personal data related to our users and their transactions, such as their names, addresses, social security or tax identification numbers, copies of government-issued identification, facial recognition data (from scanning of photographs for identity verification), bank statements and transaction data. We face risks, including to our reputation, in the handling and protection of this data, and these risks will increase as our business expands, including through our acquisition of, and investment in, other companies and technologies. Federal, state, and international laws and regulations governing privacy, data protection, and e-commerce transactions require us to safeguard our users’, employees’, and service providers’ personal data.

We have administrative, technical, and physical security measures and controls in place and maintain an information security program. However, our security measures, or the security measures of companies we acquire, may be inadequate or breached as a result of third-party action, employee or service provider error, malfeasance, malware, phishing, hacking attacks, system error, trickery, advances in computer capabilities, new discoveries in the field of cryptography, inadequate facility security or otherwise, and, as a result, someone may be able to obtain unauthorized access to sensitive information, including personal data, on our systems. We could be the target of a cyber security incident, which could result in harm to our reputation and financial losses. Additionally, our users have been and could be targeted in cyber security incidents like an account takeover, which could result in harm to our reputation and financial losses. Additionally, privacy and data protection laws are evolving, and these laws may be interpreted and applied in a manner that is inconsistent with our data handling safeguards and practices that could result in fines, lawsuits, and other penalties, and significant changes to our business practices and products and services. Our future success depends on the reliability and security of our products and services. To the extent that the measures we or any companies we acquire have taken prove to be insufficient or inadequate, or to the extent we discover a security breach suffered by a company we acquire following the closing of such acquisition, we may become subject to litigation, breach notification obligations, or regulatory or administrative sanctions, which could result in significant fines, penalties, damages, harm to our reputation, or loss of users. If our own confidential business information or sensitive user information were improperly disclosed, our business could be adversely affected. Additionally, a party who circumvents our security measures could, among other effects, appropriate user information or other proprietary data, cause interruptions in our operations, or expose users to hacks, viruses, and other disruptions.

22

We face intense competition, and if we are unable to continue to compete effectively for any reason, our business, financial condition, and results of operations could be adversely affected.

The markets in which we compete are highly competitive, and we face a variety of current and potential competitors that may have larger and more established user bases and substantially greater financial, operational, marketing and other resources than we have. The digital financial system is highly innovative, rapidly evolving, and characterized by healthy competition, experimentation, changing user needs, frequent introductions of new products and services, and subject to uncertain and evolving industry and regulatory requirements. We expect competition to intensify as existing and new competitors introduce new products and services or enhance existing ones. We compete against a number of companies operating both within the U.S. and abroad, including traditional financial institutions, financial technology companies and brokerage firms that have entered the cryptocurrency market in recent years, digital and mobile payment companies offering overlapping features targeted at our users, and companies focused on cryptocurrency.

The products and services provided by our competitors are differentiated by features and functionalities, including brand recognition, user service, reliability, distribution network and options, price, speed, and convenience. Distribution channels such as online, mobile solutions, account deposit and kiosk-based services continue to evolve and impact the competitive environment for cryptocurrency transactions. For example, traditional financial institutions could offer competing cryptocurrency-related products and services to our existing and prospective users.

Our future growth depends on our ability to compete effectively in Bitcoin transaction-related services. For example, if our products and services do not offer competitive features and functionalities or if we do not keep up with technological advances, we may lose users to our competitors, which could adversely affect our business, financial condition and results of operations. In addition, if we fail to charge our users comparable and appropriate transaction and other fees relative to our competitors, users may not use our services, which could adversely affect our business, financial condition and results of operations. For example, transaction volume, where we face intense competition, could be adversely affected by pricing pressures between our services and those of some of our competitors, which could reduce the markup at which we sell Bitcoin to users and the separate flat transaction fee that we charge and adversely affect our financial condition and results of operations. We have the ability to implement fee adjustments from time to time in response to competition and other factors. Fee reductions could adversely affect our financial condition and results of operations in the short-term and may also adversely affect our financial condition and results of operations in the long-term if transaction volumes do not increase sufficiently in response.